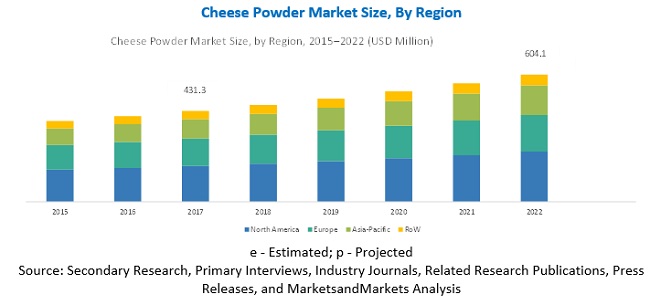

The report "Cheese Powder Market by Type (Cheddar, Mozzarella, Parmesan, American, and Blue), Application (Bakery & Confectionery, Sweet & Savory Snacks, Sauces, Dressings, Dips & Condiments, and Ready Meals), and Region – Global Forecast to 2022", The cheese powder market is projected to grow at a CAGR of 6.82% from 2016 to 2022, to reach USD 604.1 Million by 2022.

Tuesday, October 13, 2020

Cheese Powder Market to Showcase Continued Growth in the Coming Years

Upcoming Growth Trends in the Milk Protein Market

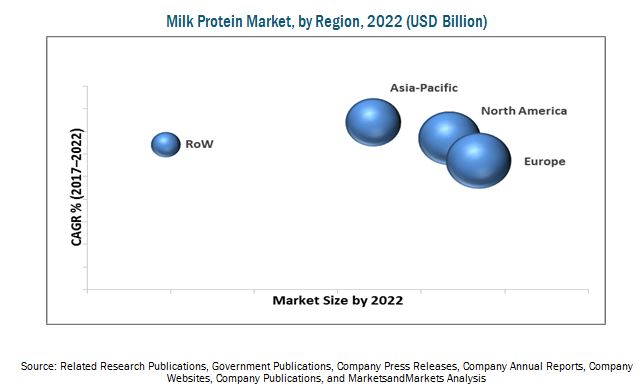

The milk protein market is projected to grow at a CAGR of 6.5%, in terms of value, from 2017 to reach a projected value of USD 13.38 Billion by 2022. The multifunctional nature of milk protein, ease of incorporation in a wide range of applications, increase in demand for high protein food, and increase in consumption of premium products are the factors driving the global market. Increase in awareness with regard to the importance of high nutritional food and its rising applications among the global population, fuels the demand for milk protein.

- Milk protein importers and exporters

- Dairy manufacturers and processors

- Secondary sources, which include the following:

- The Food and Agriculture Organization (FAO) and the International Dairy Food Association(IDFA)

- The European Food Safety Authority (EFSA) and the Food and Drug Administration (FDA)

- Food safety agencies

- End applications, which include the following:

- Bakery products, confectionery products, and convenience foods

- Dairy products

Direct-fed Microbials Market Projected to Garner Significant Revenues by 2022

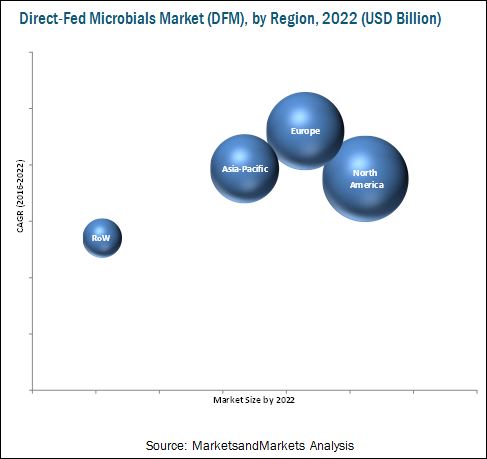

The direct-fed microbials market is projected to grow at a CAGR of 6.96% to reach USD 1,399.6 Million by 2022. The market is driven by factors such as increase in awareness about feed quality and safety, rising demand for manufactured animal feed, growth in demand for animal protein, changes in farming practices and technology, and replacing antibiotic growth promoters (AGPs) with direct-fed microbials. The continuous rise in the population has also resulted in an increase in the demand for food and the necessity for direct-fed microbials, to increase meat and milk production in a sustainable manner.

