The integrated food ingredients market is estimated at USD 60.90 billion in 2018 and is projected to reach USD 77.48 billion by 2023, growing at a CAGR of 4.9% during the forecast period. The increasing disposable incomes, growing population, busy lifestyles, and a shift in the focus for highly convenient processed food are some of the key trends influencing the growth of this market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=118618755

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=118618755

The taste enhancers segment is estimated to account for the largest share, by function, in 2017.

Based on function, the integrated food ingredients market has been segmented into taste enhancers, form, texture, preservation, and coloring. The taste enhancers segment is estimated to account for the largest share by function of the integrated food ingredients market. Taste enhancers are used in various applications such as dairy products, beverages, savories, and meat products to enhance the taste of food products. In order to serve keyboards food to the consumers, various manufacturers in the food & beverage industry are using taste enhancers thereby fueling the market for flavors. Various taste enhancers such as monosodium glutamate, monopotassium glutamate, and calcium di-glutamate are used to enhance the flavor of food products.

The beverages segment, by integrated solutions, is estimated to account for the largest share of the integrated food ingredients market in 2017.

Based on integrated solutions, the integrated food ingredients market has been segmented into beverages, bakery & confectionery, snacks, meat products, and dairy. The beverages segment is estimated to account for the largest share of the global integrated food ingredients market in 2018. Consumer demand for functional and health beverages has been on the rise for the past few years. For instance, consumer demand for beverages made of fruits & vegetables that have a high content of minerals and vitamins is one of the fast-growing trends in the beverage industry. These factors influence the integrated food ingredients market. The increasing consumption of fruit juices, vegetable juices, and energy drinks also spurs the growth of natural integrated food ingredients.

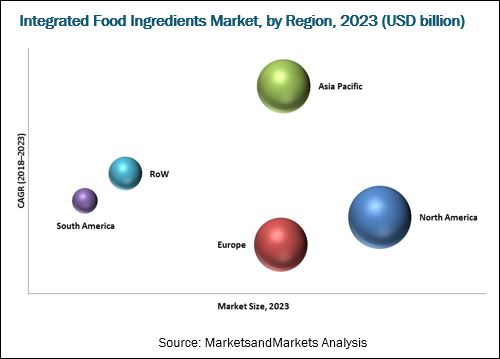

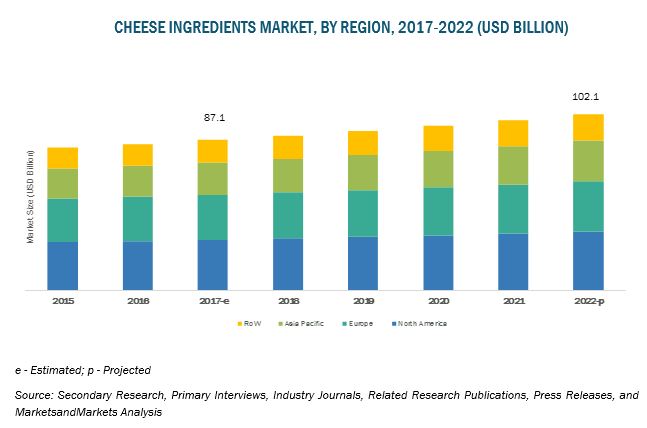

North America is projected to dominate the integrated food ingredients market in terms of value in 2017.

North America is projected to lead the global market for integrated food ingredients in terms of growth rate. The major factors driving the growth of this market are matured economy and growing urbanization. The North American region is mainly driven by the rising demand for functional and convenience foods. This leads to an increase in the demand for health and wellness food ingredients, which, in turn, drives the growth of the integrated food ingredients market. The demand for integrated food ingredients in the brewing industry and the high complexity of procedures drive the demand for enzymes. However, stringent regulations by food administration departments and governments restrain its market growth.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as CARGILL (US), ADM (US), DUPONT (US), ABF (UK), BASF (Germany), Kerry (Ireland), DSM (Netherland), Tate & Lyle (UK) , Symrise (Germany), IFF (US), Dohler (Germany), Northwest Naturals (US), GAT Foods (Israel), and FIRMENICH (Switzerland).

Targeted Audience:

- Integrated food ingredients manufacturers

- Regulatory bodies

- Intermediary suppliers

- End Users