The report "High Pressure Processing Equipment Market by Orientation Type (Horizontal and Vertical), Vessel Volume, Application (Fruits & Vegetables, Meat, Juice & Beverages, Seafood), End User Category, and Region - Global Forecast to 2022", The high pressure processing equipment market is projected to reach a value of USD 500.3 Million by 2022, at a CAGR of 11.26% from 2016. The market is driven by factors such as increasing consumption of packaged foods, growing ready to cook meat production, government assistance toward developing food technologies, and widening applicability of high pressure processing equipment.

Depending upon the application of high pressure processing equipment, the market was led by fruits & vegetables, followed by meat and juice & beverages, respectively. Juice & beverages are expected to have the highest growth rate due to the adoption of the technology for processing of packaged beverages by major multi-national companies. Hence, with the growth in the consumption of packaged food and beverages, the use of HPP technology is expected to increase.

In terms of vessel volume, the high pressure processing market was led by the 100 to250L category in 2015. The primary reason behind the large share of this segment is the lower cost of the equipment, which is affordable to food manufacturers operating on a small or medium scale. The fastest-growing segment is expected to be the less than 100L category of equipment, as it requires lesser manpower to operate.

The global market, in terms of end user category, is led by the large production plants segment in 2015. This is due to the presence of a large number of packaged meat producers of this category who adopted this technology in order to minimize the usage of preservatives in their products.

In terms of orientation type, horizontal equipment accounted for the largest-market share in 2015. Horizontal high pressure processing equipment is used to the largest extent globally. This segment is also the fastest growing as it is easy to assemble and disassemble, install, and ensures more throughput. Therefore, most high pressure processing equipment is horizontal. The horizontal segment dominated this market in 2015, owing to its large-scale application in meat, fruits & vegetables, and juice & beverages in the North American region.

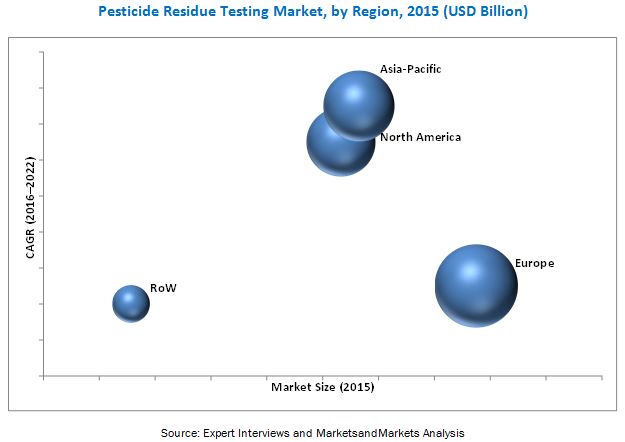

The North American region was the largest market for high pressure processing equipment in 2015. Countries such as the U.S., Canada, and Mexico are prominent users of high pressure processing equipment, as this technology is utilized in the packaged food and beverage market to process fruits, vegetables, and juices. The European manufacturers also preferred HPP preservation technology to preserve food.. The market in Spain is highly developed due to the availability of technical expertise and awareness about high pressure processing. The countries in the European region such as the U.K., Spain, Germany, and Italy have been early adopters of this technology. With the growing awareness among food business operators regarding the benefits of using high processing technology instead of traditional pasteurization techniques, there has been a growth in the supply and demand for this equipment.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies. It includes the profiles of leading companies such as Avure Technologies Inc. (U.S.), Bao Tou KeFa High Pressure Technology, Co., Ltd. (China), CHIC FresherTech (China), Hiperbaric Espana (Spain), Kobe Steel Ltd. (Japan), Multivac Sepp Haggenmuller SE & Co. KG (Germany), Stansted Fluid Power Ltd (U.K.), Universal Pasteurization Co. (U.S.), Next HPP (U.S.), and ThyssenKrupp AG (Germany).

This report is targeted at the existing players in the industry, which include the following:

- Manufacturers and suppliers of HPP equipment

- Research organizations

- Raw material suppliers

- Government authorities