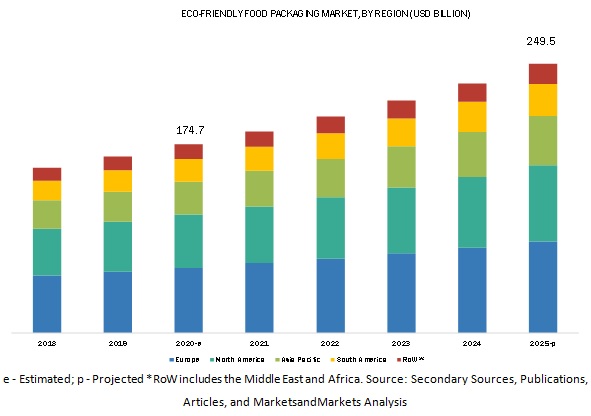

According to MarketsandMarkets, the global eco-friendly food packaging market is estimated to be valued at USD 174.7 billion in 2020 and is projected to reach USD 249.5 billion by 2025, recording a CAGR of 7.4%, in terms of value. Stringent government regulations, downsizing in the packaging industry, and technological advancements in the packaging industry for the manufacturing of packaging using non-petroleum products are driving the market for eco-friendly food packaging. Furthermore, innovative products such as edible packaging and water-soluble packaging are also fueling the market for the eco-friendly food packaging market.

Download PDF Brochure:

The paper & paperboard segment, by material, is projected to witness significant growth during the forecast period

By material, the paper & paperboard market is segmented into corrugated box, boxboard, rigid box, folded boxes, trays, flexible packaging, paper bags, shipping bags, and sachet/pouches. The packaging of products differs for the type of foods and beverages served. Paper & paperboards are the most preferred packaging in the food & beverage industry due to its degradable nature and recyclable property. Ready-to-eat, on-the-go, and frozen & fresh foods are nowadays served and transported in the paperboard packaging, which is due to the rise in environmental hazards. Rigid boxes are preferred for transportation. However, fresh products are served inflexible and molded paper & paperboards.

The eco-friendly food packaging, by application, is projected to account for a significant share in the market during the forecast period

By application, the eco-friendly food packaging market is segmented into food and beverages as applications. The food segment accounted for the largest share in 2019, acquiring approximately 70% of the overall market. Consumers seek convenience food solutions due to lack of time. The expectations of food quality, hygiene, and growing health awareness are driving the eco-friendly packaging market in the food sector. Beverages are usually served in reusable or recyclable products. Also, food products can be served in biodegradable packaging, which includes paper & paperboards; this is fueling the growth of the segment.

Request for Customization:

The Asia Pacific is projected to grow at the highest growth rate during the forecast period

The market in the Asia Pacific is projected to witness the highest growth due to the increasing demand for convenience foods due to the busy lifestyles of consumers. There is increasing consumption of on-the-go and ready-to-eat breakfast meals, as a result of urbanization, hectic lifestyles, and high disposable income. The eco-friendly food packaging industry has been growing as a result of the stringent laws and regulations levied by governments and governing bodies, as well as a shift in consumer preferences toward recyclable and eco-friendly packaging materials. Apart from these factors, the downsizing of packaging and breakthrough in new technologies are also driving the market globally. However, the high cost of recycling and poor infrastructure available for recycling processes are likely to hamper the growth of this market in underdeveloped regions.

Key players in the eco-friendly food packaging market include Amcor (Australia), Mondi Group (Austria), Sealed Air Corporation (US), Ball Corporation (US), and Tetra Pak (Sweden).

Recent Developments:

- Evergreen Packaging came up with a fully renewable ice-cream board, to sell plant-based ice-cream made by NadaMoo! (US). The product was named Sentinel. The product is a sugarcane-based polypropylene board and cups that are 100% renewable and eco-friendly.

- Winpak acquired Cheringal Associates and Norwood Printing Inc. (New Jersey, US). The new entity formed is known as Winpak Control Group. Cheringal Associates has been delivering specialized printed packaging solutions for the last 50 years. This acquisition would reduce the company’s printing costs and would enable customized printing solutions.

- Ball Corporation set-up the new aluminum cups manufacturing plant in Georgia. The company established the plant to serve the growing demand for innovative, eco-friendly beverage packaging for US customers and other consumers.

- Smurfit collaborated with a specialty brewer, Vanhonsebrouck (Belgium), to implement a complete circular supply chain and production line to make several changes in its existing production line to include recyclable cans instead of glass to provide an eco-friendly packaging solution.