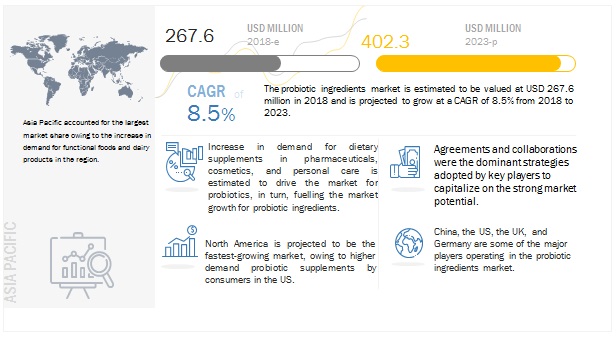

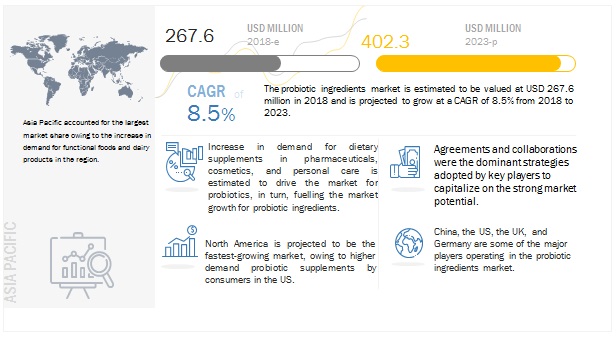

The report "Probiotic Ingredients Market by Application (Functional Foods & Beverages, Pharmaceuticals, and Animal Nutrition), Source (Bacteria and Yeast), Form (Dry and Liquid), End User (Human and Animal), and Region - Global Forecast to 2023", is estimated at USD 268 million in 2018 and is projected to reach USD 402 million by 2023, growing at a CAGR of 8.5% during the forecast period. The market is driven by factors such as increasing popularity of probiotic dietary supplements and participation of government bodies in the R&D of probiotics.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

The functional foods & beverages segment is estimated to account

for the largest share, by application, in 2018

Based on application, the probiotic ingredients market is segmented into functional foods & beverages, pharmaceuticals, animal nutrition, and others, which include cosmetics and personal care. The functional foods & beverages segment is estimated to account for the largest share in 2018 as it is widely used in the manufacture of products such as cheese, yogurt, and other dairy products. The rising health concerns among consumers is driving the market for probiotics within this segment.

The bacteria segment, by source, is estimated to dominate the probiotic

ingredients market in 2018

By source, the probiotic ingredients market is segmented into bacteria and yeast. The bacterial segment mainly consists of strains from the genus of Lactobacillus and Bifidobacterium. This segment is estimated to account for the largest share in the probiotic ingredients market in 2018. Although yeast is more stable and robust, bacteria strains have more health benefits and a large number of strains that are available within the bacteria. Due to these factors, bacteria strains continue to remain preferred over yeast.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=238635114

Asia Pacific is estimated to dominate the probiotic ingredients market

in terms of value in 2018

Probiotics are gaining popularity in the Asia Pacific market particularly in the animal nutrition segment due to the growing concerns about their health and productivity. The application of probiotic strains is projected to increase due to the consumer demand for application in functional foods and pharmaceutical end products. India offers a huge potential in this region due to the increasing number of pharmaceutical companies involving themselves in the licensing and development of probiotic drugs. China’s growth in terms of sales is attributed to the growing application of probiotics in the infant formula business.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as Kerry (Ireland), DowDuPont (US), Chr. Hansen (Denmark), Biogaia (Sweden), Probi (Sweden), Glac Biotech (Taiwan), Bifodan (Denmark), Lallemand (Canada), UAS Laboratories (US), and Biena (US).

The report "Probiotic Ingredients Market by Application (Functional Foods & Beverages, Pharmaceuticals, and Animal Nutrition), Source (Bacteria and Yeast), Form (Dry and Liquid), End User (Human and Animal), and Region - Global Forecast to 2023", is estimated at USD 268 million in 2018 and is projected to reach USD 402 million by 2023, growing at a CAGR of 8.5% during the forecast period. The market is driven by factors such as increasing popularity of probiotic dietary supplements and participation of government bodies in the R&D of probiotics.

Download PDF

Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

The functional foods & beverages segment is estimated to account for the largest share, by application, in 2018

Based on application, the probiotic ingredients market is segmented into functional foods & beverages, pharmaceuticals, animal nutrition, and others, which include cosmetics and personal care. The functional foods & beverages segment is estimated to account for the largest share in 2018 as it is widely used in the manufacture of products such as cheese, yogurt, and other dairy products. The rising health concerns among consumers is driving the market for probiotics within this segment.

