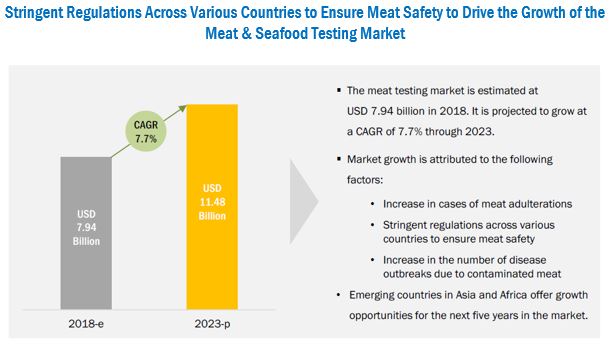

The global meat testing market is estimated at USD 7.94 billion in 2018 and is projected to reach a value of USD 11.48 billion by 2023, growing at a CAGR of 7.7%. The key players profiled have a strong presence in the global meat testing market; these include SGS (Switzerland), Bureau Veritas (France), Intertek (UK), Eurofins (Luxembourg), and TUV SUD (Germany).

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=60189057

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=60189057

The key market players adopted various growth strategies such as acquisitions, expansions & investments, partnerships, and new service launches to cater to the increasing demand for meat testing services and expand their business. The companies in this market focus on increasing their R&D expenditure to develop new meat testing technologies that provide quick and accurate results; companies also focus on expanding their service facilities by increasing their geographic presence.

Several key players in this market adopted acquisitions, which help to increase their presence and increase their market share in the meat testing market. Companies are expanding and investing in new technologies to create new techniques for getting better results for a sample test for different species. Companies such as SGS (Switzerland), Eurofins (Luxembourg), and Intertek (UK) are expanding their service facilities by acquiring other companies. Companies such as Mérieux NutriSciences (US) are expanding its operations in France by opening a food chemistry laboratory; this enhanced the company’s business network in France.

SGS (Switzerland) has been one of the major players in the global meat testing market. It offers meat testing services in Europe, the Middle East, Asia, and the Americas. In April 2018, SGS acquired Oleotest NV (Belgium), a chemical testing services provider for food and feed. This acquisition would enable the expansion in a complementary segment for chemical analyses, which would strengthen the company’s leading position for food (meat) and life sciences in Belgium. In December 2016, SGS acquired 70% stake in Biopremier (Portugal), a company which specializes in DNA sequencing services for the meat sector.

Eurofins (Luxembourg) strengthened its position in the meat testing market, mainly through expansions. It capitalizes on its portfolio of 130,000 reliable analytical methods that allow it to offer services that characterize the safety and authenticity of products and biological substances. In December 2016, Eurofins expanded its network by widening its geographic presence in Asia. It developed a new team which is in operation in the Philippines. This expansion is strategized to cover the markets of Vietnam, Indonesia, and the Philippines.

Bureau Veritas (France) focuses on developing its network through strategic acquisitions. The company has a broad service portfolio for various technologies such as ICP-MS and PCR in the meat testing market. Bureau Veritas (France), in March 2017, acquired Schutter Group B.V. (Netherlands), a leading TIC service provider for food & agri commodities. This acquisition strengthens its business network in Europe, South America, and Asia.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=60189057

North America is estimated to be the largest market for meat testing in 2018. This is due to the increased awareness of safe food products among consumers, the growing number of meat product recalls, and stringent food safety regulations in the region. The US is one of the largest meat consuming countries, with stringent regulations to keep a check on the quality of meat products. This leads to the growth of the meat testing services industry; more the production of meat, the more testing will be required.

No comments:

Post a Comment