The report "Food-grade Alcohol Market by Type (Ethanol, Polyols), Application (Food, Beverages, Healthcare & Pharmaceuticals), Source (Sugarcane & Molasses, Grains, Fruits), Functionality, and Region - Global Forecast to 2022", The food-grade alcohol market is projected to reach USD 12.86 Billion by 2022, at a CAGR of 3.9% from 2017 to 2022. The market is driven increasing global beer production and popularity of craft beer. Also, the increasing consumption of alcoholic beverages in the developing regions supported with the expansion of potential export markets due to demographic and economic reasons, have developed a growing platform for increased alcohol trade which is in turn driving the food-grade alcohol market.

Monday, June 21, 2021

Upcoming Growth Trends in the Food grade Alcohol Market

Friday, June 18, 2021

Sustainable Growth Opportunities in the Plasma Feed Market

The report “Plasma Feed Market by Source (Porcine, Bovine, and Others), Application (Swine Feed, Pet Food, Aquafeed, and Others (Includes Ruminant and Poultry Feed)), Region (North America, Europe, Asia Pacific, and Rest of the World) – Global Forecast to 2025″, The plasma feed market is projected to reach USD 2.9 billion by 2025, from USD 2.1 billion in 2019, at a CAGR of 5.7% during the forecast period. The use of animal-derived plasma proteins as the replacement for antibiotics in feed drives the market for plasma feed.

- Where will all these developments take the industry in the mid-to-long term?

- What are the upcoming commercial prospects for the plasma feed market?

- What is the impact of high capital investment on the plasma feed market?

- What are the new technologies introduced in the plasma feed market?

- What are the latest trends in the plasma feed market?

Latest Regulatory Trends Impacting the Industrial Oils Market

The report "Industrial Oils Market by Source (Soybean, Rapeseed, Sunflower, Cottonseed, Corn, Palm), Type (Grade I, Grade II, Grade III), End Use (Biofuel, Paints and Coatings, Cosmetics and Personal Care Products, Pharmaceuticals), Region - Global Forecast to 2025", The industrial oils market is evaluated at USD 60.2 billion in 2019 and is projected to grow at a CAGR of 5.0% from 2019 to 2025, to reach USD 80.7 billion by 2025. The biodiesel industry is projected to be a major revenue generator for industrial oils manufacturers in the coming years due to its reduced environmental impact. In addition, the industrial sector in the emerging countries in the Asia Pacific region is growing in countries such as China and India, which is a hub of industrial oils, due to the expanding chemical, biodiesel, and cosmetics industries. These factors are projected to create new opportunities for the growth of the global industrial oils market in the coming years.

- What are the new product areas for industrial oils that the companies are exploring?

- Which are the key players in the industrial oils market and how intense is the competition?

- What kind of competitors and stakeholders would industrial oils companies be interested in? What will be their go-to-market strategy for this market, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the industrial oils market projected to create a disrupting environment in the coming years?

- What will be the level of impact on the revenues of stakeholders due to the benefits of industrial oils compared to different stakeholders, in terms of, rising revenue, environmental regulatory compliance, and sustainable profits for the suppliers?

Wednesday, June 16, 2021

Nematicides Market to Witness Unprecedented Growth in Coming Years

The report "Nematicides Market by Type (Fumigants, Carbamates, Organophosphates, Bionematicides), Mode of Application (Fumigation, Drenching, Soil Dressing, Seed Treatment), Nematode Type (Root Knot, Cyst), Crop Type, Form, and Region - Global Forecast to 2025 ", The global nematicides market size is estimated to be valued at USD 1.3 billion in 2019 and is expected to reach a value of USD 1.6 billion by 2025, growing at a CAGR of 3.4% during the forecast period. Factors such as the growing demand for biological products and increasing number of product launches catering to the requirement of crop-specific nematodes drive the growth of the market.

