- Manufacturers/suppliers

- Beverage manufacturers & processors

- Traders & retailers

- Regulatory bodies and associations, which include the following:

- The Plant Based Foods Association (PBFA)

- The Food and Drug Administration (FDA)

- The United States Department of Agriculture (USDA)

- The European Food Safety Authority (EFSA)

- The Soyfoods Association of North America (SANA)

- The Specialty Food Association (SFA)

- The British Dietetic Association (BDA)

- The National Recreation and Park Association (NRPA)

- Dietitians of Canada (DC)

- National Milk Producers Federation (NMPF)

- Dietitians Association of Australia (DAA)

Monday, March 7, 2022

Upcoming Growth Trends in the Plant-based Beverages Market

Flavor Systems Market to Showcase Continued Growth in the Coming Years

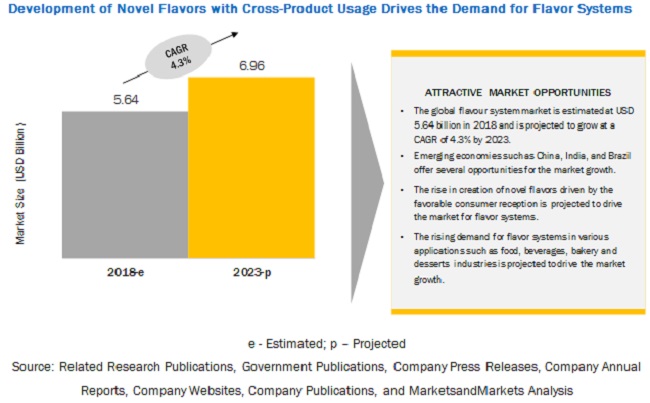

The report "Flavor Systems Market by Type (Brown, Dairy, Herbs & Botanicals, Fruits & Vegetables), Application (Beverages, Savories & Snacks, Bakery & Confectionery Products, Dairy & Frozen Desserts), Source, Form, and Region - Global Forecast to 2023", is estimated to be valued at USD 5.64 billion in 2018 and is projected to reach a value of USD 6.96 billion by 2023, growing at a CAGR of 4.3% during the forecast period. Factors such as the Creation of novel flavors driven by favorable consumer reception and cross product usage of flavors are driving the growth of this market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=237716072

By Source, the Nature-identical segment is projected to be the fastest-growing segment in the flavor systems market during the forecast period.

Nature-identical substances are chemically identical to any substance that are naturally present in materials of plant and animal origins, and are therefore a more preferred choice, for both, manufacturers of end-products, and consumers alike. Most commercial flavorants are nature-identical substances, as these tend to be more stable in nature than natural flavoring extracts, while being a more cost-effective option, hence are projected to witness rapid growth in demand during the forecast period.

By application, the beverages segment is projected to dominate the flavor systems market during the forecast period.

Flavors of fruits & vegetables and spices are widely being utilized and blended with beverages such as coffee and chocolate shake to create a worming aroma and taste, and also to create a sweet and spicy warm fall flavor. Other flavors such as mint flavors are added in beverages to create refreshing flavor and aromatic taste. Such innovations and customization in beverage products and flavor variety in line with consumer demands, is projected to boost the growth for flavor enhancers in the beverage segment.

The increasing demand for flavor systems in the North American and European regions is driving the growth of the flavor systems market.

In Europe, the growth of flavor systems is attributed to the growth in the. Beverages, bakery and dairy & frozen desserts industry, with growing demand for flavor enhancers in confectionery products. Soft drinks, dairy products, frozen products, and other alcoholic and non-alcoholic beverages are the most innovative food sectors in the region, offering significant opportunities for the growth of flavoring systems. Furthermore, the growing consumption of bakery & confectionery products and savories & snack products, and the demand for their product variety has resulted in intensifying demand for flavor systems in these food products. The innovation in food applications, with the use of flavor systems in these industries, has resulted in new product development and increased consumption of flavor systems in different food applications in this region.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=237716072

The demand for flavor systems in North America is driven by the increasing demand and creation of innovative flavor systems for processed food products as the region is among the largest consumers of processed food products. The market growth is further driven by the presence of a significant number of flavoring systems manufacturers in the region catering to the growing domestic as well as international market demand. Furthermore, the constantly evolving consumer demand for flavor varieties in end products together with the strategy of flavor systems market players to work in close proximity of their customers further aids the growth and development of the flavor systems market in the North American region.

