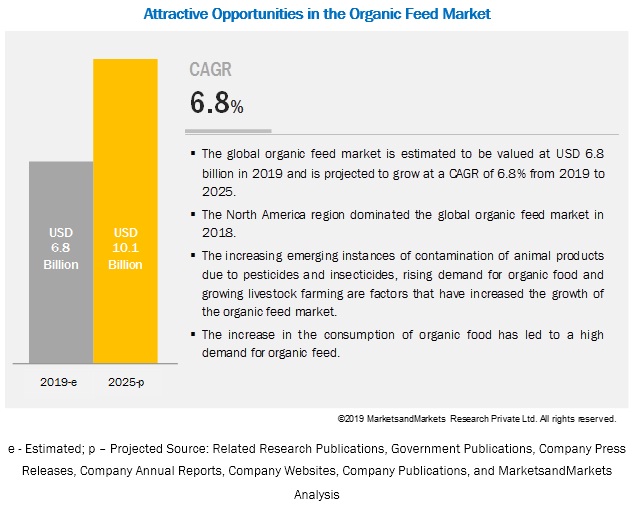

The global organic feed market size is estimated to be valued at USD 6.8 billion in 2019 and is projected to grow at a CAGR of 6.8% from 2019 to reach a value of USD 10.1 billion by 2025. The increasing instances of animal product contamination due to pesticides and insecticides, rising demand for organic food products, growing organic livestock farming, and adaption of organic farming practices by farmers due to the increasing health concerns among consumers are some of the key factors that are projected to drive the growth of the global organic feed market. Developing countries in Asia Pacific and South American regions are projected to create lucrative growth opportunities for organic feed manufacturers in the coming years.

Tuesday, June 8, 2021

Organic Feed Market to Showcase Continued Growth in the Coming Years

Friday, June 4, 2021

Factors Driving the Food Processing & Handling Equipment Market

The report “Food Processing & Handling Equipment Market by Type (Food Processing Equipment, Food Packaging Equipment, and Food Service Equipment), Application, Form (Solid, Liquid, and Semi-Solid), and Region – Global Forecast to 2025″, The global food processing & handling equipment market is estimated to be valued at USD 137.2 billion in 2019 and is projected to reach USD 196.6 billion by 2025, growing at a CAGR of 6.2%. Advancements in the food processing & packaging equipment industry, innovation in processing technology, and continuous growth in the demand for processed food are some factors that are expected to support the growth of the food & beverage processing equipment market. With the growing preference for healthy food and functional foods, manufacturers are expected to adopt new equipment to fulfill the demand for healthy functional foods & beverages. The expansion of food manufacturing capacities and growth of the food processing industry in emerging economies are also expected to support the growth of the food processing & handling equipment market.

- In May 2019, GEA launched a new SmartPacker CX400 packaging machine, which has induction sealing capabilities for meat and poultry manufacturers. In April 2019, GEA also launched CALLIFREEZE system for the GEA S-Tec spiral freezer in the Asian market. This product would help GEA’s customers to meet their Industry 4.0 strategy requirements.

- In May 2019, Bosch Packaging Technology, a subsidiary of Bosch, launched the Pack 403, a fully-automated, narrow horizontal flow wrapper in the European and Asian markets. The company has been continuously developing innovative products according to the customers’ demands.

- In April 2019, Tetra Pak launched a connected packaging platform; this would transform juice and milk cartons into interactive information channels, digital tools, and full-scale data carriers.

Rodenticides Market to Record Steady Growth by 2026

The global rodenticides market size is estimated to account for a value of USD 4.9 billion in 2020 and is projected to grow at a CAGR of 5.0% from 2020, to reach a value of USD 6.6 billion by 2026. The impact of climate change on rodent proliferation alongside the increasing damage by infestation of rodents are some of the factors driving the growth in the market.

The market includes major product manufacturers and service providers like Syngenta AG, Bayer AG, BASF SE, UPL Ltd, Rentokil Initial plc, Ecolab Inc and Rollins Inc. These companies have their manufacturing and service facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. COVID-19 has impacted their businesses up to some extent. Though this pandemic situation has impacted their businesses, there is no significant impact on the global operations and supply chain of their rodenticides. Multiple manufacturing facilities of players are still in operation. The service providers are providing rodent control services by following safety and sanitation measures.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=189089498

Driver: Impact of climatic changes on rodent proliferation

The changing climatic conditions are of significant importance in the market, as global warming leads to the change in the population dynamics of rodents and their ecosystems, as rodents breed prominently more in warmer climates. The proliferation of rodent population is related to climatic changes, which is a major international public health concern. Hantavirus infection is increasingly sensitive to climatic conditions. Rodent population responds more rapidly to favourable weather conditions, such as heavy rainfall, which could directly or indirectly proliferate rodent-borne pathogens, such as spirosis, a zoonotic bacterial disease, with an unknown, but probably high human and veterinary prevalence.