- Direct-fed microbial manufacturers

- Feed manufacturers

- Animal pharmaceutical companies

- Direct-fed microbial raw material suppliers

- Direct-fed microbial product exporters & importers

- Educational institutions

- Regulatory authorities

- Consulting firms

Monday, October 12, 2020

Upcoming Growth Trends in the Pesticide Inert Ingredients Market

The report "Pesticide Inert Ingredients Market by Type (Emulsifiers, Solvents, and Carriers), Source (Synthetic and Bio-based), Form (Dry and Liquid), Pesticide Type (Herbicides, Insecticides, Fungicides, and Rodenticides), and Region - Global Forecast to 2023 " , The pesticide inert ingredients market is projected to reach USD 4.7 billion by 2023, from USD 3.5 billion in 2018, at a CAGR of 6.14% during the forecast period. The market is driven by factors such as the increasing demand for specific inert ingredients in pesticide formulation and capability of inert ingredients to improve the efficacy of pesticide application.

On the basis of type, the emulsifiers segment is projected to witness the fastest growth during the forecast period.Emulsifiers help in stabilizing the mixture of two liquids and avoid the formation of immiscible liquid phases. Major emulsifiers that are used as inert ingredients are polymers, nonylphenol and alcohol ethoxylates, and alcohol alkoxylates. The demand for emulsifier-based products remains high in the North American region due to the increasing industrialization and decreasing land area for agriculture, which in turn, creates demand for the use of pesticides for ensuring food security and production.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=176580687

With the increasing demand for organic fruits and vegetables, the bio-based segment is projected to witness the fastest growth, on the basis of source.

It has been witnessed that some of the inert ingredients used in pesticide formulation are more toxic than the active ingredients. Increasing health hazards associated with the usage of synthetic-based inert ingredients in pesticides creates an opportunity for the market players to develop bio-based inert ingredients from sources such as microbes for the formulation of bio-based pesticides. Governmental bodies and regulatory authorities have introduced regulations for the use of toxic pesticides, which affects the growth of bio-based inert ingredients in the market.

This report includes a study of development strategies for leading companies. The scope of this report includes a detailed study of major companies such as BASF (Germany), Clariant (Switzerland), DowDuPont (US), Stepan Company (US), and Croda International Plc. (UK). Other players in the market include Eastman Chemicals (US), Solvay SA (Belgium), Evonik (Germany), Huntsman Corporation (US), AkzoNobel (The Netherlands), Royal Dutch Shell (The Netherlands), and LyondellBasell Industries (Netherlands).

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=176580687

- Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

- Which region will have the highest share in the pesticide inert ingredients market?

- Which type of pesticide inert ingredients witnesses high demand in each key country market?

- What are the trends and factors responsible for influencing the adoption rate of bio-based inert ingredients in key emerging countries?

- Which are the key players in the market and how intense is the competition?

Growth Opportunities in the Plant Breeding and CRISPR Plants Market

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

On the basis of application, the cereals & grains segment is projected to witness the fastest growth during the forecast period.Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

On the basis of type, the biotechnological method is projected to witness the fastest growth in the plant breeding and CRISPR plants market during the forecast period

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

On the basis of trait, the herbicide tolerance segment is projected to witness the fastest growth in the plant breeding and CRISPR plants market

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

North America is estimated to dominate the market in 2018, while the Asia Pacific is projected to witness the fastest growth through 2023.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=256910775

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

Key questions addressed by the report:

- Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

- Which region will have the highest share in the plant breeding and CRISPR plants market?

- Which type of plant breeding techniques have high demand in each key country market?

