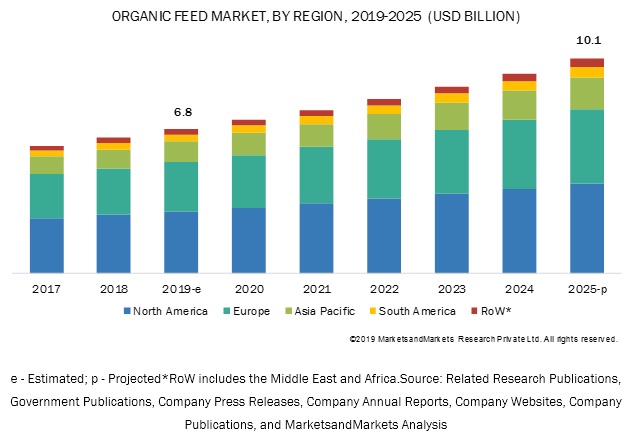

The global organic feed market size is estimated to be valued at USD 6.8 billion in 2019 and is projected to grow at a CAGR of 6.8% from 2019 to reach a value of USD 10.1 billion by 2025. The increasing instances of animal product contamination due to pesticides and insecticides, rising demand for organic food products, growing organic livestock farming, and adaption of organic farming practices by farmers due to the increasing health concerns among consumers are some of the key factors that are projected to drive the growth of the global organic feed market. Developing countries in Asia Pacific and South American regions are projected to create lucrative growth opportunities for organic feed manufacturers in the coming years.

By type, the cereal & grains segment is projected to dominate the organic feed market during the forecast period.

The cereals & grains segment is estimated to account for the largest share, on the basis of type, in the organic feed market in 2019. Cereals and grains include wheat, corn, and barley. The high growth in the Asia Pacific region is attributed to the increasing awareness about the benefits of feeding organic cereals and grains to livestock, to maintain their nutrient requirements and enhance their growth, and fulfill the rising demand for organic food. High availability of cereals and grain crops in Europe and Asia Pacific due to the increasing organic farmland practices in most of the countries in the region is also one of the key factors driving the growth of the segment.

Download PDF Brochure:

By livestock, the poultry segment is projected to dominate the organic feed market during the forecast period.

The poultry segment, on the basis of livestock, is estimated to account for the largest share in the organic feed market in 2019. The poultry industry is the largest and also the fastest-growing sector that witnesses high organic production. Poultry meat is consumed across regions, and unlike beef and swine, it does not have any religious constraints. The increasing concerns about animal health and the rising awareness pertaining to the benefits of organic feed feedstuffs have contributed to the growth of this market. Due to the increase in organic poultry production and the rise in demand for organic meat, the meat producers are focusing on investing in organic rearing of livestock to produce meat, dairy, and other by-products from animals.

North America is projected to be the largest market during the forecast period.

North America is projected to be a key revenue generator for organic feed manufacturers due to the increased demand in the US. North America witnesses various key players operating in the organic feed market. These include Cargill (US), SunOpta (Canada), and Purina Animal Nutrition LLC (US). The demand for organic feed products remains high in the poultry segment in the region. The US is among the largest producers and consumers of corn, wheat, and soybean at a global level. These ingredients are majorly used in the feed industry, as they increase their nutrient quotient. Due to the rising consumer preferences for natural ingredients, the demand for these ingredients is projected to increase in the coming years.

Speak to Analyst:

In Canada, some of the small scale players are focusing on offering organic feed for poultry, swine, and ruminants. In Mexico, the demand for organic poultry products, such as eggs and poultry meat, is projected to create lucrative opportunities for organic feed manufacturers. Milk is also projected to increase the demand for organic feed products among ruminant livestock, as consumers opt for organic dairy products in the region. Thus, North America is projected to offer high growth prospects for organic feed manufacturers in the coming years.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies, in the organic feed market. It consists of the profiles of leading companies, such as Cargill (US), BernAqua (Belgium), Country Heritage Feeds (Australia), ForFarmers (Netherlands), SunOpta (Canada), Ranch-Way Feeds (US), Aller Aqua (Denmark), Purina Animal Nutrition LLC (US), Scratch and Peck Feeds (US), Cargill (US), K-Much Feed Industry Co., Ltd (Thailand), The Organic Feed Company (UK), B&W Feeds (UK), Feeddex Compaies (US), Country Junction feed (US), Green Mountian Feeds (US), Unique Organic (US), Kreamer Feed (US), Yorktown Organics, LLC (US), and Hi Peak Feeds (UK).