The report

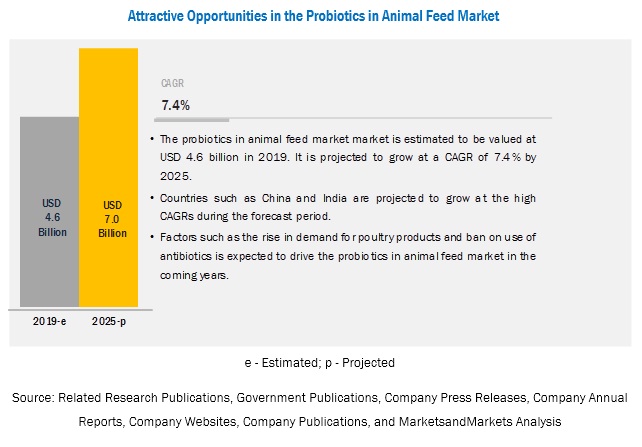

"Probiotics in Animal Feed Market by Livestock (Poultry, Ruminants, Swine, Aquaculture, Pets), Source (Bacteria [Lactobacilli, Streptococcus Thermophilus, Bifidobacteria] and Yeast & Fungi), Form (Dry and Liquid), and Region - Global Forecast to 2025", The global probiotics in animal feed market is estimated to be valued at USD 4.6 billion in 2019 and is projected to reach about USD 7.0 billion by 2025, at a CAGR of 7.4%. The growth of this market is attributed to the rise in demand for functional animal feed products in emerging economies such as Asia Pacific and RoW.

Driver: Growth in consumption of animal-based products

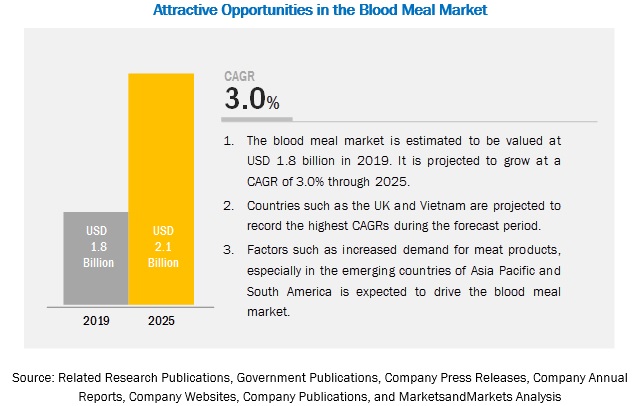

Several changes have been witnessed regarding the dietary habits and consumption patterns of the population, wherein a shift has been observed toward the increased consumption of meat and dairy products. This increase in the demand for various animal products such as milk, dairy products, meat products, eggs, and other non-food items has led to the growth in the usage of feed additives, thereby boosting the probiotics in animal feed market growth. The rapid growth in population has also increased the demand for food all over the world.

The livestock sector is under significant pressure to meet the growing global demand for high-value animal products. Consumers are becoming health-conscious and are focusing on nutrition-rich diets, which are provided by enriched feed products offered to the livestock. Livestock products such as meat, milk, and eggs are rich sources of micronutrients such as iron, zinc, and vitamins. The demand for probiotics in animal feed has increased due to the health benefits associated with the consumption of probiotics. They help in maintaining the microbial flora in the intestinal tract of animals and in enhancing the resistance against pathogens by improving their immune system. They also aid in the treatment of irritable bowel syndrome, inflammatory bowel disease, infectious diarrhea, and antibiotic-related diarrhea. This helps animals to derive maximum nutrition from the feed, which in turn increases the quality of animal products.

Download PDF Brochure:

The aquaculture segment is estimated to witness the fastest growth in the probiotics in animal feed market in 2019

By livestock, the probiotics in animal feed market is segmented into poultry, ruminants, swine, aquaculture, pets, and others (equine and rabbits). There is an increase in demand for probiotics in the feed for aquaculture due to an increase in demand for dietary animal protein. Many breeders are also developing probiotics that could cater to the all-round growth and development of aquatic animals.

The dry segment, by form, held a larger market share in the probiotics in animal feed market in 2018

By form, the probiotics in animal feed market is segmented into dry and liquid forms. The dry form of probiotics in animal feed held a larger market share in 2018 due to factors such as lower storage cost for feed manufacturers and longer shelf-life of feed products, as opposed to liquid probiotics, which have a high moisture content that leads to uncontrolled culturing, which ultimately affects the quality of the feed.

Make an Inquiry:

The Asia Pacific region is projected to dominate the market through the forecast period

In 2018, the Asia Pacific region led the global probiotics in animal feed market. Factors such as a large livestock base, high meat consumption, and increasing consumer awareness about the positive impact of probiotics on animal health are driving the Asia Pacific market. Some of the countries contributing to the growth of this region include China, India, Japan, Australia, and New Zealand.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the probiotics in animal feed market. It includes the profiles of leading companies such as Chr. Hansen (Denmark), Koninklijke DSM N.V. (Netherlands), DowDuPont (US), Evonik Industries (Germany), Land OLakes (US). Other players include Lallemand (Canada), Bluestar Adisseo Co. (China), Lesaffre (France), Alltech (US), Novozymes (Denmark), Calpis Co., Ltd. (Japan), Schouw & Co. (Denmark), Unique Biotech (India), Pure Cultures (US), Kerry (Ireland), and Mitsui & Co., Ltd. (Japan).