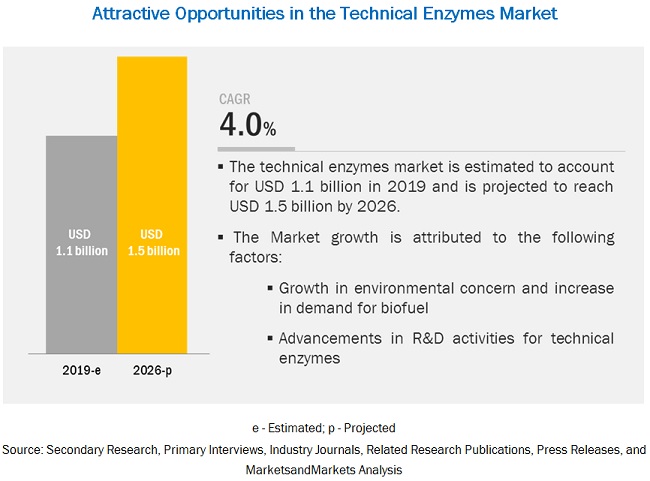

The global technical enzymes market size is projected to grow from USD 1.1 billion in 2019 to USD 1.5 billion by 2026, recording a compound annual growth rate (CAGR) of 4.0% during the forecast period. The increasing trend of environmental concerns in developing countries and advancements of R&D activities for technical enzymes are the major factors that are projected to drive the growth of this market during the forecast period.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=72989187

The microorganism source is projected to account for the largest share in the technical enzymes market during the forecast period.

Microorganisms are the primary source of technical enzymes, as they are cultured in large quantities in a short period, and genetic manipulations can be done on bacterial cells to enhance the enzyme production for usage in various industries such as biofuel, pulp & paper, textile & leather, and starch processing. Additionally, the microbial enzymes are preferred by the manufacturers due to their active and stable nature as compared to enzymes from plants and animals.

The liquid form is projected to account for a larger share in the technical enzymes market during the forecast period.

The liquid form of enzymes is widely used in the biofuel and textile & leather industries, due to better blending properties with the resources used for the production of biofuels. In biofuel, the liquid enzymes augment the supply of liquid fuel; whereas, in textiles, it offers the potential to completely replace the use of other chemicals in textile preparation processes. The enzymatic degreasing process replaces the solvent-based process followed by the leather manufacturers. Since the liquid enzymes interfere less with the skin structure, the enzymatic process also results in a product with improved quality. Due to these factors, the liquid form is projected to dominate the market during the forecast period.

North America is projected to account for the largest share in the technical enzymes market during the forecast period.The North American market is projected to account for the largest share by 2025, due to various benefits of technical enzymes, as they are an environment-friendly and cost-effective alternative to replace the conventional alkaline or conventional acidic catalysts. Technological advancements have made technical enzymes available for a wide range of applications in biofuel, paper & pulp, textile & leather, starch processing, and other industries, which is estimated to drive the growth in the region. The North American region is estimated to be the largest market for technical enzymes, globally, owing to the development of novel and superior performing products, developed technologies, and global industrialization.

Make an Inquiry:https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=72989187Key vendors in the global technical enzymes market include BASF (Germany), DuPont (US), Associated British Foods (UK), Novozymes (Denmark), DSM (Netherlands), Dyadic International (US), Advanced Enzymes Technologies (India), Maps Enzymes (India), Epygen Labs (India), Megazyme (Ireland), Aumgene Biosciences (India), Enzymatic Deinking Technologies (US), Tex Biosciences (India), Denykem (UK), MetGen (Finland), and Creative Enzymes (US). These players have a broad industry coverage and high operational and financial strength.

Key questions addressed by the report:

- Who are the major market players in the technical enzymes market?

- What are the regional growth trends and the largest revenue-generating regions for the technical enzymes market?

- What are the key regions and industries that are projected to witness significant growth in the technical enzymes market?

- What are the major industries of technical enzymes that are projected to account for a major revenue share during the forecast period?

- In which major forms are technical enzymes majorly used, and which form is projected to dominate during the forecast period?

- What are the major sources of technical enzymes that are projected to account for a major revenue share during the forecast period?