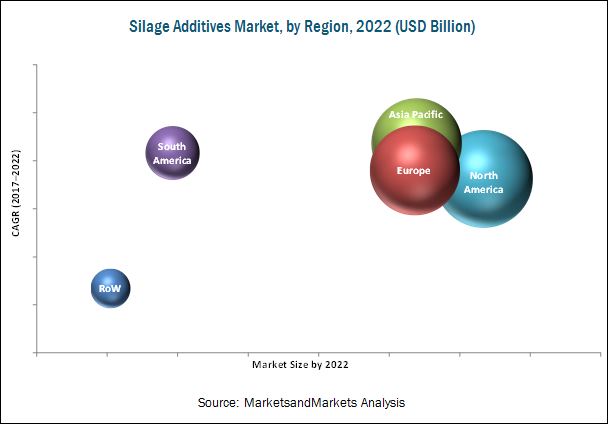

The report “Silage Additives Market by Type (Inoculants, Organic Acids, Sugars, Absorbents, NPN Nutrients), Silage Crop (Corn, Alfalfa, Sorghum, Oats, Barley, Rye) Function (Stimulation, Inhibition), Form, and Region – Global Forecast to 2022″, The silage additives market is projected to grow at a CAGR of 4.40% from an estimated value of USD 1.62 Billion in 2017 to reach USD 2.00 Billion by 2022. The market is driven by factors such as the rise in demand for sustainable farming practices, growth in research on cost-effective silage preparation processes, and the impact of silage additives on silage quality and production costs.

On the basis of type, the inoculants segment is projected to grow at the highest CAGR in the market from 2017 to 2022, due to the growth in demand for homofermentative inoculants among silage farmers and the advent of combination products in the market by key manufacturers.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=231745563

On the basis of silage crop, the corn segment is projected to grow at the highest CAGR during the forecast period, as crop growers prefer the efficiency of corn silage over other crops in gaining better results, abundant production of corn silage in North American and European countries, enhanced productivity, and increase in application of corn silage in biofuel industry.

On the basis of form, the liquid segment accounted for the largest market share in 2016, due to the increased preference for liquid additives owing to their ease in handling, storage, and transport. Liquid concentrates are highly preferred for application, owing to the increased use of chemical additives in developing countries.

Rise in export quality requirements for agricultural products and increasing adoption of sustainable agriculture practices in countries such as China, Australia, New Zealand, India, Brazil, and Argentina are expected to drive the demand for silage additives among the silage growers in the Asia Pacific and South American regions during the forecast period. This would increase the inflow of various international manufacturers to set up their business units and distribution networks, thereby leading to a strong market competition.

This report includes a study of marketing and development strategies, along with the product portfolio of leading companies. These companies include Lallemand (US), DuPont, Pioneer (US), Chr. Hansen (Denmark), Schaumann Bioenergy (Germany), and BASF (Germany), which are some of the well-established and financially stable players that have been operating in the industry for several years. Other players include Volac (UK), Trouw Nutrition (Netherlands), ADDCON (Germany), Micron Bio-Systems (US), Biomin (Germany), American Farm Products (US), and Josera (Germany).

Target Audience:

- Silage manufacturers

- Silage additive manufacturers

- Silage additive importers and exporters

- Silage traders/distributors/suppliers

- Cattle farms and associations

- Inoculants and chemical traders/distributors/suppliers

- Government regulatory authorities and research organizations

- Organic certification agencies

- Crop producers and exporters

- Raw material suppliers and technology providers to manufacturers