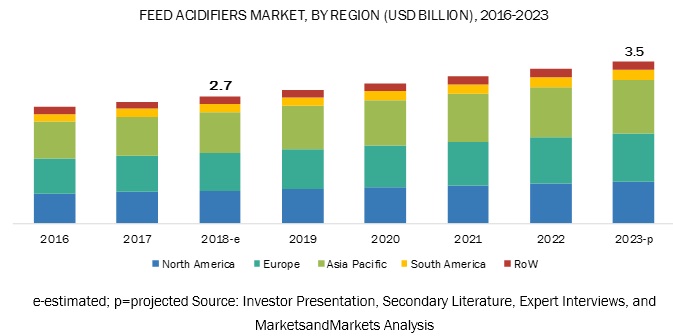

The feed acidifiers market is estimated to grow from USD 2.7 billion in 2018 to USD 3.5 billion by 2023, at a CAGR of 5.1% during the forecast period. The major factors driving the feed acidifiers market include the rising consumption of livestock by-products, high threat of diseases in livestock, growing government aids or funds promoting the wellness of the feed industry, and ban of antibiotics in the European Union (EU). The feed acidifiers market is experiencing strong growth due to initiatives being taken for improving animal health globally.

Download PDF Brochure:

Opportunity: Encapsulation techniques being used for feed acidifiers

Feed acidifiers have positive effects on livestock health but are often difficult to properly process in feed. Acidifiers tend to lose their efficacy and efficiency, owing to their vulnerability to high temperatures, dusty environment, significant odors, and other volatile properties. As a result, manufacturers are now coming up with newer technologies that help improve feed efficiency by successfully locking in feed acidifiers along with their relevant efficacies and properties. Encapsulation acts as a novel technology for feed products, especially for acidifiers that allow them to improve their release and enteric action and have a longer shelf-life by protecting them against environmental changes, by keeping the liquid, gaseous, or solid acidifier substance packed in a tiny millimetric capsule. These acidifiers are encapsulated in such a manner that the digestive tract obtains small quantities of various acids in a progressive manner. As a result, the amount of acidifiers released into the stomach remains low while the amount reaching the intestinal tract is higher, thereby improving operating efficiency. Along with this protection against extreme environmental factors, encapsulation also maintains the key properties of acidifiers, such as the enhancement of palatability, stability in ration, improved digestion, and better livestock performance.

The Propionic Segment Is Projected To Hold the Largest Share in the Feed Acidifiers Market

As consumers become more sensitive to food safety, rearers are focusing on investing in feed additives that enhance the quality of meat and prevent diseases in livestock. Rearers prefer propionic acid as feed additives as they are a rich source of nutrients and are generally recognized as safe (GRAS) substances by the FDA. Due to their increasing preference in the livestock industry, the propionic segment is projected to account for the largest share in the feed acidifiers market during the forecast period.

Dry Feed Acidifiers To Outpace the Sales of Liquid Feed Acidifiers in the Market Throughout 2023

To maintain consistency in the application and enhance the nutrient quotient of crops, the dry form of feed acidifiers is utilized extensively. Demand for dry feed acidifiers is preferred as they are convenient to store, transport, and use. Also, the dry form of feed acidifiers can be used efficiently due to their free-flowing structure. Owing to these factors, dry feed acidifiers are projected to outpace the sales of the liquid form during the forecast period.

Speak to Analyst:

The Feed Acidifiers Market To Record the Fastest Growth in South America During the Forecast Period

As governments in the South American region focus on investing in the livestock sector, rearers in various countries of this region are allocating their budget to utilize feed acidifiers. Rearers are mainly focusing on improving the meat quality by utilizing feed acidifiers and offer GRAS-certified produce in the market. The demand for meat and poultry products is also projected to increase in parallel to the population growth and disposable income of consumers in this region. Due to these factors, the market in this region is expected to record the highest growth during the forecast period.

Leading players in the feed acidifiers market are adopting strategies such as product launches, acquisitions, expansions, and collaborations & divestments. Key players identified in this market include Yara International ASA (Norway), Kemira OYJ (Finland), BASF SE (Germany), Biomin Holding GmbH (Austria), and Kemin Industries Inc., (US).

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the feed acidifiers market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?