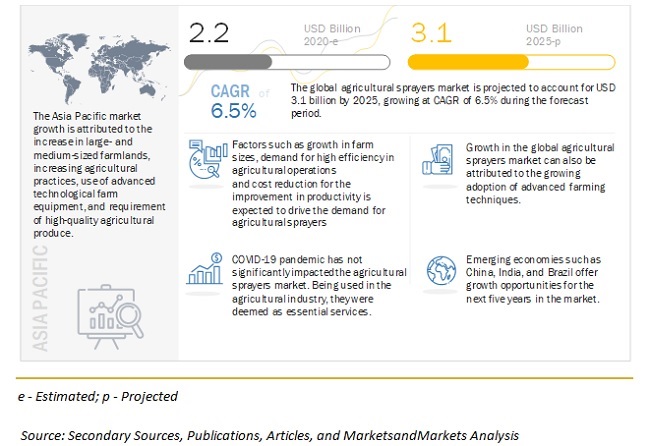

The report "Agricultural Sprayers Market by Type (Self-propelled, Tractor-mounted, Trailed, Handheld, Aerial), Capacity, Farm Size, Crop Type, Power Source (Fuel-based, Electric & Battery-driven, Manual, Solar), and Region - Global Forecast to 2025", the global agricultural sprayers market size is estimated to be valued at USD 2.2 billion in 2020. It is projected to reach USD 3.1 billion by 2025, recording a CAGR of 6.5% during the forecast period. Agricultural sprayers have become essential for farmers or growers for spraying pesticides, herbicides, and fertilizers in the field pre- and post-harvest as per the requirement. Thus, the market for agricultural sprayers is growing due to extensive changes in farming and spraying technologies.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46851524

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46851524

The self-propelled segment is projected to be the fastest-growing, in terms of value, during the forecast period.

Agricultural sprayers are equipment or devices used by farmers to apply fertilizers, herbicides, and pesticides to the crops. They are used to control pests, weeds, and diseases in crop fields. The increasing awareness and adoption of advanced farming techniques, such as electrostatic spray system and VRT, are fueling the growth of the market.

Self-propelled sprayers are used to meet the large-scale productivity demand of crops. The tanks capacity in such sprayers is much higher than other types of sprayers, which increases its spraying time while reducing the traveling time and the filling downtime of the tank.

The medium-sized farm segment is projected to account for a major share in the market during the forecast period

Mid-sized farms range from 100 to 200 hectares of farm size. These farms employ more people per acre than large, industrialized farms. They are more likely to purchase inputs locally, retaining more money in their local economies. Areas with more moderate-sized farms have lower poverty and unemployment rates, higher average household incomes, and greater socioeconomic stability. In mid-size farms, sprayers such as small self-propelled sprayers, tractor-mounted sprayers, and trailed sprayers are used to apply fertilizers, herbicides, and pesticides to the crops.

The fuel-based segment is projected to account for a major share in the market during the forecast period

Owing to technological advancements, the popularity of fuel-based sprayers on large and medium farms and growing demand for large capacity from farmers with large farms are driving the growth for fuel-based sprayers globally.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=46851524

The Asia Pacific region is projected to account for a major share in the market during the forecast period

This market is also projected to be the fastest-growing during the forecast period. Agriculture is the major occupation in the Asia Pacific region; it has a huge regional presence, including countries like China, India, Australia, Japan, and the Rest of Asia Pacific. Thus, the increasing agricultural practices, use of advanced technological farm equipment, and requirement of high-quality agricultural produce are expected to drive the agricultural sprayers market in this region.

This report includes a study on the marketing and development strategies and the product portfolios of leading companies. It consists of profiles of leading companies, such as John Deere (US), CNH Industrial N.V. (UK), Kubota Corporation (Japan), Mahindra & Mahindra Ltd. (India), STIHL (Germany), AGCO Corporation (US), Yamaha Motor Corp. (Japan), Bucher Industries AG (Switzerland), EXEL Industries (France), AMAZONEN-Werke (Germany), BGROUP S.p.A. (Italy), Agro Chem Inc. (US), Boston Crop Sprayers Ltd. (UK), H&H Farm Machine Co. (US), Buhler Industries Inc. (Canada), AG Spray Equipment, Inc. (US), and John Rhodes AS Ltd (UK).