https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=60189057

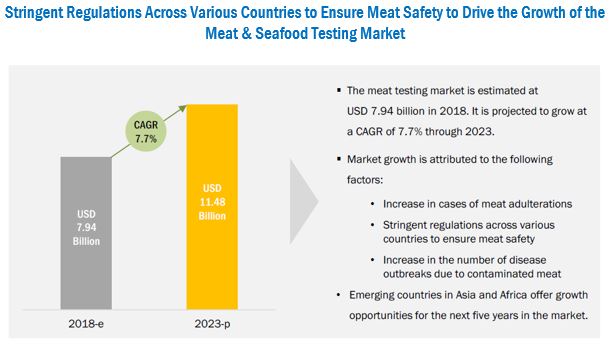

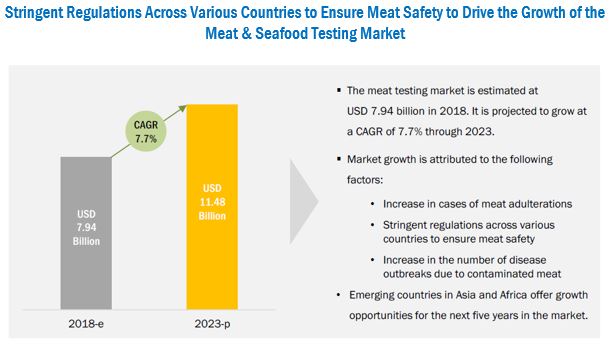

The report "Meat Testing Market by Target Tested (Pathogen, Species, Allergen, GMO, Mycotoxin, Heavy Metal, Veterinary Drug Residue), Sample (Meat and Seafood), Technology (PCR, Immunoassay, Chromatography, Spectroscopy), and Region - Global Forecast to 2023", The meat testing market is anticipated to reach a value of USD 11.48 billion by 2023, at a CAGR of 7.7%. Growth in the international trade of meat and seafood creates the need for global mandates and regulations on food safety, which is a significant factor that drives the market for meat & seafood testing. Additionally, globalization has a major impact on the global meat supply and has increased the import & export of meat, poultry, and seafood products worldwide. This has increased the risk of unsafe or contaminated products reaching consumers in distant markets, which, in turn, creates a demand for meat testing across the world.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=60189057

In terms of target tested, the pathogens testing segment is estimated

to account for the largest share of the meat testing market in 2018.

On the basis of target tested, the pathogen testing segment is estimated to hold the largest share of the meat testing market in 2018. The level of contamination is at its peak during packaging and processing and due to improper storage practices, such as non-maintenance of a suitable temperature. Highly occurring pathogens in meat & seafood include E. coli, Salmonella, Campylobacter, Shigella, Vibrio, and many others.

Meat testing by PCR technology is estimated to hold the largest market

share in 2018.

On the basis of technology, PCR accounted for the largest share of the market in 2018, followed by immunoassay. An advantage of PCR technology is its automated approach to testing, which provides quick results and aids the decision-making process for product recalls. Besides quick results, this technology can detect contamination at a level of 0.1%.

On the basis of sample type, poultry meat is estimated to hold the

largest market share in 2018.

On the basis of sample type, poultry meat is estimated to account for the largest market share in 2018. The poultry meat sector provides ready-to-eat products, which should be safe for the consumer and have a long shelf life; thus, ensuring the microbial safety of poultry carcasses and cuts is an important issue. The demand for poultry meat is high as there is no religious barrier is eating poultry meat; also, poultry meat is healthier than red meat. Due to these reasons, the production of the poultry meat products is increasing, and therefore, it is vital to ensure the microbial safety of poultry meat products in the context of increasing consumption and production.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=60189057

North America is estimated to dominate the meat testing market in 2018.

North America is estimated to be the largest market for meat testing in 2018. This is due to the increased awareness of safe food products among consumers, the growing number of meat product recalls, and stringent food safety regulations in the region. The US is one of the largest meat consuming countries, with stringent regulations to keep a check on the quality of meat products. This leads to the growth of the meat testing services industry; more the production of meat, the more testing will be required.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies. It includes profiles of leading companies such as SGS (Switzerland), Eurofins (Luxemburg), Bureau Veritas (France), Intertek (UK), TUV SUD (Germany), ALS (Australia), Mérieux NutriSciences (US), AsureQuality (New Zealand), Romer Labs (Austria), LGC Limited (UK), Genetic ID (US), and Microbac Laboratories (US).

The report "Meat Testing Market by Target Tested (Pathogen, Species, Allergen, GMO, Mycotoxin, Heavy Metal, Veterinary Drug Residue), Sample (Meat and Seafood), Technology (PCR, Immunoassay, Chromatography, Spectroscopy), and Region - Global Forecast to 2023", The meat testing market is estimated at USD 7.94 billion in 2018 and is projected to reach a value of USD 11.48 billion by 2023, at a CAGR of 7.7%. Growth in the international trade of meat and seafood creates the need for global mandates and regulations on food safety, which is a significant factor that drives the market for meat & seafood testing. Additionally, globalization has a major impact on the global meat supply and has increased the import & export of meat, poultry, and seafood products worldwide. This has increased the risk of unsafe or contaminated products reaching consumers in distant markets, which, in turn, creates a demand for meat testing across the world.