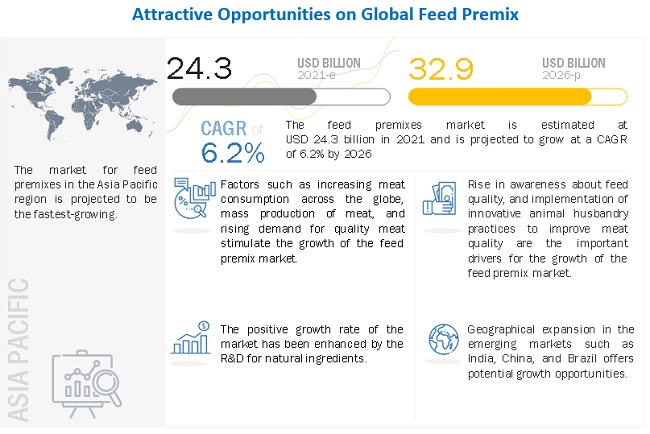

Feed Premix Market Growth by Emerging Trends, Analysis, & Forecast to 2026

- In October 2020, DSM completed the acquisition of Erber Group (Austria) for an enterprise value of EUR 980 million (USD 1.16 Billion). The transaction excludes two smaller units in Erber Group. DSM acquired Erber Group’s Biomin and Romer Labs. Erber Group’s specialty animal nutrition and health business Biomin specializes primarily in mycotoxin risk management and gut health performance management, whereas the Romer Labs business focuses on food and feed safety diagnostic solutions. Thus, this would enhance DSM’s animal health & nutrition business in the global market.

- In May 2019, Bayer Animal Health GmbH (Germany) and Nutreco formed an agreement to collaborate for the development of animal health and animal nutrition industries.

Friday, June 11, 2021

Upcoming Growth Trends in the Plant Breeding and CRISPR Plants Market

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

On the basis of application, the cereals & grains segment is projected to witness the fastest growth during the forecast period.

Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

On the basis of type, the biotechnological method is projected to witness the fastest growth in the plant breeding and CRISPR plants market during the forecast period

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

On the basis of trait, the herbicide tolerance segment is projected to witness the fastest growth in the plant breeding and CRISPR plants market

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

North America is estimated to dominate the market in 2018, while the Asia Pacific is projected to witness the fastest growth through 2023.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

Key Trends Shaping the Biofortification Market

The report “Biofortification Market by Crop (Sweet Potato, Cassava, Rice, Corn, Wheat, Beans, and Pearl Millet), Target Nutrient (Zinc, Iron, and Vitamins), and Region (Latin America, Africa, and Asia Pacific) – Global Forecast to 2023 “, is estimated at USD 78 million in 2018, and it is projected to grow at a CAGR of 8.6% from 2018 to reach USD 118 million by 2023. Biofortified crops are usually sweet potato, cassava, rice, corn, wheat, beans, pearl millet, and other crops such as tomato, banana, sorghum, and barley. The growth of the biofortification market is driven by the rising demand for high nutritional content in food.

By crop, the biofortified sweet potato is projected to dominate the biofortification market during the forecast period.

The sweet potato segment is estimated to hold the largest share of the biofortified crop market in 2018. The demand for biofortified crops such as sweet potato and cassava has increased with the rising technological advancements to increase the nutrient content, particularly in orange-fleshed sweet potato (OFSP). Sweet potato has been an important source of energy in the human diet for centuries owing to its high carbohydrate content. However, its vitamin A content from carotene only became recognized over the past century. Using biofortification, sweet potato breeding in Africa is focused on higher yields, sweeter taste, and higher dry matter, which increase its carotene concentration.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38080924

By target nutrient, the vitamins segment is projected to be the fastest-growing segment in the biofortification market during the forecast period.

On the basis of target nutrient, the biofortification market is segmented into iron, zinc, vitamins, and others. The vitamins segment is the fastest-growing target nutrient in the biofortification market from 2018 to 2023. The demand for biofortified crops is increasing due to the increasing demand for high nutrient content in food. The rising demand for vitamins as feed additives or in premixes from the animal nutrition industry and the increasing demand for high-quality meat products have also been essential factors responsible for the increase in the demand for vitamins across the world.

Asia Pacific to be the dominant region in the biofortification market in 2018

The Asia Pacific is the dominant region in the biofortification market. Biofortification of crops has strong growth potential in agriculture, and it also improves the nutrition content in food. The biofortification market has grown considerably over the last five years, and this trend is expected to continue in the near future. The growing consumer demand for high nutritional content in food is projected to fuel the demand for biofortified crops, globally. Since the last decade, many countries in the Asia Pacific region have banned the usage of GM technology, and the researchers are opting to adopt biofortified crops as a key to unlock the region’s food production.

This report includes a study of marketing and development strategies along with the product portfolios of the leading companies in the biofortification market. It also includes the profiles of leading companies such as Bayer (Germany), Syngenta (Switzerland), Monsanto (US), and DowDuPont (US).

Key Questions Addressed by the Report:

- What are the new target nutrients areas, which the biofortification companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What kind of competitors and stakeholders such as biofortification companies, would be interested in this market? What will be their go-to strategy for this market and which emerging market will be of significant interest?