The report "Specialty Fertilizers Market by Type (UAN, CAN, MAP, Potassium Sulfate, and Potassium Nitrate), Application Method (Soil, Foliar, and Fertigation), Form (Dry and Liquid), Crop Type, Technology, and Region – Global Forecast to 2025", The global specialty fertilizers market is estimated to be valued at USD 37.6 billion in 2020 and is projected to reach a value of USD 51.3 billion by 2025, growing at a CAGR of 6.4% during the forecast period. Factors such as the rise in demand for high-efficiency fertilizers and an increase in crop varieties are projected to drive the growth of the specialty fertilizers market.

Friday, July 23, 2021

Specialty Fertilizers Market: Growth Opportunities and Recent Developments

Drip Irrigation Market to Witness Unprecedented Growth in Coming Years

The global drip irrigation market is projected to grow from USD 5.5 billion in 2020 to USD 9.3 billion by 2025, at a CAGR of 10.8%. The rise in the popularity of drip irrigation solutions can be attributed to government initiatives, water conservation activities, enhancement of production, and a decrease in production cost. Markets such as China and India are among the key markets targeted by drip irrigation manufacturers and distributors due to the large agriculture sector driven by regional demand and exports that are adopting drip irrigation services in the region.

Driver: Government programs and subsidies driving acceptance of drip irrigation systems

Developing countries such as India and China are among the major countries adopting drip irrigation systems, and the key driver is the support from government agencies and public-private partnerships through prominent industry participants. Government programs such as India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) seeks to extend the coverage of micro-irrigation in the country through subsidies on kits and systems to improve acceptance among farmers. State-sponsored projects are another factor that continues to drive the growth of drip irrigation systems in developing countries.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=217216582

Challenge: Soil salinity hazards and bio clogging in drip irrigation systems

Drip irrigation systems are often limited by the presence of high saline content in water, which poses a threat to the crops being grown. The excess of salt content is one of the major concerns with water used for irrigation. A high salt concentration present in the water and soil would negatively affect the crop yields, degrade the land, and pollute groundwater. The use of drip irrigation systems causes no foliar accumulation of salts; however, the salt accumulates near the periphery of the wetted area. This salt accumulation is a cause for concern when the emitter placement does not coincide with the location of the plant row, particularly for crops that are sensitive to soil salinity.

Increasing concerns over water withdrawal and government initiatives are the key factor driving the growth in the drip irrigation market during the forecast period

Drip irrigation helps minimize water loss due to evaporation by distributing water through a network of valves, pipes, tubing, and emitters. Drip irrigation methods are known to offer a significant advantage in efficiency against other conventional irrigation methods, including sprinkler and flooding. The adoption of micro irrigation technology has helped achieve higher cropping and irrigation intensity, which has made a significant impact on resource saving, cultivation cost, crop yield, and farm productivity. This technology has received considerable attention from policymakers and government for its perceived ability to contribute significantly toward agricultural productivity and economic growth.

Asia Pacific is projected to account for the largest market size during the forecast period

The Asia Pacific drip irrigation market is estimated to be the largest between 2020 and 2025 and is projected to grow at the highest CAGR. Asia Pacific was the largest consumer of drip irrigation in 2020. The region is marking a dramatic shift from the installation of basic irrigation facilities to the adoption of precision irrigation systems through technological upgrading. The focus of agriculture has shifted from traditional crops to more commercial crops. Due to these changes, irrigation facilities are expected to modernize their irrigation management and preferably their infrastructure. Drip irrigation has become an essential aspect as commercial crops are sensitive to the amount of water required and the time taken for its delivery.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=217216582

Key Market Players:

The key drip irrigation manufacturers in this market include Jain Irrigation Systems Ltd. (India), Lindsay Corporation (US), The Toro Company (US), Netafim Limited (Israel), Rain Bird Corporation (US), Chinadrip Irrigation Equipment Co. Ltd. (China), Elgo Irrigation Ltd. (Israel), Shanghai Huawei Water Saving Irrigation Corp. (China), Antelco Pty Ltd. (Australia), EPC Industries (India), Microjet Irrigation (South Africa), KSNM Drip (India), Sistema Azud (Italy), Metzer Group (Israel), Grupo Chamartin Chamsa (Italy), and Dripworks Inc. (US). These players are undertaking a strategy involving new product launches, acquisitions, and collaborations & agreements to improve their market position and extend their competitive advantage.

Recent Developments:

- In June 2020, Lindsay Corporation announced the acquisition of Net Irrigate, LLC (US), an agriculture Internet of Things technology company that provides remote monitoring solutions for irrigation customers. The acquisition would help the company to enhance its irrigation technology offering.

- In May 2020, The Toro Company launched clog-resistant drip tape, Toro Aqua-Traxx Azul drip tape. The drip tape offers a filter inlet design and optimized flow passages that pass through debris to maximize clog resistance and product performance.

