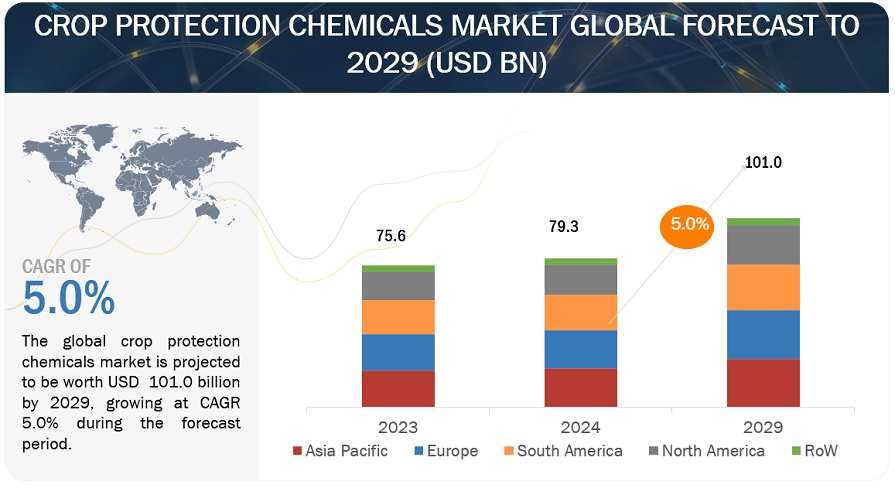

The global crop protection chemicals market is projected to reach USD 101.0 billion by 2029 from USD 79.3 billion by 2024, at a CAGR of 5.0% during the forecast period in terms of value. Climate change is reshaping weather patterns, leading to emerging and persistent threats from pests and diseases. Warmer temperatures and altered precipitation can extend the range of pests, such as the Fall Armyworm, which has wreaked havoc on crops across Africa and Asia. This growing intensity and frequency of threats drive up the demand for crop protection chemicals to preserve yields.

Crop Protection Chemicals Market Opportunities: Integrated pest management (IPM)

Integrated Pest Management (IPM) offers significant potential for the crop protection chemicals market by fostering a comprehensive and sustainable approach to pest control. IPM integrates chemical, biological, cultural, and physical methods to manage pests in a balanced manner. It emphasizes the careful use of crop protection chemicals, applying them only when needed and alongside other control methods to reduce environmental impact and avoid pest resistance. This approach drives the creation of more targeted and eco-friendly chemical products that align with IPM principles. As a result, it paves the way for innovation and growth in the market, with companies developing new formulations and technologies to meet the rising demand for sustainable and effective pest management solutions.

Which trends are driving the steady expansion of the solid segment in the crop protection chemicals industry?

Solid formulations of crop protection chemicals, such as granules, pellets, and powders, offer distinct advantages over liquid forms. These benefits include greater stability, easier storage, and a lower risk of spillage or leakage during transportation and handling. Solid formulations are particularly popular in agricultural practices that require precise application and extended efficacy, such as soil treatments and controlled-release methods. Recent advancements in formulation technology have further enhanced the performance and versatility of these products, making them an increasingly attractive option for farmers who prioritize cost-effective and environmentally sustainable solutions. The growing preference for solid formulations reflects their practical advantages and effectiveness in safeguarding crops from pests, diseases, and weeds, ultimately boosting agricultural productivity.

The Asia Pacific region is expected to dominate the crop protection chemicals market share.

The dominance and rapid growth in this region are driven by its vast agricultural base and the growing need to improve crop yields to sustain a rapidly increasing population. Asia-Pacific, home to over 60% of the world's population, sees countries like China and India at the forefront of agricultural production. In these nations, agriculture plays a crucial role in the economy, making efficient crop protection solutions essential for food security and economic stability. The region's diverse climatic conditions lead to significant pest and disease challenges, further fueling the demand for effective crop protection chemicals. For example, the widespread impact of pests like the Fall armyworm has resulted in notable crop losses, encouraging governments and farmers to invest in robust pest management strategies. Additionally, the rising adoption of modern farming practices and technologies in countries such as Japan, Australia, and South Korea is driving the market for advanced crop protection products, including precision agriculture techniques that enhance the efficiency of chemical applications by reducing waste and improving effectiveness.

Industry Leaders: Crop Protection Chemicals Companies

The key players in the market include BASF SE (Germany), Bayer AG (Germany), FMC Corporation (US), Syngenta Group (Switzerland), Corteva (US),UPL (India), Nufarm (Australia), Sumitomo Chemical Co., Ltd (Japan), Albaugh LLC (US), Koppert (Netherlands), Gowan Company (US), American Vanguard Corporation (US), Kumiai Chemical Industry Co., Ltd (Japan), PI Industries (India), and Chr. Hansen A/S (Denmark).

No comments:

Post a Comment