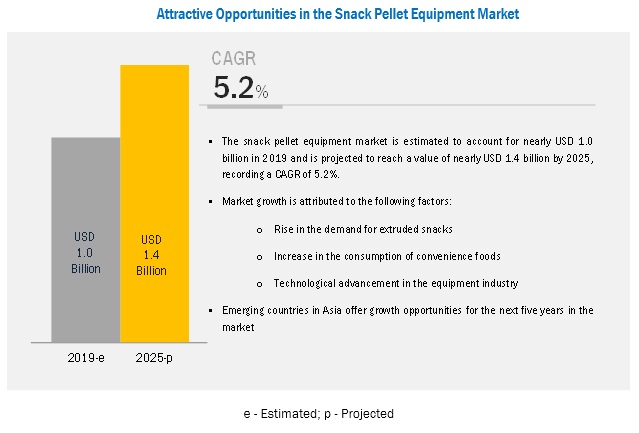

The report "Snack Pellets Market by Type (Potato, Corn, Rice, Tapioca, Multigrain), Form (Laminated, Tridimensional, Die-face, Gelatinized), Technique (Twin-screw extruder, Single-screw extruder), Flavor (Plain, Flavored, Nutritional), and Region – Global Forecast to 2023", The snack pellets market is estimated to account for about USD 2.0 billion in 2018 and is projected to reach a value of about USD 2.5 billion by 2023, growing at a CAGR of 5.3% from 2018. The snack pellets market is highly impacted by innovations, as manufacturers are always introducing new ingredients, new variants, and processing techniques to meet the increasing demand and cater to changing consumer demands. The rise in on-the-go consumption has encouraged the savory snack manufacturing industry to produce new products that could meet these rising demands from the working-class consumers. In addition to this, the growing focus on facility expansion, marketing schemes, and information exchange programs for creating awareness to enhance the consumption of snack pellets have contributed to the growth of the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=34540077

By type, the potato segment is estimated to account for the largest share in the snack pellets market in 2018.

On the basis of type, the potato segment is estimated to dominate the snack pellets market in 2018. Potato starch is the most widely used ingredient in the production of snack pellets. Potato starch, to obtain extruded snacks with the desired texture and properties, is used in the rice meal. Potato-based snack pellets are widely consumed due to their long shelf-life, low-cost transport, easy availability, and storage convenience. It also offers high bulk density, various flavors, and choices for consumers of all age groups.

The snack pellets market is witnessing strong growth due to the increasing usage of twin-screw extruders in the snack industry.

Twin-screw extruders consist of two intermeshing and co-rotating screws mounted on splined shafts in a closed barrel. This equipment offers numerous advantages over single-screw extruders. As a result, these extruders witness increasing demand from various manufacturers in the food processing industry. Twin-screw extruders have various possible configurations for producing different shapes of snack pellets with the help of counter-rotating screws, as compared to single-screw extruders. These extruders also offer various advantages, such as extrusion of heat-sensitive products, rapid mixing characteristics, and reduced volatilization of flavors, to end users.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=34540077

North America is estimated to dominate the snack pellets market in 2018.

North America is estimated to account for the largest market share for snack pellets in 2018. Because of the abundant availability of raw materials and the presence of a strong food processing industry, North America holds the largest share of the snack pellets market, in terms of both volume and value. Additionally, snacks made from potatoes are highly preferred by consumers. These factors are responsible for the largest share of potato-based snack pellets in the region.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies in the snack pellets market. It includes the profiles of the leading companies such as Limagrain Céréales Ingrédients (France), Liven S.A. (Spain), Grupo Michel (Mexico), Leng dOr S.A. (Spain), and Pellsnack-Products GmbH (Germany).