Monday, July 19, 2021

Growth Opportunities in the Confectionery Processing Equipment Market

The report "Confectionery Processing Equipment Market by Type (Thermal, Mixers, Blenders, Cutters, Extrusion, Cooling, Coating), Product (Hard Candies, Chewing Gums, Gummies & Jellies, Soft Confectionery), Mode of Operation, and Region - Global Forecast to 2023", The confectionery processing equipment market is estimated to be valued at USD 4.69 Billion in 2018 and is projected to reach USD 6.55 Billion by 2023, at a CAGR of 6.90% from 2018. Factors such as the growth of the retail industry and increase in demand for confectionery items such as candies, toffees, chocolates, chewing gums, and jellies have driven the growth of the confectionery processing equipment market.

- To define, segment, and forecast the size of the confectionery processing equipment market with respect to product, type, mode of operation, and region

- To analyze the market structure by identifying various sub-segments of the confectionery processing equipment market

- To forecast the size of the market for confectionery processing equipment and its various submarkets with respect to four main regions, namely, North America, Asia Pacific, Europe, and the Rest of the World (RoW)

- To provide detailed information about crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as expansions & investments, acquisitions, and partnerships in the market for confectionery processing equipment.

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=26974693

Factors Driving the Glucose, Dextrose, and Maltodextrin Market

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=217379551

- To get a comprehensive overview of the glucose, dextrose, and maltodextrin market with specific reference to the application markets

- To gain a wide range of information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights into the major regions/countries in which the glucose, dextrose, and maltodextrin market is flourishing

Friday, July 16, 2021

Growth Opportunities in the Lycopene Market

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=104131737

- In January 2018, E.I.D. Parry (India) entered into a partnership with Synthite Industries Ltd to synergize the company’s marketing strength in its human nutrition segment

- In September 2018, E.I.D. Parry (India) acquired Alimtec S.A. (Chile), which is a part of Bayer Group (Germany), to strengthen its nutraceutical business.

- In June 2019, DDW (US) The Color House acquired the natural color business from DuPont’s Nutrition & Biosciences division to expand its global reach and also to add manufacturing and technical attributes in new natural colors.

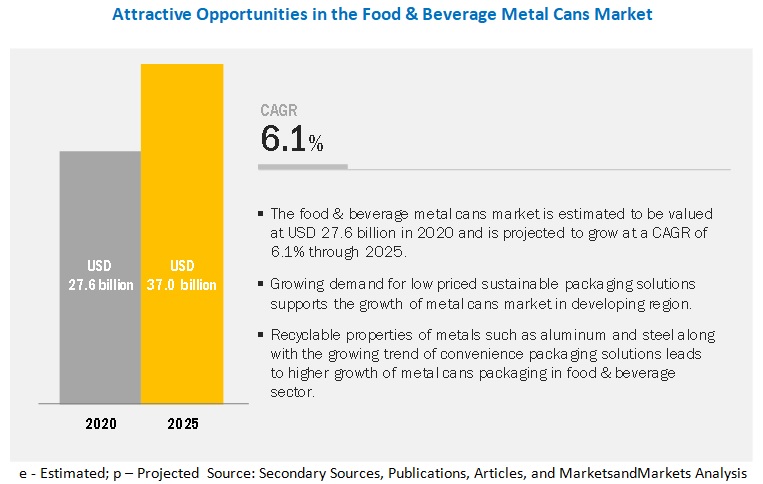

Upcoming Growth Trends in the Food & Beverage Metal Cans Market

The report "Food & Beverage Metal Cans Market by Material (Aluminum and Steel), Type (2-Piece and 3-Piece), Degree of Internal Pressure (Pressurized Cans and Vacuum Cans), Application (Food and Beverages), and Region - Global Forecast to 2025", According to MarketsandMarkets, the food & beverage metal cans market is estimated to be valued at USD 27.6 billion in 2020 and is projected to reach USD 37.0 billion by 2025, recording a CAGR of 6.1%. The rapid growth in awareness toward environmental sustainability and recyclable properties of metal cans are the driving factors for the food & beverage metal cans market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=251

- In April 2019, Crown Holdings, Inc. announced the launch of round and square shorter cans in the luxury packaging market. This will help the company to broaden its product portfolio.

- In August 2019, Ball Corporation signed an agreement to sell its tinplate steel aerosol packaging facilities to Envases del Plata (Argentina), an Argentinian metal packaging company. This agreement will help the company to expand its reach in the South American region.

- In October 2019, Ball Corporation announced the construction of its new aluminum cups manufacturing plant in Rome, Georgia to cater to the growing demand for beverage packaging in the US. This new plant will help the company expand its presence in the US region.

- In July 2019, Ardagh Group launched a slimline 187 ml can particularly designed for protecting wine and wine-based drinks. This launch would help the company to expand its product portfolio.

Thursday, July 15, 2021

Factors Driving the Biofortification Market

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=38080924

- What are the new target nutrients areas, which the biofortification companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What kind of competitors and stakeholders such as biofortification companies, would be interested in this market? What will be their go-to strategy for this market and which emerging market will be of significant interest?

- How are the current R&D activities and M&As for biofortified crop industry projected to create a disruptive environment in the coming years for the agricultural sector?

- What will be the level of impact on the revenues of stakeholders through the benefits of nanotechnology to different stakeholders‒‒from rising farmer revenue to environmental regulatory compliance to sustainable profits for the suppliers?