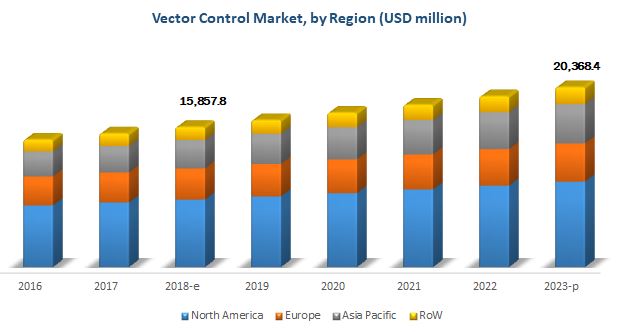

The vector control market was valued at USD 15.12 Billion in 2017 and is projected to reach 20.37 Billion by 2023, at a CAGR of 5.13% during the forecast period. Factors such as the rising prevalence of vector-based diseases worldwide, promotions by the individual country government as a part of their disease / vector eradication programs, and the efficiency of a chemical-based vector control products have been the primary drivers responsible for the growth of the vector control market.

Download PDF Brochure:

On the basis of vector type, the insect control segment accounted for a major share in the market for 2017, due to the rising cases of epidemics caused by vectors such as mosquitoes, cockroaches, bedbugs, flies, and ants across the globe. Promotions by individual country governments and renowned global organizations such as the WHO for the disease / vector eradication programs have also driven the growth of the insect control segment.

On the basis of method of control, the biological segment is projected to grow at the highest growth rate during the forecast period. This can be attributed to the growing concerns on the environmental impact of chemical compounds and the rising number of cases of insecticide resistance among pests. Additionally, biologicals are gaining preference as they are perceived to be safer than their chemical-based counterparts.

On the basis of end-use sector, the commercial & industrial segment accounted for a larger market share in 2017, two to the increased demand from sectors such as food & beverage manufacturing, food services, hospitality, government organizations, and pharmaceuticals. The demand can be attributed to the need for complying with the local authorities for workplace hygiene and maintenance as a part of the stringent regulations laid by governments.

The vector control market has a high potential in emerging markets such as China and India since the climatic conditions and ineffective waste management in the Asia Pacific region are conducive to insect and rodent growth. There is also an increase in the middle-class population, who are aware of vector-borne diseases leading to the growing demand for vector control products for vectors such as mosquitoes and rodents.

Request for Customization:

This report includes a study of marketing and development strategies, along with the product and / or service portfolios of leading companies. Key companies in the market include vector control product manufacturers and service providers such as Bayer AG (Germany), Syngenta AG (Switzerland), BASF SE (Germany), Bell Laboratories, Inc. (US), Rentokil Initial plc (UK), FMC Corporation (US), Ecolab (US), The Terminix International Company LP (US), Rollins, Inc. (US), Arrow Exterminators, Inc. (US), Massey Services Inc. (US), and Anticimex Group (Sweden) .

Target Audience:

- Vector control product manufacturers, suppliers, and formulators

- Professional pest control service providers

- Pesticide traders, distributors, importers, exporters, and suppliers

- Public health contractors

- Agricultural warehouse owners and animal & dairy co-operative societies

- Commercial research & development (R&D) organizations and financial institutions

- Pest control associations and industry bodies

- Government health authorities and regulatory bodies such as World Health Organization (WHO), Environmental Protection Agency (EPA), and Pest Management Regulatory Agency (PMRA)