Constraint: Stringent regulations and the ban on the use of rodenticides in developed countries

The usage of rodenticides is subject to registrations by health, environmental protection, and pest control agencies in various countries. Governments evaluate the policies related to the purchase, registration, formulation, application, and disposal of pesticides. The nature of government policies affects the demand and prices of rodenticides. According to Rentokil, the use of rodenticides as control and preventive methods have been restricted in many European and North American countries.

By end-use sector, residential segment is projected to dominate the rodenticides market.

With the rapid urbanization, increase in disposable income, and the rise in awareness about epidemics from rodent attacks, residential holders have been increasingly adopting chemical agents besides mechanical control methods. Thus, the growth potential in residential holdings is projected to remain higher than the other end uses.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=189089498

North America to be the largest market for rodenticides during the forecast period.

High rodent population densities result in increased cases of rodent-borne disease (for instance, Hantavirus) transmission to humans. According to the CDC, the density of rodents that can cause Hantavirus is high in the US states, including Texas, Oklahoma, Louisiana, and Arkansas. Due to these factors, there are plans to eradicate the growing rodent population in North American countries, and hence contributing to the high consumption of rodenticides.

Key Market Players:

Some of the major players operating in the rodenticides market include Bayer AG (Germany), Syngenta AG (Switzerland), BASF SE (Germany), Rentokil Initial Plc (UK), JT Eaton (US), UPL Limited (India), Anticimex (Sweden), The Terminix International Company (US), Liphatech Inc (US), Neogen Corporation (US), PelGar International (UK), Bell Laboratories Inc (US), Ecolab Inc (US), Rollins Inc (US), Abell Pest Control (Canada), Futura Germany (Germany), SenesTech Inc (US), and Impex Europa S.L (Spain).

Wednesday, June 2, 2021

Food Encapsulation Market to Record Steady Growth by 2025

The global food encapsulation market is estimated to account for USD 9.9 billion in 2020 and is projected to reach USD 14.1 billion by 2025, recording a CAGR of 7.5% during the forecast period. The market is primarily driven by the increasing use of encapsulated flavors in the food and beverage industry and the rising adoption of microencapsulation for functional ingredients.

- In July 2019, DSM (Netherlands) entered into a joint venture with Evonik (Germany) to produce encapsulated omega-3 fatty acids, reducing the pressure on fish stocks, and supporting the aquaculture industry.

- In May 2017, Lycored (Israel) entered into a joint venture with a biotechnology company, Algatechnologies (Israel), to distribute Algatech's AstaPure in the form of beadlets, which will help in increasing the brand's commercial reach for this product range in the North American market.

- In January 2017, DSM (Netherlands) launched a new product, MEG-3, with new encapsulation technology.

Upcoming Growth Trends in the Food & Beverage Metal Cans Market

The report "Food & Beverage Metal Cans Market by Material (Aluminum and Steel), Type (2-Piece and 3-Piece), Degree of Internal Pressure (Pressurized Cans and Vacuum Cans), Application (Food and Beverages), and Region - Global Forecast to 2025", According to MarketsandMarkets, the food & beverage metal cans market is estimated to be valued at USD 27.6 billion in 2020 and is projected to reach USD 37.0 billion by 2025, recording a CAGR of 6.1%. The rapid growth in awareness toward environmental sustainability and recyclable properties of metal cans are the driving factors for the food & beverage metal cans market.

By material, the aluminum segment is projected to account for the larger share in the food & beverage metal cans market

The aluminum segment is projected to dominate the market, on the basis of material, during the forecast period. This is attributed to the cost-effectiveness and recycling rates of aluminum. Increasing the use of metal packaging for food & beverages packaging provides a sustainable and environment-friendly solution for packaging in multiple applications. Aluminum cans are convenient to keep in refrigerators and ovens. Changes in consumer preferences are observed for food & beverage packaging. According to the Environmental Protection Agency of the United States (EPA), 1.9 million tons of aluminum packaging was generated for beers and soft drink cans, and 49.2% of aluminum beverage cans were recycled. The metal packaging for the food industry is considered to be safe, which is one of the major factors to support its growth in the market.

