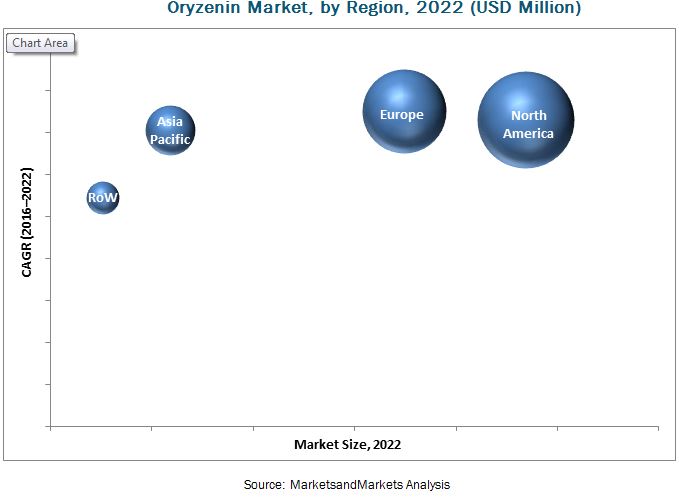

The report “Oryzenin Market by Type (Isolates, Concentrates), Application (Bakery & Confectionery, Meat Analogs & Extenders, Sports & Energy Nutrition, Dairy Alternatives, Beverages), Form (Dry, Liquid), and Region – Global Forecast to 2022″, is estimated at USD 88.2 Million in 2016 and is projected to reach USD 198.2 Million by 2022, at a CAGR of 14.5% during the forecast period. The market is driven by factors such as the increasing demand for rice protein due to its functional properties, growth in consumption of plant protein, cost-effectiveness of plant protein as compared to animal protein, and the increasing awareness among consumers towards the importance of protein.

On the basis of application, the oryzenin market was led by sports & energy nutrition, followed by beverages, in 2015. Sports & energy nutrition was the leading segment, owing to the increase in the consumption of sports & energy drinks due to the trend of healthy living among consumers. The application of oryzenin in sports & energy nutrition is attributed to its high amino acid profile and branched chain amino acids (BCAAs), which are essential for athletes and bodybuilders for muscle recovery. Oryzenin increased lean body mass skeletal muscle hypertrophy, power, and strength similar to whey protein. This segment has potential for growth in the near future, with increasing application of oryzenin as a nutrition enhancer in food products.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=111247029

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=111247029

On the basis of form, the dry segment accounted for a larger market share in 2015. The dry form dominated the oryzenin market as it is easy to handle and can be transported easily with lower expenses, which has increased the demand for dry oryzenin powder. In addition, the liquid form needs further processing to be extracted from the dry form, thus increasing the investment.

The rapid growth of economies in Europe has led to the increase in demand for protein. This factor has resulted in the growth of low-cost protein sources such as vegetable proteins that can be used as substitutes for other protein ingredients. European consumers are emphasizing more on healthier lifestyles; hence, protein product manufacturers need to focus on reducing consumer fears concerning its allergies and safety issues. Gluten is found to cause allergies and it has been estimated that up to 90% of protein in wheat is gluten. Amongst northern European consumers, 30% carry genes for gluten intolerance. This creates tremendous opportunity for other sources of proteins which are free from gluten such as rice protein.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=111247029

This report includes a study of development strategies, along with the product portfolios of the leading companies in the oryzenin market. The key companies profiled are Axiom Foods, Inc. (U.S.), AIDP Inc. (U.S.), RiceBran Technologies (U.S.), Kerry Group plc (Ireland), and BENEO GmbH (Germany). The other players of the oryzenin market are Ribus, Inc. (U.S.), Green Labs LLC (U.S.), Golden Grain Group Limited (China), Shaanxi Fuheng (FH) Biotechnology Co., Ltd. (China), and Bioway (Xi’An) Organic Ingredients Co., Ltd. (China).

Targeted Audience:

- Supply side: Oryzenin manufacturers, suppliers, formulators, traders, distributors, and suppliers

- Demand side: Plant protein manufacturers, food processing industries, whey producers, large sports drink manufacturing companies, and researchers

- Regulatory side: Organizations such as the Food and Drug Administration (FDA), European Food Safety Authority (EFSA), United States Department of Agriculture (USDA), and Food Standards Australia New Zealand (FSANZ)