Key Market Players:

Givaudan (Switzerland), International Flavors & Fragrances (IFF) (US), Firmenich (Switzerland), Symrise (Germany), and Mane SA (France) are the leading players in the flavor systems market. Major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Friday, March 4, 2022

Upcoming Growth Trends in the Feed Antioxidants Market

- What are the growth opportunities in the feed antioxidants market?

- What are the major and new product launches in the feed antioxidants market?

- What are the significant trends that are disrupting the feed antioxidants market?

- What are some of the major regulatory challenges and restraints that the industry faces?

- Which region is projected to emerge as a global leader by 2025?

Latest Regulatory Trends Impacting the Water Soluble Packaging Market

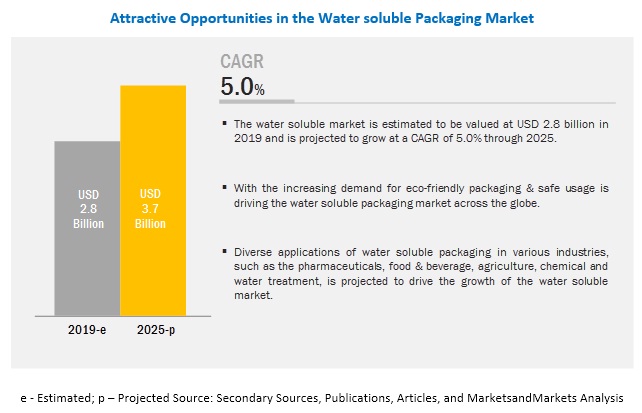

The water-soluble packaging market is estimated to be valued at USD 2.8 billion in 2019 and is projected to reach USD 3.7 billion by 2025, recording a CAGR of 5.0% during the forecast period. The increasing demand for sustainable and green packaging drives the market growth for water-soluble packaging.

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=243293980

- What are the growth opportunities in the water soluble packaging market?

- What are the major raw materials used for manufacturing water soluble packaging?

- What are the key factors affecting market dynamics?

- What are some of the significant challenges and restraints that the industry faces?

Thursday, March 3, 2022

Enteric Disease Testing Market Growth by Emerging Trends, Analysis, & Forecast

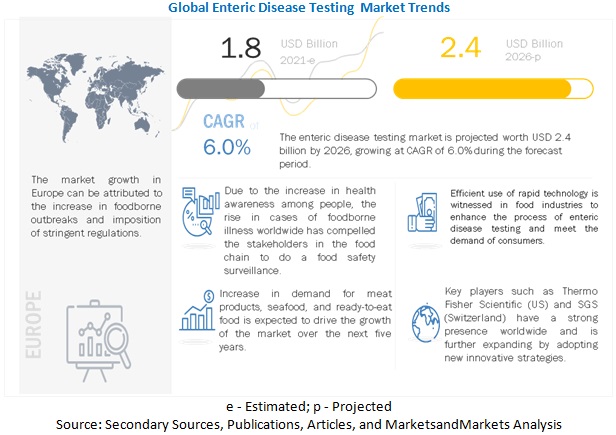

The report "Enteric Disease Testing Market by Technology (Traditional and Rapid), End Use (Food (Meat, Poultry, Seafood, Dairy, Processed Foods, and Fruits & Vegetables) and Water), Pathogen Tested, and Region - Global Forecast to 2026", The market for enteric disease testing is estimated at USD 1.8 billion in 2021; it is projected to grow at a CAGR of 6.0% to reach USD 2.4 billion by 2026. The increase in global food production impacts the food enteric disease testing market growth by increasing the number of food safety controls in each step from raw material procurement till the product reaches the consumers. Further, food manufacturers are willing to pay for testing and certification and have included this practice in their manufacturing cycles. With consumers becoming increasingly aware about the food and water-borne illnesses and stringent regulations to meet international standards, there is growing demand for enteric disease testing market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=139763313

Salmonella pathogen is estimated to account for the largest market share in the by pathogen for enteric disease testing market.

