The report "

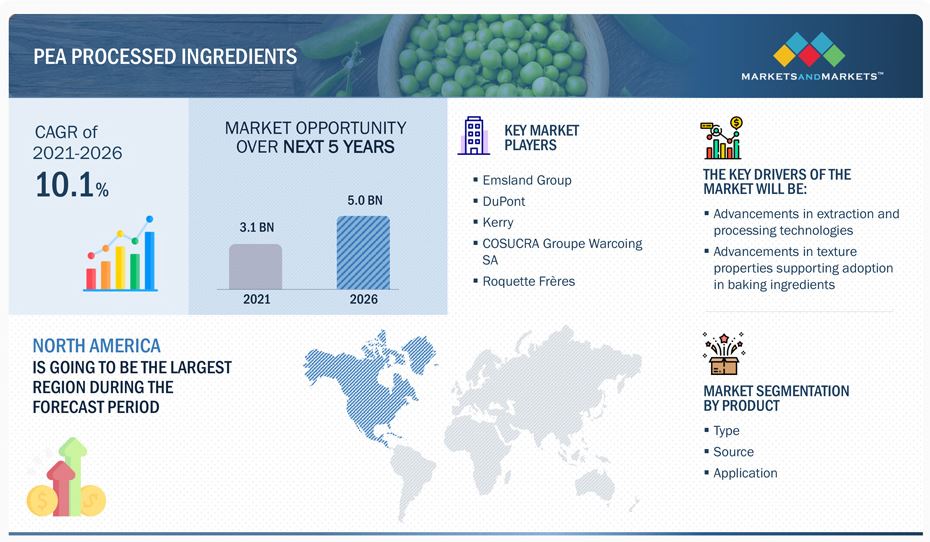

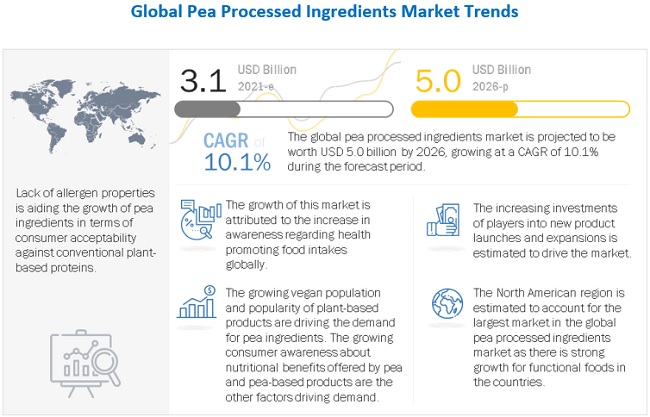

Pea Processed Ingredients Market by Type (Pea protein (Isolates, Concentrates and Textured), Pea starch, Pea fiber, Pea Flour), Application (Food & Beverages), Source (Yellow split peas, chickpeas, and lentils), and Region - Global Forecast to 2026", pea processed ingredients includes pea protein, pea starch, pea flour, and pea fiber. The global pea processed ingredients market is expected to value at USD 3.1 billion in 2021 and is projected to reach nearly USD 5.0 billion by 2026, growing at a CAGR of 10.1% during the forecast period (2021-2026). Pea processed ingredients are used in different industries that include food and beverage industry, pet food industry, feed industry among others. Owing to the health benefits received from the pea ingredients has resulted in more popularity among the customers across the globe.

COVID-19 Impact on the global pea processed ingredients Market

COVID-19 had a huge impact on the food supply chain in all regions, including North America, Europe, Asia-Pacific, South America, and the rest of the world. Due to the spread of COVID-19, there has been a growing number of death cases and long-term health impacts. This has resulted in the government imposing severe lockdown regulations, impacting all aspects of the economy. Governments around the world have developed policies for responding to the various impacts caused by COVID-19 for avoiding supply chain disruptions, higher raw material prices, and severe economic fallout for employees. Europe and Asia Pacific are some of the major regions that are significantly impacted by the COVID-19 scenario. This is because of the huge number of cases recorded in the regions, especially in the countries such as Spain, Italy, France, Germany in Europe and Japan, China, and South Korea in Asia Pacific. Companies in different countries are coming up with innovative technologies that are friendly to the environment and protect the pea processed ingredients end user products from any kind of contamination with germs.

