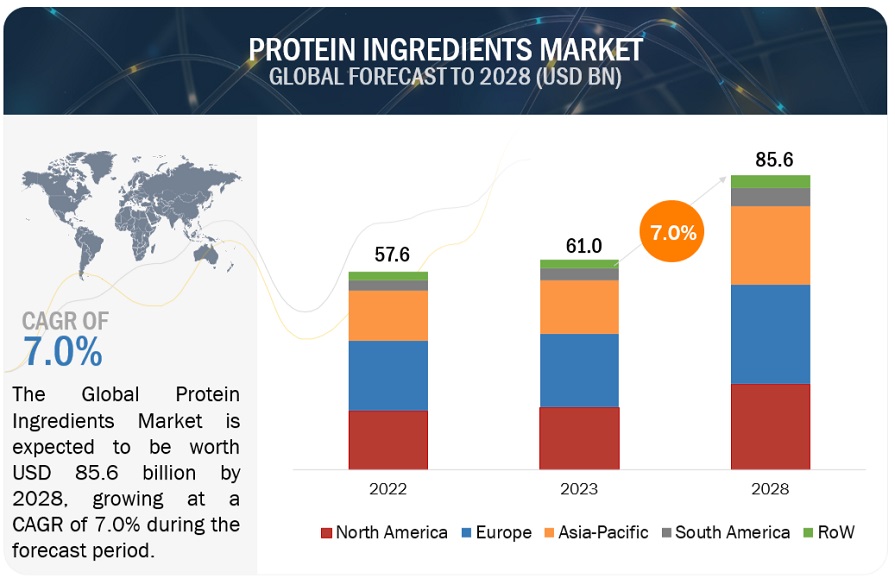

The global protein ingredients market size is estimated to be valued at USD 52.5 billion in 2020 and projected to reach USD 70.7 billion by 2025, at a CAGR of 6.1% during the forecast period. This is attributed to the increase in demand for protein functionalities, awareness about healthy diet & nutritional food, new technological development in the protein ingredients industry, growth in demand for superior personal care and healthcare products, and increase in consumption of animal by-products.

DRIVER: Increasing demand for proteins as nutritional and functional ingredients

Protein ingredients sourced from both animals and plants are well-known for their emulsification, gelation/viscosity, water-binding/hydration, foaming, aeration properties; other attributes of protein ingredients include thickening ability, stabilizing ability, and solubility. These functionalities, along with nutritional aspects of proteins, are a major advantage to end-user industries, and are, thus, one of the major market drivers. Another advantage associated with protein sources used for specific functional properties is that they are often less price-sensitive than those that are used only for their nutritional properties. This often benefits the end-user industries with cost advantages. In the end-user industries such as cosmetic & personal care, protein ingredients are primarily used for their conditioning and moisturizing properties in the hair and skin care industries. In major applications such as food & beverages, the use of protein ingredients continues to grow with the increasing demand for improved functionalities. The ability of protein ingredient manufacturers to design and develop specific isolates, concentrates, and other forms of protein ingredients for dairy products, beverages, dietary supplements, infant formula, bakery products, confectionery, and other food products is likely to drive the growth of the protein ingredients market during the forecast period.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=114688236

CHALLENGE: Demand-based price fluctuations in cropping pattern

Even though the prices of soy proteins are comparatively lower than most of the proteins, the supply can prove to be a significant factor in price escalation. The raw material for soy protein ingredients is soy meal, which is also highly demanded by the feed industry. Unless there is no drop in the cultivation area under soybeans, the supply is expected to remain unfazed for both feed and protein manufacturers.

Sometimes, crop growers, to avail better crop value, change their crop patterns, which can marginalize the flow of supply, and thereby, lead to an increased demand for protein manufacturing and price escalation. In 2013, increased diversion to biofuel and vegetable oil consumption led to more corn and canola production than soybean in North America. However, soybean cultivation has been maintaining better positive year-by-year growth in this region. So, the crops cultivated by growers are subject to change, based on the crop demand and price value. A wide-scale change in cropping patterns can be expected with the decline in price levels for a crop after a certain point of price saturation. Around 2020, this can play an important role in seeking a cost-effective supply channel to maintain operational efficiency, as Latin America is expected to near its optimum land resource utilization for soybean by that time.

The pharmaceutical segment is projected to be the fastest-growing segment during the forecast period

The pharmaceutical segment is projected to be the fastest-growing, by application, during the forecast period. This is attributed to the increase in the aging population and their need for improved metabolism and health products as proteins are essential amino acids that help the human body boost its immunity and help build and repair tissues. They are the building blocks for bones, muscles, cartilage, skin, and blood. Thus, protein form an important component in the pharmaceutical and healthcare industries.

Europe is projected to be the largest and fastest-growing market during the forecast period

The European market accounted for the largest share in the market. This dominance is attributed to high consumption in this region. The consumption in Europe is more than twice the global average consumption. The high-protein trend in food & beverages and personal care & cosmetics is gaining a foothold in Germany, as protein claims on food and drink launches continue their growth path. The increasing prevalence of health-related problems along with high importance being laid on the quality, taste, and freshness of foods is modifying food demand, owing to which, the market for protein ingredients is projected to witness growth.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=114688236

This report includes a study of the marketing and development strategies used, along with the product portfolios of leading companies. It consists of the profiles of leading manufacturers such Cargill (US), ADM (US), DuPont (US), Kerry Group (Ireland), Omega Protein Corporation (US), Friesland (Netherlands), Fonterra (New Zealand), Arla Foods (Denmark), AMCO (US), Roquette (France), Gelita AG (Germany), Kewpie Corporation (Japan), AGRANA (Austria), AMCO Proteins (US), Hilmar Ingredients (US), Axiom Foods (US), and Burcon Nutrascience (Canada).

Recent Developments:

- In May 2020, Cargill and Procter & Gamble collaborated to introduce nature-powdered innovation, fueling the future for more powerful products.

- In October 2019, Cargill announced plans to invest $USD 225 million at a facility in Sydney, Ohio, to better serve area farmers and meet the growing demand for protein and refined oils.