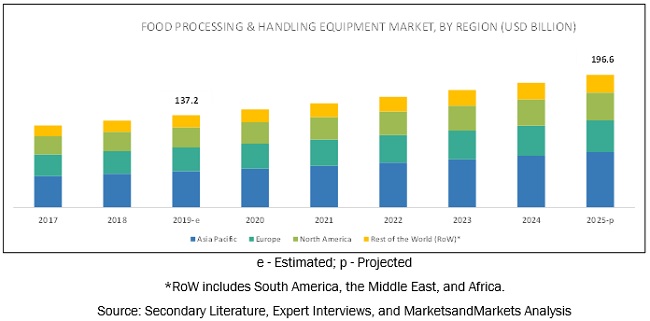

The report “Food Processing & Handling Equipment Market by Type (Food Processing Equipment, Food Packaging Equipment, and Food Service Equipment), Application, Form (Solid, Liquid, and Semi-Solid), and Region – Global Forecast to 2025″, The global food processing & handling equipment market is estimated to be valued at USD 137.2 billion in 2019 and is projected to reach USD 196.6 billion by 2025, growing at a CAGR of 6.2%. Advancements in the food processing & packaging equipment industry, innovation in processing technology, and continuous growth in the demand for processed food are some factors that are expected to support the growth of the food & beverage processing equipment market. With the growing preference for healthy food and functional foods, manufacturers are expected to adopt new equipment to fulfill the demand for healthy functional foods & beverages. The expansion of food manufacturing capacities and growth of the food processing industry in emerging economies are also expected to support the growth of the food processing & handling equipment market.

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=145960225

- In May 2019, GEA launched a new SmartPacker CX400 packaging machine, which has induction sealing capabilities for meat and poultry manufacturers. In April 2019, GEA also launched CALLIFREEZE system for the GEA S-Tec spiral freezer in the Asian market. This product would help GEA’s customers to meet their Industry 4.0 strategy requirements.

- In May 2019, Bosch Packaging Technology, a subsidiary of Bosch, launched the Pack 403, a fully-automated, narrow horizontal flow wrapper in the European and Asian markets. The company has been continuously developing innovative products according to the customers’ demands.

- In April 2019, Tetra Pak launched a connected packaging platform; this would transform juice and milk cartons into interactive information channels, digital tools, and full-scale data carriers.