Restraint: High cost of extraction

Food & beverage manufacturers have been looking for more healthy and affordable alternatives for animal-based sources, thereby increasing investments in the plant-based ingredient market. Currently, soy ingredients has been dominating the plant-based ingredients space. Pea processed ingredients, due to its high extraction and processing costs and limited production, fails to lead the market for plant-based ingredients. Compared to pea, there is a greater consumer awareness about soy protein. Manufacturers have achieved economies of scale for soy-based ingredients due to their high production capacities and high demand. On the other hand, pea is a comparatively newer product, which, due to the availability of low-cost products, such as soy, is finding it difficult to dominate the plant-based alternative industry. Manufacturers are finding it difficult to sell standalone pure pea processed ingredients that fetch lower margins, which is leading to the sales of blends of pea processed ingredients.

By type, the pea protein segment is estimated to hold the largest share in the pea processed ingredients market.

The pea protein segment dominated the market in 2020 and is expected to display similar trend in the coming years. Pea protein in food with neutral taste extracted mostly from yellow peas and split peas and has a typical legume amino acid profile. While its amino acid profile is similar to whey protein. Peas are particularly high in arginine, lysine, and phenylalanine. Consumers concerned about current meat-producing processes and the trend of eating healthier are inclining consumers toward alternative proteins. Their well-balanced profile fulfills the essential amino acid requirements outlined by the World Health Organization for adults. It is highly used in smoothies and shakes in recent years and is also a great fit for almost any diet since it’s naturally vegan. It is also a great source of iron. It can aid muscle growth, weight loss, and heart health. Owing to it is functional properties, it is gaining popularity among consumers.

By source type, the yellow split peas segment is projected to grow at the fastest CAGR in the pea processed ingredients market until 2026.

The demand for yellow split peas is high owing to presence of high protein content and popularity among the food manufacturers. There is rising production of yellow peas over the years owing to the increasing demand of the same. For instance, according to the 2018 American Pulse Association Data, dry peas rank fourth in terms of the world production of food legumes below soybeans, peanuts, and dry beans. They have also reported that yellow peas and green peas, along with other minor classes, are the most commonly grown, with yellow peas accounting for approximately two-thirds of the US production. Yellow split peas are also regarded as high in fiber and is considered taste neutral thereby resulting to rising application of the same in the food and beverage products.

The increasing demand for plant based food products, in the North America region is driving the market growth

In North America, Canada is the largest dry pea-producing nation and also the largest exporter for the same in the world. However, the highest consumption of pea protein in the US, and Canada together drives significant manufacturing potential in terms of processing technology and availability of raw materials, due to the high growth potential of the pea processed ingredients market in North America. The use of meat and dairy substitutes from plants in burgers, nuggets, and many other foods is growing, which is driving the demand for pea ingredients, such as proteins, starch, and flours. According to a report published by Agri-Canada, for the year 2019-2020, dry pea production in Canada was estimated to rise by 30% to 4.7 million tonnes (Mt).

The US is one of the largest consumers of pea ingredients in the world and is also expected to hold a strong industry outlook over the forecast period. There has been a growing awareness of the consumption of healthy foods in the region, which has resulted in people shifting to lactose-free and gluten-free protein products. The country has recorded the highest number of obese and overweight people in the world. According to the National Centre for Health Statistics (NCHS), about one-third of the US adults aged 20 and older were found obese in the year 2019.

Key Market Players:

The key players in this market include Emsland Group (Germany), DuPont (US), Kerry (Ireland), COSUCRA Groupe Warcoing SA (Belgium), Roquette Frères (France), Vestkorn Milling AS (Norway), Ingredion Incorporated (US), Axiom Foods, Inc (US), Felleskjøpet Rogaland Agder (Norway), AGT Food and Ingredients (Canada), Parrheim Foods (Canada), Puris Foods (US), Meelunie B.V (Netherlands) among others.