The trace minerals in feed market refers to the market for minerals that are added to animal feed in trace amounts. These minerals are essential for the proper growth, development, and overall health of livestock. Some of the commonly added trace minerals include iron, copper, zinc, manganese, and selenium.

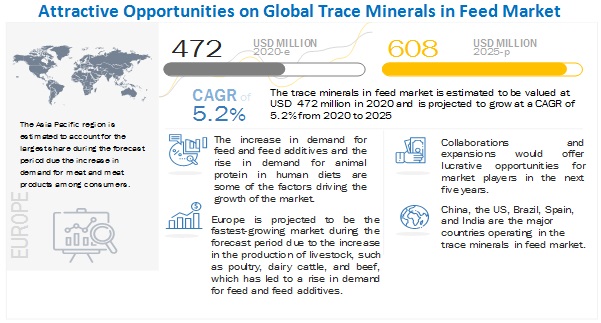

The demand for trace minerals in feed has been growing due to the increasing population and rising demand for meat and dairy products. This, in turn, has led to an increase in the number of livestock and poultry, which has fueled the demand for trace minerals in feed.

There are several factors that are driving the growth of the trace minerals in feed market. One of the major factors is the increasing awareness about the importance of animal nutrition, which has led to an increase in the use of trace minerals in feed. The demand for high-quality animal-derived products has also led to an increase in the demand for trace minerals in feed.

In terms of geography, the trace minerals in feed market is expected to grow at a significant rate in Asia-Pacific and Latin America, due to the increasing demand for meat and dairy products, and the increasing number of livestock in these regions.

The major players operating in the trace minerals in feed market include ADM Animal Nutrition, Alltech, Inc., Evonik Industries AG, Nutreco N.V., and BASF SE, among others.

Trace Minerals in Feed Market Growth Opportunities -

The trace minerals in feed market are expected to grow due to several factors, including the increasing demand for animal-based products, such as meat, dairy, and eggs, as well as the need for better animal health and nutrition. The use of trace minerals in animal feed helps to meet the nutritional requirements of livestock, which leads to improved animal health and performance.

Growing awareness about the benefits of trace minerals in animal feed, coupled with advancements in animal nutrition, is also driving the growth of the trace minerals in feed market. Additionally, increasing consumer demand for high-quality animal-based products and a growing focus on sustainability and animal welfare are expected to fuel the demand for trace minerals in feed.

Furthermore, increasing trade in animal-based products and the growth of the global livestock industry are also contributing to the growth of the trace minerals in feed market. The increasing demand for organic and sustainable animal-based products is also expected to create growth opportunities for the trace minerals in feed market.

However, the high cost of trace minerals and the lack of standardization in the quality of trace minerals used in feed may pose challenges to the growth of the trace minerals in feed market.