By application, the beverages segment accounted for the larger size in the food & beverage metal cans market during the forecast period

Based on the application, the food & beverage metal cans market is segmented into food and beverages. The beverage cans are estimated to account for the larger share, because of the high consumption of carbonated, non-carbonated, and sports & energy drinks. The rise in the consumption of alcoholic beverages leads to the growth of beverage cans market. Moreover, changes in consumer trends toward healthy drinks are driving the market for metal cans during the forecast period.

The Asia Pacific region is projected to witness the fastest growth during the forecast period

The Asia Pacific food & beverage metal cans market is projected to have higher growth potential in the coming years. A large consumer market and increasing disposable income in India and China are driving the growth of the demand for high-quality metal packaging. Also, China is the hub for the manufacture of metal cans and has sufficient manufacturing plants to meet the demand for food & beverage metal packaging. Moreover, rapid urbanization in countries such as India and China are expected to result in high growth of the food & beverage metal cans market in Southeast Asia during the forecast period.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=251

This report includes a study on the marketing and development strategies, along with the product portfolios of the leading companies. It consists of the profiles of leading companies such as Crown Holdings, Inc (US), Ball Corporation (US), Silgan Holdings Inc. (US), Ardagh Group (Luxembourg), CAN-PACK S.A. (Poland), Kian Joo Group (Malaysia), CPMC Holdings Limited (China), Huber Packaging Group GmbH (Germany), CCL Industries (US), Toyo Seikan Group Holdings Ltd (Japan), Universal Can Corporation (Japan), Independent Can Company (US), Mauser Packaging Solution LLC (Germany), Visy (Australia), Lageen Food Packaging (Israel), Massilly Holding S.A.S (France), P. Wilkinson Containers Ltd. (UK), Unimpack (Netherlands), Müller und Bauer GmbH (Germany), and Allied Cans (Canada).

Recent Developments:

- In April 2019, Crown Holdings, Inc. announced the launch of round and square shorter cans in the luxury packaging market. This will help the company to broaden its product portfolio.

- In August 2019, Ball Corporation signed an agreement to sell its tinplate steel aerosol packaging facilities to Envases del Plata (Argentina), an Argentinian metal packaging company. This agreement will help the company to expand its reach in the South American region.

- In October 2019, Ball Corporation announced the construction of its new aluminum cups manufacturing plant in Rome, Georgia to cater to the growing demand for beverage packaging in the US. This new plant will help the company expand its presence in the US region.

- In July 2019, Ardagh Group launched a slimline 187 ml can particularly designed for protecting wine and wine-based drinks. This launch would help the company to expand its product portfolio.

Tuesday, June 1, 2021

Upcoming Growth Trends in the Organic Feed Market

The global organic feed market size is estimated to be valued at USD 6.8 billion in 2019 and is projected to grow at a CAGR of 6.8% from 2019 to reach a value of USD 10.1 billion by 2025. The increasing instances of animal product contamination due to pesticides and insecticides, rising demand for organic food products, growing organic livestock farming, and adaption of organic farming practices by farmers due to the increasing health concerns among consumers are some of the key factors that are projected to drive the growth of the global organic feed market. Developing countries in Asia Pacific and South American regions are projected to create lucrative growth opportunities for organic feed manufacturers in the coming years.

Bioinsecticides Market: Growth Opportunities and Recent Developments

The global bioinsecticides market size is projected to grow at a CAGR of 15.8% from an estimated value of USD 2.2 billion in 2020 to reach USD 4.6 billion by 2025. The increasing area under organic cultivation and growing concerns toward the impact of pesticide use on biodiversity is leading to the growth of the bioinsecticide industry.

- To describe, segment, and project the global market size for the bioinsecticides market

- To offer detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To evaluate the micro-markets, concerning individual growth trends, prospects, and their contribution to the total bioinsecticides market

- To propose the size of the submarkets, in terms of value, for various regions

- To profile the major players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

- In March 2020, Marrone Bio Innovations signed an agreement with Anasac (Chile) to develop and distribute Grandevo and Venerate bioinsecticide in Chile.

- In March 2020, Andermatt Biocontrol AGs’ Madex Top product was approved to be used in Sweden and Israel, to control codling moth in pome fruit orchards.

- In October 2019, Nufarm opened a new manufacturing facility in Greenville, Mississippi, US, which will allow the company to support its expanding portfolio and provide customers with high-quality crop protection products.

- In July 2019, a new biological insecticide named Velifer was launched by BASF SE for pest control in vegetable crops, registered for use in Australia.

- In March 2019, Syngenta AG launched its first bioinsecticide, Costar, in Portugal. The formulation is based on the strain of Bacillus spp., for use in more than 50 crops in European countries.