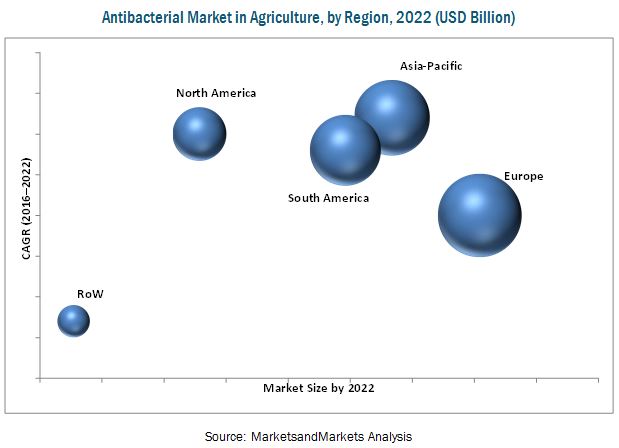

The global antibacterial market in agriculture is projected to reach USD 11.89 Billion by 2022, at a CAGR of 4.6% during the forecast period. The market growth is driven by multiple factors such as the rise in the need for food security for the growing population, advancement in farming practices and technologies, and ease of application of antibacterial in agriculture. The antibacterial market is further driven by factors such as the increase in demand for fruits & vegetables, increase in acceptance for Integrated Pest Management (IPM) by farmers, and high opportunities in developing countries.

The objectives of the report are as follows:

- To define, segment, and measure the antibacterial market based on type, crop type, mode of application, form, and region

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To analyze opportunities in the market for stakeholders and details of the competitive landscape for market leaders

- To analyze competitive developments such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and collaborations in the agricultural bactericides market

- Analyzing the demand-side factors based on the impact of macro and microeconomic factors on the market and shifts in demand patterns across different subsegments and regions

Download PDF Brochure:

Significant growth expected in the dithiocarbamate segment

Antibacterials in agriculture are highly used to control bacterial disease by specifically inhibiting or killing the bacterial causing the disease. They can be mixed with water, and hence easily applied through foliar spray, soil treatment. The ease in application mode has made these antibacterial products more convenient to use for the farmers. Dithiocarbamate are projected to be the fastest-growing types in the next six years.

The cereals & grains segment projected to be the fastest-growing market during the forecast period

Cereals & grains dominated the antibacterial market in agriculture in 2015; it is projected to grow at the highest CAGR of from 2016 to 2022. Rise in demand for cereals & grains, owing to the increased awareness regarding their nutritional benefits is driving the cereals & grains segment.

With a global increase in consumption of fruits & vegetables and growth in demand for tropical and exotic fruits & vegetables in the developing countries, this segment is likely to witness a growth by 2022.

Request for Customization:

Increase in need for food security, high investment in R&D, and change in farming practices key to success in the European region

Europe is one of the largest contributors to the global antibacterial market in agriculture due to the increase in use of antibacterial products through advanced agricultural techniques and rise in need for food security in the European countries. Italy and France constituted the largest country-level markets in the European region in 2015. High market penetration by the leading antibacterial companies, for enhancing the agricultural growth and productivity, and the decrease in arable land are the main factors influencing the growth of the antibacterial market in agriculture in Europe.

This report includes a study of marketing and development strategies, along with the product portfolio of leading companies. These companies include BASF SE (Germany), Dow AgroSciences LLC (U.S.), Sumitomo Chemical Co., Ltd (Japan), and Bayer CropScience AG (Germany); these are well-established and financially stable players that have been operating in the industry for several years. Other players include Syngenta AG (Switzerland), Nippon Soda Co. Ltd. (Japan), and Nufarm Ltd. (Australia).