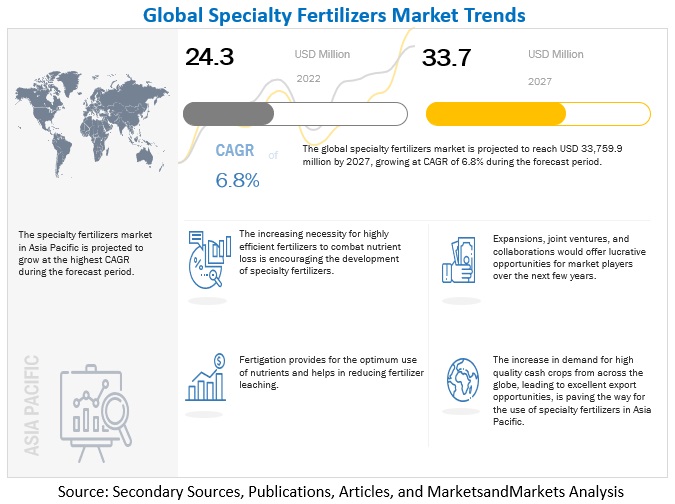

The global specialty fertilizers market size is projected to reach USD 33.7 billion by 2027, recording a CAGR of 6.8% in terms of value. The global industry was estimated to be valued at USD 24.3 billion in 2022 and The high nutrient use efficiency and precise & localized application associated with specialty fertilizers help reduce growers’ dependency on commercial fertilizer usage and simultaneously achieve higher quality crops and yields with a lower environmental impact. This trend is expected to drive the market significantly in value sales during the forecast period.

Specialty Fertilizer Market Opportunities: Crop-specific nutrient management through precision farming

Precision agriculture focuses on growing crops efficiently in a site-specific manner with specialized application equipment, which can help retain water and nutrients in the root zone. The work scheme of precision agriculture can be summarized in three stages:

1. Geo-referenced remote area information using certain sensors

2. Analysis of data obtained through an appropriate system of information processing

3. Adjustment of the amount applied depending on the needs of each location

Precision farming can improve production and nutrient use efficiency, ensuring that nutrients do not leach from or accumulate in excessive concentrations in parts of the field. Precision farming has been gaining importance in developed countries for efficient usage of fertigation. The release patterns and coating technology of CRFs can be fed into the information system for an accurate analysis of the nutrient requirements of crops, the application rate, and the mixing ratio required within the fertigation system. Precision agriculture involves a growing range of digital technologies to make farming more efficient while increasing crop yields and quality.

Micronutrients are Essential for Plant Growth, Which Drives Demand For Micronutrient Fertilizers

Micronutrients consist of a fine blend of mineral elements comprising zinc (Zn), copper (Cu), manganese (Mn), iron (Fe), boron (B), and molybdenum (Mo). Mineral elements nurture horticultural crops, cereals, pulses, oilseeds, spices, and plantations. Despite their low demand, critical plant functions are hindered if micronutrients are unavailable, which results in plant deformations, lower yield, and diminished growth. Micronutrients are crucial for plant growth and play an important role in balancing crop nutrition. Micronutrient deficiency is easily identified from visual symptoms on crops and by testing soil and plant tissues. To understand these visual symptoms, it is necessary to know the role each micronutrient plays in plant growth and development.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=57479139

The growth of the specialty fertilizers market in Europe is driven by well-established distribution networks of Key players

Agriculture in Europe is driven by the adoption of advanced technologies for farming and the introduction of regulations for innovative agricultural products. Most of the arable farmland in Europe is used for cereal production. There has been a significant utilization of controlled-release and water-soluble fertilizers for fruit and vegetable crops in this region for their effectiveness in reducing the application of nitrogen-based fertilizers.

Recently, Europe launched the new European Fertilizer Products Regulation EU 2019/1009 on July 16, 2022. The regulation aims to standardize quality, safety, and labeling requirements for all fertilizing products, support the Farm2Fork strategy, and replace its predecessor EU 2003/2003, which regulated mineral fertilizers. To reduce environmental degradation and align with the EU’s Green Deal, key companies such as ICL have launched a new control release technology in urea administration in Europe in 2022. The technology, “ego.x’’ claims to leverage biodegradable release technology to enhance nutrient use efficiency by 80% and reduce nutrient losses to the environment by 50%. It is further claimed to help provide higher or similar yields with reduced frequency and fertilizer usage. The development is expected to help the European farmers who faced an average production decline of 10-20%. The European strategy, launched in mid-2020, aims at minimizing the environmental footprint of the agriculture industry by reducing fertilizer losses by at least 50% and reducing overall fertilizer use by at least 20% by 2030.

Specialty Fertilizers Market Share

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as C Nutrien Ltd. (Canada), Yara (Norway), ICL (Israel), The Mosaic Company (US), CF Industries and Holdings, Inc. (US), Nufarm (Australia), SQM SA (Chile), OCP Group (Morocco), Kingenta (China), K+S Aktiengesellschaft (Germany), OCI Nitrogen (Netherlands), EuroChem (Switzerland), Coromandel International Limited (India), Zuari Agro Chemicals Ltd. (India), and Deepak Fertilizers and Petrochemicals Corporation Limited (India).