https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248809422

Tuesday, April 5, 2022

Growth Strategies Adopted by Major Players in the Tractor Implements Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248809422

Friday, November 26, 2021

Tractor Implements Market to Record Steady Growth by 2023

Monday, September 13, 2021

Tractor Implements Market to Witness Unprecedented Growth in Coming Years

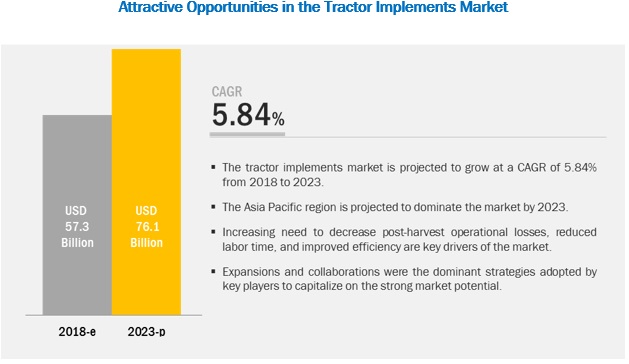

The report "Tractor Implements Market by Phase (Tillage, Irrigation and Crop Protection, Sowing and Planting, Harvesting and Threshing), Drive (2-Wheel and 4-Wheel Drive), Power (Powered and Unpowered), and Region - Global Forecast to 2023", The tractor implements market is projected to reach USD 76.1 billion by 2023, from USD 57.3 billion in 2018, at a CAGR of 5.84% during the forecast period. The market is driven by factors such as high labor cost in the agriculture industry and the growing need to prevent the post-harvest food loss.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248809422

Tractor implements for the tillage segment are projected to be widely used implements during the forecast period.

Tilling is an agricultural phase implemented for land development process during cultivation. It is the longest and a crucial phase of cultivation, which requires effective tools and machines for the preparation of seedbed as per the requirement of various seeds. The tillage segment accounted for the highest market share in 2017 and is projected to hold the highest market share during the forecast period. The tillage segment accounted the largest market share across various regions including North America, Asia Pacific, Europe, and South America.

The powered implements segment is projected to witness the fastest growth during the forecast period.

Use of powered tractor implements is growing with the increasing need to enhance food production and the integration of technologies in various farm equipment. It is estimated that the powered implements segment is projected to grow at the fastest rate during the forecast period, due to various benefits over unpowered implements, which include high-speed operations with much effectiveness.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=248809422

The Asia Pacific is estimated to dominate the market in 2018 and is projected to witness the fastest growth in the tractor implements market through 2023.

The highly populated countries such as India and China in the Asia Pacific regions has created profitable growth opportunities for the market due to high food demand. These factors have encouraged mechanization of agriculture in the region for efficiently producing food crops, which can be enhanced by the use of highly advanced mechanical implements on the fields. The Asia Pacific is projected to witness a high demand for tractor implements due to lack of funds available to farmers in developing countries to purchase exclusive machineries for various field processes, and the growing need to improve crop yield.

This report includes a study of development strategies, along with product portfolios of leading companies. It also includes the profiles of leading companies such as CLAAS (Germany), Deere & Company (US), Kubota Corporation (Japan), Mahindra and Mahindra (India), Tractor and Farm Equipment Limited (India), JCB (UK), CNH Industrial (US), SDF Group (Italy), Actuant (US), Kuhn Group (France), and Alamo Group (US).