Increasing instances of food contamination and foodborne poisoning are the major reasons for the growth of the enteric disease testing market. Pathogens such as Salmonella are highly occurring contaminants in cereals & grains and are also known as enteric bacteria often caused by birds or rodents during harvesting. Salmonella also causes contamination in meat, poultry, fruits, and vegetables. A several number of cases are found for diarrhea and cholera, resulting in several deaths caused by Salmonella infected food. These factors are paving way for growth of testing for Salmonella within the enteric disease testing market.

By technology, the rapid testing technology sub-segment is estimated to account for the fastest growth in the enteric disease testing market.

The rapid technology market has been proved as a driver for the enteric disease testing market owing to the attributes such as low turnaround time, higher accuracy, sensitivity, and ability to test a wide range of contaminants in comparison to traditional technology. Increasing food trade across borders, rising food consumption, changing lifestyles of consumers, and demand for convenience & processed food have led to the growing demand for enteric disease testing in countries around the world, especially in the booming markets of Europe.

The meat, poultry and seafood sub-segment by end use is estimated to account for the largest market share of enteric disease testing market over the forecast period.

The meat, poultry, and seafood segment is estimated to dominate the enteric disease testing market in 2021. Due to easy susceptibility to microbial and other contaminations along with the growing number of tests for meat, poultry, seafood products has resulted in the growth of the market. Stringent government policies & regulations for meat, poultry, and seafood products and assurance of safe meat to consumers have led to consistent enteric disease testing with checkpoints at different stages to eliminate any incidences of meat contamination.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=139763313

Europe is projected to be the fastest-growing market for the forecast period.

The market in this region is primarily driven by growth in the German and UK markets. It is also driven by European food policies that have been extensively emphasized by the National Reference Laboratories (NRLs) and the European Reference Laboratories (EURLs) to maintain food standards and protect consumer health. Campylobacter has been the most commonly reported food outbreak, with an increase in confirmed human cases in the European Union (EU). The market is further fueled by the presence of major enteric disease testing companies such as SGS SA (Switzerland), Eurofins Scientific (Luxembourg), and Intertek Group plc (UK), which are continuously investing and collaborating for the development of better and faster testing technologies to aid conformity to various enteric disease regulations.

Key Market Players:

Key players in this market include SGS SA (Switzerland), Eurofins Scientific (Luxembourg), Intertek Group plc (UK), Bureau Veritas (France), ALS Limited (Australia), and TÜV SÜD (Germany). Key players in this market are focusing on increasing their presence through mergers & acquisitions and new product developments, specific to consumer tastes in these regions. These companies have a strong presence in Europe and North America. They also have manufacturing facilities along with strong distribution networks across these regions.

Wednesday, March 2, 2022

Crop Protection Chemicals Market: Growth Opportunities and Recent Developments

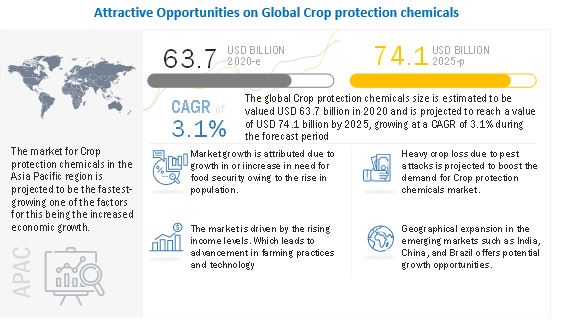

The report "Crop Protection Chemicals Market by Type (Herbicides, Insecticides, Fungicides & Bactericides), Origin (Synthetic, Biopesticides), Form (Liquid, Solid), Mode of Application (Foliar, Seed Treatment, Soil Treatment), Crop Type and Region - Global Forecast to 2025" The global Crop protection chemicals size is estimated to be valued USD 63.7 billion in 2020 and is projected to reach a value of USD 74.1 billion by 2025, growing at a CAGR of 3.1% during the forecast period. The growth of this market is attributed to an increasing need for food security of the growing population.

