The report

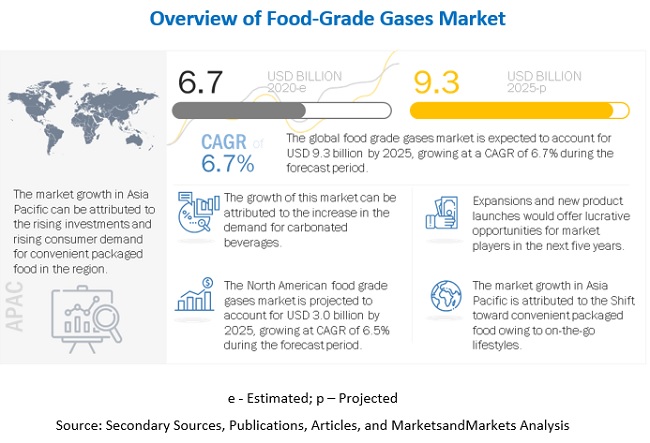

"Food-Grade Gases Market by Type (Carbon Dioxide, Nitrogen, Oxygen), Application (Freezing & Chilling, Packaging, Carbonation), End-Use (Dairy & Frozen Products, Beverages, Meat, Poultry & Seafood), and Region - Global Forecast to 2025", is estimated to be valued at USD 6.7 billion in 2020 and is projected to reach USD 9.3 billion by 2025, at a CAGR of 6.7% from 2020 to 2025. Shifting consumer preferences toward convenient food packaging owing to their on-the-go lifestyles and the growing number of microbreweries across all regions are some of the factors driving the growth of the food-grade gases market.

Opportunities: Increasing Number of New Food & Beverage Product Developments

Consumers are increasingly demanding food products that are healthy, convenient, natural, and sustainable. This has forced food and beverage manufacturers to formulate new and innovative products accordingly. New products, new variety line extensions, new packaging, and new formulations are the marketing strategies adopted by food & beverage manufacturers. As new products are increasingly being launched, the need for packaging and storage of these products increases. The use of food-grade gases will serve as a significant opportunity for manufacturers.

Challenges: Safe & Proper Handling of Food-grade gases

Food-grade gases must be controlled and readily available at the point of use, and the means of delivery is critically important to ensure system compatibility and safe transportation. A variety of storage containers are used for this purpose such as bulk containers, cryogenic cylinders, gas cylinders, and glass bottles. All the storage containers require safe and proper handling of the stored gases is essential. This is a major challenge faced by food-grade gases manufacturers, in order to prevent hazard and environment risks associated with these food-grade gases.

By mode of supply, the bulk segment is projected to record faster growth during the forecast period

Based on the volume required by end-users, the gases are either supplied in bulk or cylinder. Companies that require large volumes of gases opt for bulk supplies for easy transportation and storage. On the other hand, companies that require lesser volumes of gases generally opt for gases in cylinders. Owing to the factors such as ease of handling, transportation, and storage, the bulk mode of supply is projected to register a higher CAGR during the forecast period.

North America is estimated to dominate the food-grade gases market, in terms of value, in 2020

The microbrewery culture is also on the rise in the North American market. There are multiple microbreweries present in the region. These microbreweries require carbon dioxide for beer dispensing. Also, the North American soft drinks market is one of the largest, with the presence of all the big brands such as Coca-Cola and PepsiCo. The soft drinks industry is one of the largest users of food-grade carbon dioxide for the carbonation of beverages.

Make an Inquiry:

The large beverage industry and rising trends of microbreweries create a huge demand for carbon dioxide in the North American region, with the US being the largest and fastest growing market. Also, because of the presence of highly organized retail chains and cold chain infrastructure, the North American market holds the largest market share in the food-grade gases market.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as The Linde Group (Germany), Air Products & Chemicals (US), Air Liquide (France), The Messer Group (Germany), Taiyo Nippon Sanso (Japan), Wesfarmers Ltd. (Australia), SOL Group (Italy), Gulf Cryo (Kuwait), Air Water, Inc. (Japan), Massy Group (Caribbean), PT Aneka Industri (Indonesia), National Gases Limited (Pakistan), SIAD (Italy), Cryogenic Gases (US), Les Gaz Industriels Ltd. (East Africa), Aditya Air Products (India), Sidewinder Dry Ice & Gas (South Africa), Axcel Gases (India), Chengdu Taiyu Industrial Gases Co., Ltd (China), Yingde Gas Group Ltd (China), Siddhi Vinayak Industrial Gases Pvt Ltd (India), American Welding & Gas (US), Ijsbariek Strombeek N.V (Belgium), Air Source Industries (US), and Purity Cylinder Gases Inc. (US).