The bacteria segment, by source, is estimated to dominate the probiotic ingredients market in 2018

By source, the probiotic ingredients market is segmented into bacteria and yeast. The bacterial segment mainly consists of strains from the genus of Lactobacillus and Bifidobacterium. This segment is estimated to account for the largest share in the probiotic ingredients market in 2018. Although yeast is more stable and robust, bacteria strains have more health benefits and a large number of strains that are available within the bacteria. Due to these factors, bacteria strains continue to remain preferred over yeast.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=238635114

Asia Pacific is estimated to dominate the probiotic ingredients market in terms of value in 2018

Probiotics are gaining popularity in the Asia Pacific market particularly in the animal nutrition segment due to the growing concerns about their health and productivity. The application of probiotic strains is projected to increase due to the consumer demand for application in functional foods and pharmaceutical end products. India offers a huge potential in this region due to the increasing number of pharmaceutical companies involving themselves in the licensing and development of probiotic drugs. China’s growth in terms of sales is attributed to the growing application of probiotics in the infant formula busines

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as Kerry (Ireland), DowDuPont (US), Chr. Hansen (Denmark), Biogaia (Sweden), Probi (Sweden), Glac Biotech (Taiwan), Bifodan (Denmark), Lallemand (Canada), UAS Laboratories (US), and Biena (US).

The

report "Probiotic Ingredients Market by

Application (Functional Foods & Beverages, Pharmaceuticals, and Animal

Nutrition), Source (Bacteria and Yeast), Form (Dry and Liquid), End User (Human

and Animal), and Region - Global Forecast to 2023", is estimated at USD 268 million in 2018 and is

projected to reach USD 402 million by 2023, growing at a CAGR of 8.5% during

the forecast period. The market is driven by factors such as increasing

popularity of probiotic dietary supplements and participation of government

bodies in the R&D of probiotics.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

By application, the market has

been segmented into functional food & beverages, pharmaceuticals, animal

nutrition, and others which include cosmetics & personal care products. The

pharmaceuticals segment is growing at the highest rate owing to a spike in the

number of diseases such as antibiotic-associated diarrhea, inflammatory bowel

disease, lactose intolerance, irritable bowel syndrome, vaginal infections,

rheumatoid arthritis, liver cirrhosis, and immune enhancement. The intake of

dietary supplements for overall improvement in health among consumers would

drive the growth of the segment during the forecast period.

By form, the market has been segmented into dry and liquid.

The dry form is projected to dominate the market during the forecast period

owing to lower costs in transportation when compared with liquid form. The dry

form of probiotic ingredients has a higher shelf-life, due to which it is

preferred by manufacturers and suppliers.

By end use, the probiotic ingredients market has been segmented into animal and human use. While human use accounts for a larger market share during the forecast period, the usage of probiotic strains in the animal nutrition industry is growing. Probiotic strains are used in feed to enhance the effectiveness of nutrients and show their effects on the gut by aiding in better digestion and reducing the impact of pathogenic bacteria, which causes various diseases in animals. The animals can grow better as the feed is altered in terms of quality and palatability due to its added probiotic content. The aim of probiotic strains is to take care of deficiencies of the natural microflora and provide animals with better resistance against diseases.

Speak to Analyst: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

By region, the Asia Pacific

market accounted for the largest share of the probiotic ingredients market in

2017, followed by Europe. Some factors that influence these market shares

include the high demand for functional foods and dairy products, the presence

of major players in these regions, and awareness about the benefits of using

probiotics. Top probiotic manufacturers, such as DowDuPont (US), Kerry

(Republic of Ireland), Lallemand (US), and Chr. Hansen (Denmark) together

account for more than one-third of the total market share. These companies have

a strong presence in Europe and the Asia Pacific and have manufacturing facilities

across these regions along with strong distribution networks.

The competitive landscape for the probiotic ingredients is fragmented, with many big and small players concentrated in the European market. The focus is on the human use products due to which the competition is higher to provide for the functional food and pharmaceutical industries where the demand is high. Significant growth is being witnessed in new players trying to penetrate the probiotic ingredients market to cater to the animal feed industry.

The global probiotic ingredients market was

valued at USD 246.6 million in 2017 and is projected to reach USD 402.3 million

by 2023, at a CAGR of 8.5% from 2018. The global demand for probiotic

ingredients is increasing significantly due to growth in awareness among

customers about their direct relation to digestive health benefits, rise in

demand for high-nutrient foods, and increase in demand for quality feed

products. Probiotics are also found in supplement form or as components of food

& beverages. Their integration with inexpensive but good-for-health

products, such as yogurt, fruit juices, and cultured dairy drinks, has

contributed to their significant market size.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

By application, the

market has been segmented into functional food & beverages,

pharmaceuticals, animal nutrition, and others which include cosmetics &

personal care products. The pharmaceuticals segment is growing at the highest

rate owing to a spike in the number of diseases such as antibiotic-associated

diarrhea, inflammatory bowel disease, lactose intolerance, irritable bowel

syndrome, vaginal infections, rheumatoid arthritis, liver cirrhosis, and immune

enhancement. The intake of dietary supplements for overall improvement in

health among consumers would drive the growth of the segment during the

forecast period.

