The

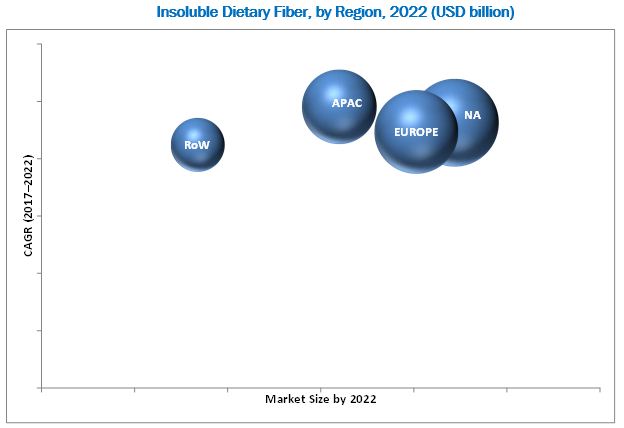

insoluble dietary fiber market is projected to grow at a CAGR of 9.2% from 2017 to 2022, to reach USD 2.66 billion by 2022. Factors such as growth in demand for functional foods, rising consumer awareness through government health programs, and increase in health-consciousness among consumers are driving this market.

The objectives of the report:

- To define, segment, and estimated the size of the insoluble dietary fibers market, with respect to its sources, applications, types, and key regional markets

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To project the size of the market in terms of value and volume, with respect to four regions (along with their respective countries), namely, North America, Europe, Asia-Pacific, and Rest of the World (RoW)

- To strategically profile the key players and comprehensively analyze their product portfolios and core competencies

- To analyze the competitive developments such as new product launches, acquisitions, expansions & investments, agreements, collaborations and joint ventures in the insoluble dietary fibers market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=174505495

Growth in demand for functional foods

Changes in lifestyles and lack of time have led to high consumption of functional foods in countries around the world, especially in Asia. With growth in workload, busy lifestyles, and increase in the number of working women (considering women play a predominant role in preparing meals in households), the time and means to intake healthy food have reduced. This has resulted in the growing demand for products that offer balanced nutrition. Thus, the consumer demand for functional foods, nutraceuticals, and supplements has been increasing. As insoluble dietary fibers form an essential ingredient in functional food products, their market is also increasing.

With changing consumer lifestyles, there is a need for intake of extra fiber. Insoluble dietary fiber content varies in different types of foods. Several key players such as Archer Daniels Midland Company (U.S.), Cargill (U.S.), and E. I. du Pont de Nemours and Company (U.S.), offer a range of insoluble dietary fibers obtained from different sources including wheat, oats, corn, peas, potato, legumes, and rice for their application in food, feed, and pharmaceutical products. Further, the products offered by these companies are also in accordance with consumer needs. This is projected to drive the market for insoluble dietary fibers.

The insoluble dietary fiber market, based on type, has been segmented into cellulose, hemicellulose, chitin & chitosan, lignin, fiber/bran, resistant starch, and others. The cellulose segment dominated this market in 2016. Cellulose is insoluble dietary fiber used in a wide range of food applications such as meat products, poultry products, and bakery items. Cellulose fibers with low water absorption capacity are mainly used for providing fiber enrichment in different types of bakery products such as bread and tortillas. Cellulose with high water- and oil-holding capacity is used in processed meat to manage the moisture level. The fiber/bran segment is projected to be the fastest-growing due to the growing technological advancements in extraction processes and the investment by the key companies in sourcing fiber/bran from grains, fruits, and vegetable.

The insoluble dietary fiber, based on application, is segmented into functional food & beverages, pharmaceutical, animal feed, and pet food. The functional food and beverage segment is projected to be the largest application segment during the forecast period. Consumption of extra insoluble dietary fibers with food leads to the prevention of health disorders such as constipation, hyperglycemia, obesity, and high cholesterol. Due to the changing diet patterns and the increasing health concerns, insoluble dietary fibers have begun to form an integral part of processed and packaged food in a bid to meet nutritive requirements.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=174505495

The North American region was the largest market for insoluble dietary fibers market in 2016. This can be attributed to the increase in demand for various dietary fiber fortified products in the U.S. and Canada. The consumer awareness related to dietary supplement consumption in this region is very high, and can be attributed as a reason for its largest market share in this market.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies. It includes profiles of leading companies such as Cargill (U.S.), Roquette Frères (France), E. I. du Pont de Nemours and Company (U.S.), Ingredion Incorporated (U.S.), SunOpta, Inc. (Canada), Interfiber (Poland), Solvaira Specialties (U.S.), Unipektin Ingredients AG (Switzerland), AdvoCare International, L.P. (U.S.), J. Rettenmaier & Söhne GmbH Co. KG (Germany), Grain Processing Corporation (U.S.), and Barndad Nutrition (U.S.).