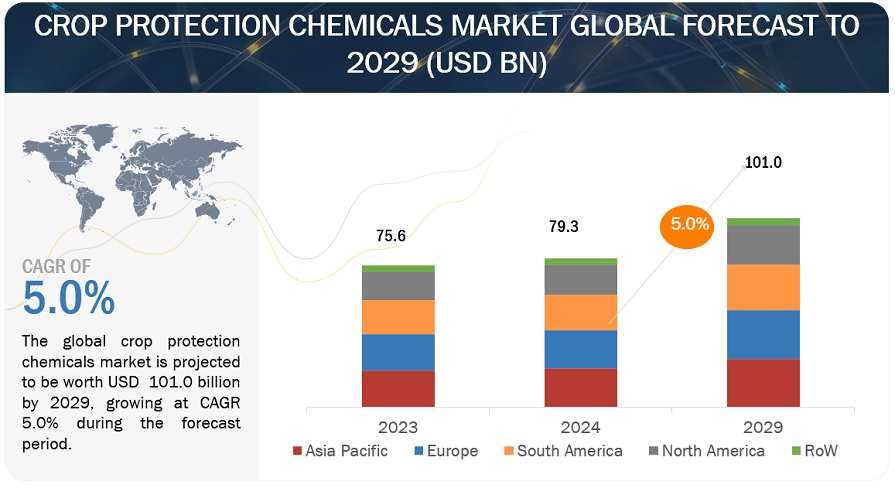

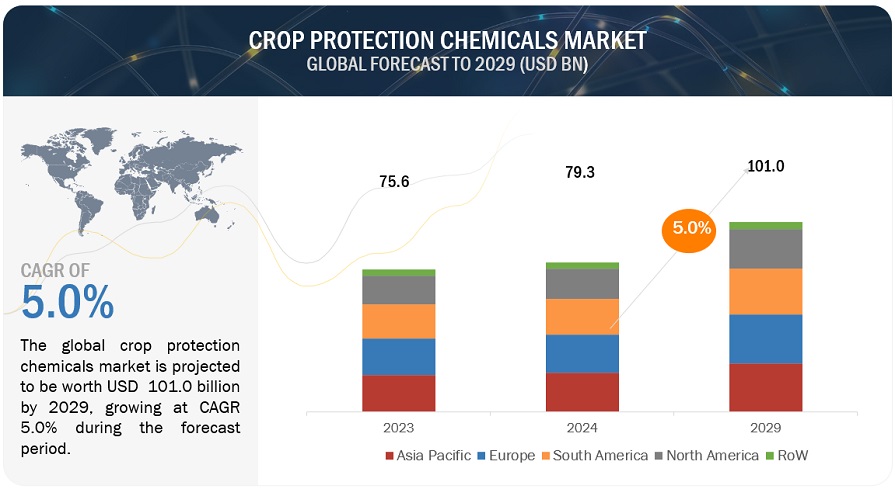

The global crop protection chemicals market is anticipated to grow from USD 79.3 billion in 2024 to USD 101.0 billion by 2029, with a CAGR of 5.0% during this period. Climate change is impacting weather patterns, increasing the prevalence of pests and diseases that threaten crops. Warmer temperatures and shifting rainfall patterns allow pests like the Fall Armyworm to expand their range, affecting crops in Africa and Asia. These rising threats are driving demand for crop protection chemicals to safeguard yields. The Food and Agriculture Organization (FAO) estimates that 20–40% of global crop production is lost annually due to pests, highlighting the critical need for effective crop protection. To support agriculture, governments worldwide are introducing policies and subsidies, such as India's Pradhan Mantri Fasal Bima Yojana (PMFBY), which provides insurance for crop losses due to pests and diseases, indirectly promoting crop protection solutions. Additionally, regulatory frameworks encourage the safe use of these chemicals, further supporting market growth.

