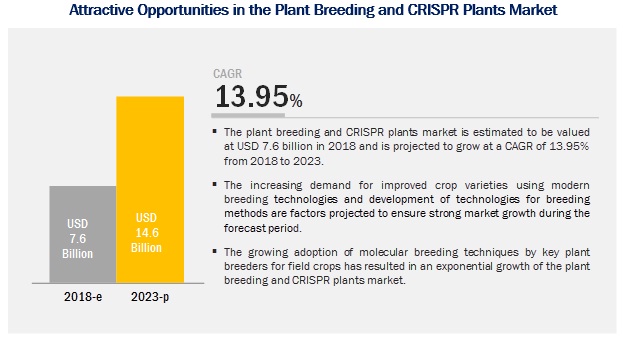

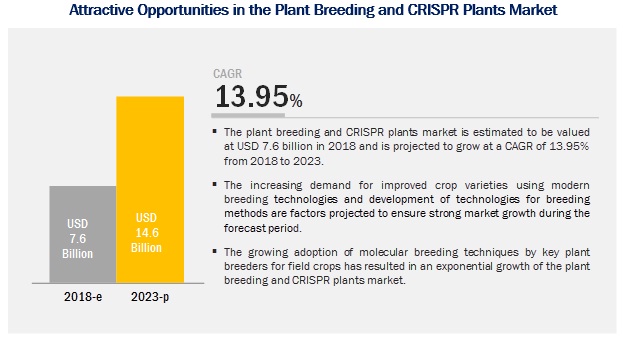

The report "Plant Breeding and CRISPR Plants Market by Type (Conventional and Biotechnological [Hybrid, Molecular Breeding, GM, Genome Editing]), Trait (Herbicide Tolerance, Disease Resistance, and Yield Improvement), Application, and Region–Global Forecast to 2023" The plant breeding and CRISPR plants market is projected to reach USD 14.6 billion by 2023, from USD 7.6 billion in 2018, at a CAGR of 13.95% during the forecast period. The market is driven by factors such as the growing need for high-quality crops and increased yield, and rising application of plant biotechnology in the agriculture industry.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

Plant breeding techniques for the cereals & grains segment are

projected to be widely researched during the forecast period.

Various countries have adopted molecular techniques such as marker-assisted selection (MAS) for plant breeding, due to the increasing demand for high yield from field and horticultural crop growers. Corn is a major crop that finds application in various industries across the world; biotechnological techniques such as hybrid and molecular breeding are increasingly adopted for corn by all plant genetic breeders. Also, the genetic data available for corn is higher, followed by wheat.

The higher adoption of genetically modified crops such as corn, wheat, and rice in the US, Brazil, and China (only imported for feed purpose) has been a major factor contributing to the growth of the cereals & grains segment in the plant breeding market.

The molecular breeding segment is projected to witness the fastest

growth during the forecast period.

Since the cultivation of GM crops has been adopted in all regions except Europe, the genetic engineering technique is projected to exhibit a sluggish growth in the coming years due to strong regulatory control of its practice in many countries. This holds true for CRISPR technology as well. Though, the CRISPR technology in agriculture promised exponential growth while its emergence, regulations by Europe in line with genetic modification, affected the adoption rate of CRISPR gene editing tool. However, since the molecular breeding technique is based on molecular markers for trait selection, it is completely unregulated across the globe; hence, the segment has higher growth potential in comparison with all other breeding techniques.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=256910775

North America is estimated to dominate the market in 2018, while the

Asia Pacific is projected to witness the fastest growth through 2023.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=256910775

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

On the basis of application, the cereals & grains segment is projected to witness the fastest growth during the forecast period.The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).