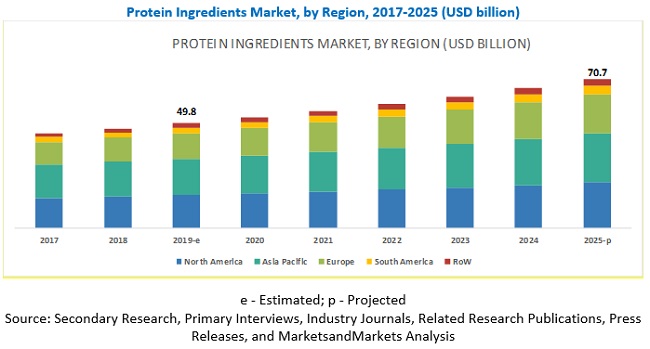

According to MarketsandMarkets, the global protein ingredients market was estimated to be valued at USD 52.5 billion in 2020 and is projected to reach USD 70.7 billion by 2025, recording a CAGR of 6.1%, in terms of value. The market is mainly driven by factors such as the increasing demand for protein functionalities, awareness about healthy diets and nutritional food, new technological development in the protein ingredients industry, growth in demand for superior personal care and healthcare products, and rising consumption of animal by-products. Europe will dominate the global market due to the high consumption of animal protein in the region. Further, the increasing emphasis of the European population on healthier lifestyles will lead to the growth of the market in the region.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=114688236

Impact of COVID-19 on the Protein Ingredients Market

The rapid spread of COVID-19 and the equally rapid government response to restrict the movement of the majority of the population in different countries have dramatically changed the consumption patterns, which has also impacted the food & agriculture industries.

The significant changes in consumer purchasing behavior are gradually transforming the food industry. Due to rising health concerns, consumers have started avoiding the consumption of meat and poultry. They are now more inclined toward protein substitute products to fill in the gap. The sales of immunity-related ingredients have spiked globally. These trends have fueled the demand for protein-based products as protein is one of the most important constituents that help in building immunity. However, the coronavirus has caused a severe disruption in the supply chain and has influenced the supply of ingredients and raw materials. Companies are constantly trying to handle the situation and be ready for any further disruption.

Drivers: Increasing demand for proteins as nutritional and functional ingredients

Protein ingredients sourced from animals and plants are well-known for their emulsification, gelation/viscosity, water-binding/hydration, foaming, aeration, and other functional properties. These functionalities, along with the nutritional aspects of proteins, are a major advantage to end-user industries, and are, thus, one of the major market drivers. In end-user industries such as cosmetic & personal care, protein ingredients are primarily used for their conditioning and moisturizing properties in the hair and skincare industries. In major applications such as food & beverages, the use of protein ingredients continues to grow with the increasing demand for improved functionalities. The ability of protein ingredient manufacturers to design and develop specific isolates, concentrates, and other forms of protein ingredients for various applications is likely to drive the growth of the protein ingredients market during the forecast period.

COVID-19 is expected to boost the demand for protein ingredients at a higher rate in the global market as people across the globe are more health-conscious and finding ways to strengthen their immunity.

By form, the dry segment is projected to grow at a higher rate in the protein ingredients market during the forecast period

The global market, by form, has been segmented into dry and liquid. The dry form is projected to grow at a higher CAGR during the forecast period. This form of protein ingredients is largely preferred by manufacturers of food & beverage, feed, and pharmaceutical products as they have better stability and ease of handling & storage compared to the liquid form. Furthermore, they have a longer shelf life compared to the liquid form.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=114688236

The European market accounted for the largest share in the protein ingredients market. This dominance is attributed to the high consumption in this region. The consumption in Europe is more than twice the global average consumption. The high-protein trend in food & beverages and personal care & cosmetics is gaining a foothold in Germany, as protein claims on food and drink launches continue on their growth path. The increasing prevalence of health-related problems, along with high importance being laid on the quality, taste, and freshness of foods is modifying the demand for food, owing to which the market for protein ingredients is projected to witness growth.

Key Market Players:

Key players in this market include Cargill (US), ADM (US), DuPont (US), Kerry Group (Ireland), Omega Protein Corporation (US), FrieslandCampina (Netherlands), Fonterra Co-operative Group Limited (New Zealand), Arla Foods (Denmark), Roquette (France), Gelita AG (Germany), Kewpie Corporation (Japan), AGRANA (Austria), AMCO Proteins (US), Hilmar Ingredients (US), Axiom Foods (US), Burcon Nutrascience (Canada), Rousselot (Netherlands), Foodchem International Corporation (China), A&B Ingredients (US), and Reliance Private Label Supplements (US).