- What are the trends and factors responsible for influencing the adoption rate of biotechnological methods in key emerging countries? What is the level of investment preferred by local seed manufacturers to adopt these technologies?

- Which are the key players in the market and how intense is the competition?

Factors Driving the Biofortification Market

The report “Biofortification Market by Crop (Sweet Potato, Cassava, Rice, Corn, Wheat, Beans, and Pearl Millet), Target Nutrient (Zinc, Iron, and Vitamins), and Region (Latin America, Africa, and Asia Pacific) – Global Forecast to 2023 “, is estimated at USD 78 million in 2018, and it is projected to grow at a CAGR of 8.6% from 2018 to reach USD 118 million by 2023. Biofortified crops are usually sweet potato, cassava, rice, corn, wheat, beans, pearl millet, and other crops such as tomato, banana, sorghum, and barley. The growth of the biofortification market is driven by the rising demand for high nutritional content in food.

By crop, the biofortified sweet potato is projected to dominate the biofortification market during the forecast period.The sweet potato segment is estimated to hold the largest share of the biofortified crop market in 2018. The demand for biofortified crops such as sweet potato and cassava has increased with the rising technological advancements to increase the nutrient content, particularly in orange-fleshed sweet potato (OFSP). Sweet potato has been an important source of energy in the human diet for centuries owing to its high carbohydrate content. However, its vitamin A content from carotene only became recognized over the past century. Using biofortification, sweet potato breeding in Africa is focused on higher yields, sweeter taste, and higher dry matter, which increase its carotene concentration.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38080924

By target nutrient, the vitamins segment is projected to be the fastest-growing segment in the biofortification market during the forecast period.

On the basis of target nutrient, the biofortification market is segmented into iron, zinc, vitamins, and others. The vitamins segment is the fastest-growing target nutrient in the biofortification market from 2018 to 2023. The demand for biofortified crops is increasing due to the increasing demand for high nutrient content in food. The rising demand for vitamins as feed additives or in premixes from the animal nutrition industry and the increasing demand for high-quality meat products have also been essential factors responsible for the increase in the demand for vitamins across the world.

Asia Pacific to be the dominant region in the biofortification market in 2018

The Asia Pacific is the dominant region in the biofortification market. Biofortification of crops has strong growth potential in agriculture, and it also improves the nutrition content in food. The biofortification market has grown considerably over the last five years, and this trend is expected to continue in the near future. The growing consumer demand for high nutritional content in food is projected to fuel the demand for biofortified crops, globally. Since the last decade, many countries in the Asia Pacific region have banned the usage of GM technology, and the researchers are opting to adopt biofortified crops as a key to unlock the region’s food production.

This report includes a study of marketing and development strategies along with the product portfolios of the leading companies in the biofortification market. It also includes the profiles of leading companies such as Bayer (Germany), Syngenta (Switzerland), Monsanto (US), and DowDuPont (US).

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=38080924

Key Questions Addressed by the Report:

- What are the new target nutrients areas, which the biofortification companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What kind of competitors and stakeholders such as biofortification companies, would be interested in this market? What will be their go-to strategy for this market and which emerging market will be of significant interest?

- How are the current R&D activities and M&As for biofortified crop industry projected to create a disruptive environment in the coming years for the agricultural sector?

- What will be the level of impact on the revenues of stakeholders through the benefits of nanotechnology to different stakeholders‒‒from rising farmer revenue to environmental regulatory compliance to sustainable profits for the suppliers?

Feed Packaging Market to Showcase Continued Growth in the Coming Years

The feed packaging market is further bifurcated into pet food and livestock feed packaging. The market for feed packaging is projected to grow from USD 13.8 billion in 2018 to USD 17.8 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period. This is attributed to the feeding of traditional dry farms leftover to the livestock in the developing regions. However, with the growing demand for quality livestock products and the increasing production of feed and feed additives, this market is expected to grow at a higher rate in the coming years.