Crop Protection Chemicals Market Opportunities: Integrated Pest Management (IPM)

Integrated Pest Management (IPM) is a promising approach in the crop protection chemicals market, combining chemical, biological, cultural, and physical strategies to manage pests sustainably. IPM advocates for the careful use of chemicals, employing them alongside other methods to minimize environmental impact and avoid pest resistance. This approach drives the development of targeted, eco-friendly chemicals compatible with IPM, fostering innovation and growth in the sector as companies respond to the increasing demand for sustainable pest control solutions.

Mode of Application Segment: Seed Treatment

The seed treatment segment is expected to experience the highest growth rate during the forecast period. Seed treatment involves applying protection chemicals directly to seeds before planting, shielding them from pests, diseases, and other stressors during early growth. This approach offers efficient chemical use, targeted application, and minimal environmental impact compared to traditional spraying. The rise of precision agriculture and advancements in seed coating technology are boosting the popularity of seed treatments, which provide uniform coverage and improved efficacy, enhancing crop establishment and yield. Farmers are increasingly adopting seed treatments as they seek cost-effective, sustainable solutions to maximize productivity.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=380

Why is the Asia-Pacific Region Expected to Dominate the Crop Protection Chemicals Market?

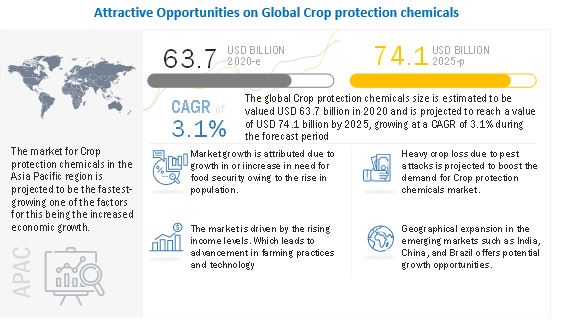

The Asia-Pacific region’s dominance is attributed to its vast agricultural base and the need to enhance crop yields to support its large and growing population. With over 60% of the global population, Asia-Pacific is a hub for agriculture, particularly in countries like China and India, where effective crop protection is essential for food security and economic stability. The region's diverse climates create significant pest and disease challenges, increasing demand for crop protection chemicals. For example, the Fall Armyworm has caused substantial crop losses, pushing governments and farmers to invest in pest management solutions. Additionally, modern farming practices and technology adoption in countries like Japan, Australia, and South Korea are propelling the market for advanced crop protection products. Precision agriculture is helping optimize chemical usage, reducing waste and boosting efficacy.

Leading Crop Protection Chemicals Companies

Prominent companies in the crop protection chemicals market include BASF SE (Germany), Bayer AG (Germany), FMC Corporation (US), Syngenta Group (Switzerland), Corteva (US), UPL (India), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), Albaugh LLC (US), Koppert (Netherlands), Gowan Company (US), American Vanguard Corporation (US), Kumiai Chemical Industry Co., Ltd. (Japan), PI Industries (India), and Chr. Hansen A/S (Denmark). These companies are expanding through partnerships and agreements, maintaining a strong presence across North America, Asia-Pacific, South America, Europe, and other regions, with support from extensive manufacturing facilities and distribution networks.

Crop Protection Chemicals Industry News

- January 2024: Gowan Crop Protection Limited, an affiliate of Gowan Company, LLC, entered agreements with Syngenta Crop Protection AG to acquire global rights to the active ingredient cyromazine, including product registrations, trademarks like TRIGARD and LEPICRON, intellectual property, and labels.

- March 2023: Corteva completed acquisitions of Symborg, a microbiological technology company based in Spain, and Stoller, a large biologicals industry company in the US, strengthening its position in the biologicals market.

- December 2023: Albaugh LLC received U.S. Environmental Protection Agency approval for Maxtron 4SC herbicide (EPA Reg. No. 45002-37), containing ethofumesate, a broad-spectrum herbicide for controlling weeds such as annual sowthistle and nutsedge in sugar beets, garlic, onions, and other crops. This product addition strengthens Albaugh’s market presence and weed control offerings, improving crop yields.