By form, the market has been segmented into dry and

liquid. The dry form is projected to dominate the market during the forecast

period owing to lower costs in transportation when compared with liquid form.

The dry form of probiotic ingredients has a higher shelf-life, due to which it

is preferred by manufacturers and suppliers.

By end use, the probiotic ingredients market has been

segmented into animal and human use. While human use accounts for a larger

market share during the forecast period, the usage of probiotic strains in the

animal nutrition industry is growing. Probiotic strains are used in feed to

enhance the effectiveness of nutrients and show their effects on the gut by

aiding in better digestion and reducing the impact of pathogenic bacteria,

which causes various diseases in animals. The animals can grow better as the

feed is altered in terms of quality and palatability due to its added probiotic

content. The aim of probiotic strains is to take care of deficiencies of the

natural microflora and provide animals with better resistance against diseases.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=238635114

Probiotics are gaining

popularity in the Asia Pacific market particularly in the animal nutrition

segment due to the growing concerns about their health and productivity. The

application of probiotic strains is projected to increase due to the consumer

demand for application in functional foods and pharmaceutical end products.

India offers a huge potential in this region due to the increasing number of

pharmaceutical companies involving themselves in the licensing and development

of probiotic drugs. China’s growth in terms of sales is attributed to the

growing application of probiotics in the infant formula business.

This report includes a study on the marketing and

development strategies, along with a study on the product portfolios of the

leading companies. It includes the profiles of leading companies such as Kerry

(Ireland), DowDuPont (US), Chr. Hansen (Denmark), Biogaia (Sweden), Probi

(Sweden), Glac Biotech (Taiwan), Bifodan (Denmark), Lallemand (Canada), UAS

Laboratories (US), and Biena (US).

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on

30,000 high growth niche opportunities/threats which will impact 70% to 80% of

worldwide companies’ revenues. Currently servicing 7500 customers worldwide

including 80% of global Fortune 1000 companies as clients. Almost 75,000 top

officers across eight industries worldwide approach MarketsandMarkets™ for

their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™

are tracking global high growth markets following the "Growth Engagement

Model – GEM". The GEM aims at proactive collaboration with the clients to

identify new opportunities, identify most important customers, write

"Attack, avoid and defend" strategies, identify sources of

incremental revenues for both the company and its competitors.

MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top

players across leaders, emerging companies, innovators, strategic players)

annually in high growth emerging segments. MarketsandMarkets™ is determined to

benefit more than 10,000 companies this year for their revenue planning and

help them take their innovations/disruptions early to the market by providing

them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and

market research platform, "Knowledgestore" connects over 200,000

markets and entire value chains for deeper understanding of the unmet insights

along with market sizing and forecasts of niche markets.

The probiotic ingredients market is projected to grow from USD 268 million in 2018 to USD 402 million by 2023, at a compound annual growth rate (CAGR) of 8.5% during the forecast period. The increasing demand for dietary supplements in the pharmaceuticals, cosmetics, and personal care industries is projected to drive the market for probiotics, which in turn, is projected to drive the market growth for probiotic ingredients.

The probiotic ingredients market is projected to grow from USD 268 million in 2018 to USD 402 million by 2023, at a compound annual growth rate (CAGR) of 8.5% during the forecast period. The increasing demand for dietary supplements in the pharmaceuticals, cosmetics, and personal care industries is projected to drive the market for probiotics, which in turn, is projected to drive the market growth for probiotic ingredients.

The probiotic ingredients market is projected to grow from USD 268 million in 2018 to USD 402 million by 2023, at a compound annual growth rate (CAGR) of 8.5% during the forecast period. The increasing demand for dietary supplements in the pharmaceuticals, cosmetics, and personal care industries is projected to drive the market for probiotics, which in turn, is projected to drive the market growth for probiotic ingredients.

The probiotic ingredients market is projected to grow from USD 268 million in 2018 to USD 402 million by 2023, at a compound annual growth rate (CAGR) of 8.5% during the forecast period. The increasing demand for dietary supplements in the pharmaceuticals, cosmetics, and personal care industries is projected to drive the market for probiotics, which in turn, is projected to drive the market growth for probiotic ingredients.

The probiotic ingredients market is projected to grow from USD 268 million in 2018 to USD 402 million by 2023, at a compound annual growth rate (CAGR) of 8.5% during the forecast period. The increasing demand for dietary supplements in the pharmaceuticals, cosmetics, and personal care industries is projected to drive the market for probiotics, which in turn, is projected to drive the market growth for probiotic ingredients.