Report Objectives:- Determining and projecting the size of the feed packaging market with respect to livestock, pet, type, material, feed type, and regional markets, over a five-year period ranging from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, future prospects, and their contribution to the total market

- Identifying and profiling key market players in the livestock feed and pet food packaging markets

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=187589113

The plastic segment is projected to grow at the highest CAGR in the global feed packaging market during the forecast period.

The feed packaging (for pets) market has been segmented, on the basis of material, into 4major categories: plastic, paper & paperboards, metals, and others. The market for plastics is driven by advancements such as usage of decomposable and biodegradable plastic in plastic packaging and the growing demand for attractive and see-through packaging for pet food.

The feed packaging (for livestock) market has been segmented, on the basis of material, into 4 major categories: plastic, paper, jute, and others. Plastic packaging is relatively affordable, reusable, convenient, and prevents feed from spoilage. Furthermore, plastic is durable, tensile, and can take any shape or size. It is the most appropriate form of material and helps to retain shelf life extension of feed without degrading its texture and taste.

The plastic segment, by material, is projected to grow at the highest rate during the forecast period.

The plastic is among the most used material in the feed packaging market for both pets and livestock. This is owing to the increasing demand for convenient packaging, online pet food shopping, the rise in consumption of single-serve pet food, growing consumption on compound feed along with wet feed additives. The flexible packaging type, wherein the plastic material is highly used, has been playing the major role in the feed packaging market. Further, advancements in the packaging industry-for instance, the usage of decomposable and biodegradable plastic materials and the adoption of recyclable and reusable packaging-are driving the growth of this market. Moreover, compared to other materials, plastic is more durable, tensile, and can take any shape or size. These factors have boosted the growth of the feed packaging market.

The key markets such as the US have been witnessing an increase in the number of pet dogs. Similarly, in growing markets such as India, pet dog population has grown significantly in the last ten years and is further expected to grow in the coming five to six years. Additionally, pets are being treated as companions in the majority of households in the developed countries. This trend has also been growing in developing countries like Brazil, China, India, and Thailand. This has further stimulated pet owners to spend more on premium pet foods. Such positive trends in pet dog food demand are expected to drive the feed packaging market for dogs.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=187589113

North America is projected to hold the largest market share in the feed packaging (for pets) market during the forecast period.

North America is estimated to account for the largest share of the market in 2018. The region is considered the most advanced, in terms of pet adoption and packaging technology. The market for feed packaging (for pets) in this region is mainly driven by high pet ownership, premiumization, the proliferation of innovations, and the introduction of a variety of packaging types for pet food. Increasing demand for premium pet food with high nutritional value, along with pet food safety concerns among pet owners, has helped to improve the quality standards of packaging and labeling in the region, thereby propelling the market growth for pet food packaging.

Major vendors in the feed packaging market include LC Packaging (the Netherlands), El Dorado Packaging, Inc. (US), NPP Group Limited (Ireland), Plasteuropa Group (UK), NYP Corp. (US), ABC Packaging Direct (US), Shenzhen Longma Industrial Co., Limited (China), Amcor Limited (Australia), Mondi Group (Austria), ProAmpac (US), Sonoco Products Company (US), Winpak Ltd., (Canada), NNZ Group (the Netherlands), Constantia Flexible Group (Austria), and Huhtamäki Oyj (Finland).

Recent Developments:

- In August 2018, ProAmpac was awarded a Level-2 Food Safety Management Certification by the Safe Quality Food (SQF) Institute for its facility in Auburn, Washington, US.

- In June 2018, ProAmpac announced a launch of the no.2 Quadflex Pouch. This new pouch will provide synergies to its sustainable packaging solution for pet foods such as cereals and pet treats.

- In January 2018, Huhtamaki expanded its paper bag manufacturing operations in Poland by establishing a joint venture with Smith Anderson Group Limited (UK). Smith Anderson Group Limited is one of Europe's leading paper bag suppliers.