Upcoming Growth Trends in the Biofertilizers Market

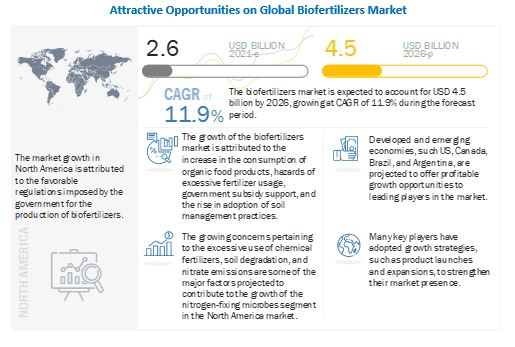

The report "Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Type (Nitrogen-fixing, Phosphate solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Crop Type, and Region - Global Forecast to 2026" The global biofertilizers market size is estimated to be valued at USD 2.6 billion in 2021 and is expected to reach a value of USD 4.5 billion by 2026, growing at a CAGR of 11.9% in terms of value during the forecast period. Factors such as growth in consumer preference for organic food products, adoption of soil fertility management practices, serious concerns regarding the control of nitrate emissions and eutrophication in the aquatic environment, and government promotions for the use of organic fertilizers are some of the factors driving the growth of the biofertilizers market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

COVID-19 Impact on the Biofertilizers Market:

The global market has witnessed a relatively stable market growth post-COVID-19 pandemic, with a similar trend of high demand in 2020. Biofertilizers can be developed easily, and therefore, are run by domestic manufacturers. As the produce can be manufactured by local companies, the supply chain has not been affected much due to the crisis. Therefore, local manufacturers are projected to dominate the market in most of the countries. There has been a significant increase in food crop production, such as soybean, in South America, fruits & vegetables in European countries, rice in Asian countries. In addition, there is repetitive cultivation due to the increased need in each country to step up domestic food production. Hence, biofertilizer is an effective tool, which helps in replenishing soil nutrition and has gained a high demand in the market. In addition, due to the ban on harmful chemical pesticides, the growth of the market for biofertilizers has not dropped significantly. With the relaxation of restrictions by the government, the market for biofertilizers is projected to grow significantly in the future.

Driver: Growth in the organic food industry

Consumers nowadays are becoming highly concerned about food safety issues, the rising residue levels in food, and environmental issues, due to the rising concerns about their health. This rise in awareness has induced them to prefer chemical-free food products. As a result, major supermarket chains such as Wal-Mart and Cosco are increasing their product offerings of organic foods. The restaurant industry in many developed countries is also offering organic food menus to serve health-conscious consumers. The growth in the organic food industry is triggering the demand for biofertilizers and organic manures, as these are pre-requisites of organic farming. With the outbreak of the COVID-19 pandemic, people have become more conscious about healthy organic food products, which has driven the market growth of biological inputs, such as biofertilizers. These factors have increased organic retail sales in many countries, such as the US, Germany, China, Switzerland, and Denmark.

Seed treatment by mode of application drives the market during the forecast period

By mode of application, the seed treatment segment is projected to have the highest CAGR during the forecast period. In seed treatment, biofertilizers such as Rhizobium, Azotobacter, and Azospirillum. are applied as coatings on seeds. This is the most common method of applying biofertilizers, as it is easy and generally effective under most conditions. This helps to encapsulate small amounts of functional microorganisms on it, which enables the plant to provide nitrogen for the roots, to uptake the nutrients. Seed treatment is extensively carried out for legume seeds for the purpose of nitrogen fixation.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=856

North America is the fastest-growing market during the forecast period in the global market

The North American market is projected to dominate the market due to the rising demand for organic products, increasing acceptance of biofertilizers among rural farmers, and high adoption of advanced irrigation systems such as drip & sprinkler irrigation for fertigation. A stringent regulatory environment in addition to a growing preference for the usage of biofertilizer products has led to the favorable growth of the market. Industrialization, mining, and urbanization have led to a decrease in arable land in North America.

Key Marker Players:

Key players in this market include Novozymes A/S (Denmark), Vegalab SA (Switzerland), UPL Limited (India), Chr. Hansen Holding A/S (Denmark), Kiwa Bio-Tech (China), Lallemand Inc. (US), Rizobacter Argentina S.A. (Argentina), T. Stanes & Company Limited (India), IPL Biologicals Limited (India), Nutramax Laboratories Inc. (US), Symborg (Spain), Kan Biosys (India), Mapleton Agri Biotech Pty Ltd (Australia), Seipasa (Spain), AgriLife (India), Manidharma Biotech Pvt Ltd (India), Biomax Naturals (India), Jaipur Bio Fertilizers (India), Valent BioSciences (US), Aumgene Biosciences (India), Agrinos (US), Criyagen (India), LKB BioFertilizer (Malaysia), Varsha Bioscience and Technology India Pvt Ltd. (India), and Valagro (Italy).