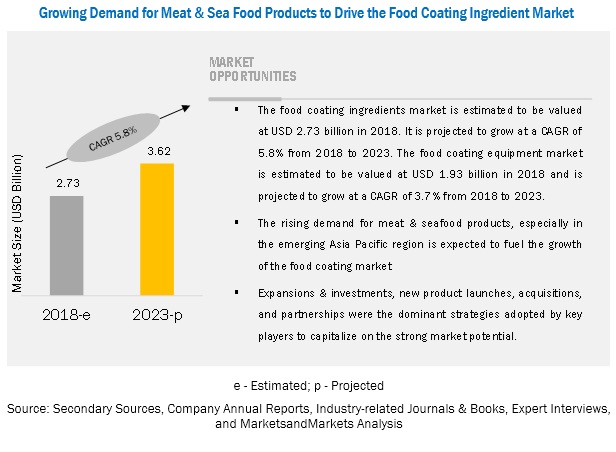

The global Food Coating Market is projected to reach 5,936.3 USD Million by 2023 at a CAGR of 4.98% from 2018-2023. The food coating ingredients and equipment markets are estimated to be valued at USD 2.73 billion, and USD 1.93 billion, respectively in 2018 and are projected to reach a value of USD 3.62 billion and USD 2.31 billion by 2023, respectively, at a CAGR of 5.8% and 3.7% from 2018 to 2023. The key players profiled have a strong presence in the global food coating equipment market; they include Marel (Iceland), GEA Group (Germany), Bühler (Switzerland), JBT Corporation (US), and Clextral (France).

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168532529

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168532529

The key market players adopted various growth strategies such as new product launches, expansions, investments, acquisitions, and partnerships, in order to cater to the increasing demand for food coating equipment. The companies in this market focus on increasing their product portfolios through strategic acquisitions and on expanding their manufacturing capacities.

The companies in the food coating ingredient industry adopted all developmental strategies in 2015 but mainly focused on acquisitions to sustain and grow in the market. In the same year, new product launches & agreements, joint ventures, and partnerships were the second-most favored strategies. The developments observed in the market are expected to increase with the increasing consumption of bakery, confectionery, and processed meat products. In 2018, companies are mainly focusing on adopting strategies such as expansions, investments, partnerships, and joint ventures to retain their market share and meet consumer demand, globally. For instance, in July 2018, Kerry Group (Iceland) invested in the expansion of its Wittstock breadcrumb manufacturing facility in Germany. This expansion will help the company to serve its customers in the European region better. The expansion is expected to involve the installation of a new crumb baking line and a warehouse extension.

Cargill (US) has a robust product offering in the food coating ingredients market and occupies a major share due to its large distribution network, strong geographical presence, and high brand value. The company operates through four business segments, namely, food ingredients & applications, animal nutrition & protein, origination & processing, and industrial & financial services. It offers coating ingredients through its food ingredients & applications division. It has been consistent in strengthening its position in the food coating ingredient market by engaging in strategic acquisitions and expansions. The company has a global presence and focuses on continuous improvement and innovation with regard to its growth prospects. In terms of organic growth strategies, the company focuses on expansions. It also focuses on expanding its product portfolio of food coating ingredients through inorganic development, and in line with this strategy, the company acquired ADM’s global chocolate business in August 2015. This acquisition helped the company to strengthen its position in the cocoa and chocolate industry.

GEA Group is one of the well-established manufacturers of a wide range of food coating equipment to multiple food industries such as bakery products, confectionery products, snacks, meat & seafood, and baking cereals. The operating segments of the company include business area equipment and business area solutions. The business area equipment segment specializes in the development of food processing equipment and technologies, while the business area solutions segment is involved in providing customized equipment and technologies that cater to industries such as food & beverages, chemical, and pharmaceuticals.

There have been multiple organic attempts by the company to grow within the food coating technology market. The increased demand for the company’s highly efficient coating line for confectionery products is one of the driving factors for the increase in the company’s presence in the food coating technology market across developed as well as developing regions such as Europe and South America. The company has focused on continuous improvement of its production efficiency and has strategized its approach to new product launches to meet the varying demand from customers.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=168532529

North America is expected to continue its dominant presence in the food coating ingredients market during the forecast period. The region is backed by superior food coating technologies and utilizes automatic equipment for coating food ingredients. Consumers in the US and Canada majorly consume salty snacks such as potato chips, which need dry coating. Apart from this, these countries consume frozen food that requires coating for an extended shelf life. Consumers in this region opt for cereal as breakfast options where coating is applied. The US is also a huge market for confectionery products. These factors have fueled the growth of the food coating market in North America.

No comments:

Post a Comment