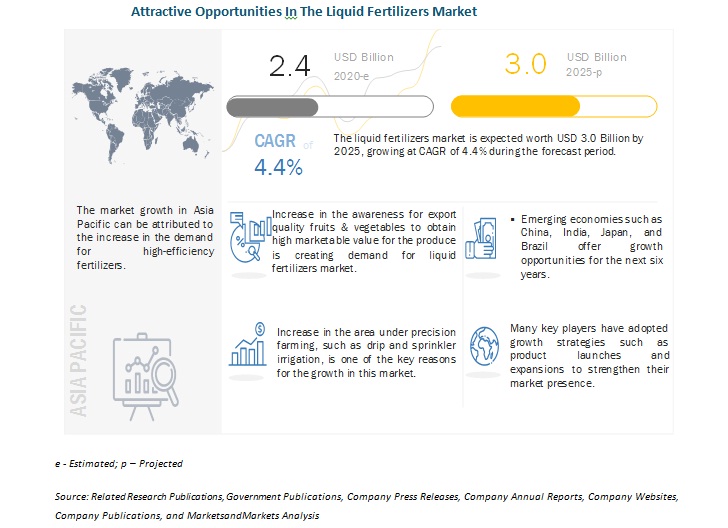

The report "Liquid Fertilizers Market by Type (Nitrogen, Phosphorus, Potassium, and Micronutrients), Mode of Application (Soil, Foliar, and Fertigation), Major Compounds (CAN, UAN, MAP, DAP, and Potassium Nitrate), Crop Type, and Region - Global Forecast To 2025", The global liquid fertilizers market size is estimated to be valued at USD 2.4 billion in 2020 and is projected to reach a value of USD 3.0 billion by 2025, growing at a CAGR of 4.4% during the forecast period. Factors such as the rise in demand for high-efficiency fertilizers and an increase in crop varieties are projected to drive the growth of the liquid fertilizers market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=225530281

The liquid fertilizers market includes major Tier I and II suppliers like Nutrien, Ltd. (Canada), Yara International ASA (Norway), Israel Chemical Ltd. (Israel), K+S Aktiengesellschaft (Germany), Sociedad Química y Minera de Chile (SQM) (Chile) and The Mosaic Company (US). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. Most of the companies are facing the impact of COVID-19 on their businesses upto some extent, affecting the supply chain due to logistics restrictions. But, companies are ensuring to smoothen the supply chain process despite of barriers to support the farmers and ensure food security. The companies are planning to recover the business losses in the third quarter of the year 2020 and soon as the government takes relaxing measures.

The nitrogen segment is estimated to account for the largest market share, in terms of value, in 2020.

Nitrogen is one of the most-widely consumed nutrients among all the macro and microelements required for plant growth. It is used to build amino acids, which produces proteins, takes part in almost every biochemical reaction performed in a plant. Inadequate nitrogen (N) availability in the soil is a common problem that farmers often witness. Therefore, additional liquid nitrogen fertilization is used to eradicate this problem. Urea, ammonium nitrate, ammonium sulfate, and calcium nitrate are commonly available nutrient sources of liquid nitrogen. In addition, various combinations of nutrients are manufactured and used to provide nutrition to plants. Urea is one of the most commonly used sources of nitrogen.

The urea-ammonium nitrate (UAN) segment, on the basis of major compounds, is estimated to record significant growth due to its high demand in the global liquid fertilizers market.

UAN is gaining popularity among liquid fertilizer users, as it can be mixed with pesticides, herbicides, growth regulators, and other nutrients. Hence, it allows farmers to reduce costs by applying several materials simultaneously. Due to its chemical properties, UAN is compatible with many other nutrients and agricultural chemicals. Thus, it is more often mixed with solutions containing phosphorus, potassium, and other essential plant nutrients. Fluid fertilizers can be blended to precisely meet the specific needs of the soil or crop.

The fertigation segment is projected to witness the fastest growth, in terms of value, in the liquid fertilizers market, on the basis of mode of application, from 2020 to 2025.

Fertigation is an agricultural technique, which includes water and fertilizer application through irrigation. This process provides an opportunity to maximize the yield and minimize environmental pollution. Moreover, through fertigation, a farmer can uniformly apply nutrients throughout the field, whenever required. This market is projected to grow due to the adoption of efficient irrigation systems globally. The fertigation method allows homogenous application of liquid fertilizers in adequate amount to the wetted zone in the root development, where most of the active roots are concentrated. This helps in enhancing the efficiency of liquid fertilizers.

The cereals & grains segment, on the basis of crop type, is estimated to account for the largest market share, in terms of value, in 2020.

The cereals & grains segment in the market comprises different crops, such as rice, wheat, corn, and maze. The production of cereals and grains vary across different regions, depending on the topography and climatic conditions. Hence, the type of fertilizers used for crop growth also varies. Due to this, the cereals and grains recorded the highest consumption of nitrogen-based fertilizers in North America. This segment is projected to witness an increase in the share of nearly 5%, which is contributed largely by the US and Canada, according to the FAO World Fertilizer Outlook in 2019.

Make an Inquiry @

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=225530281

South America is projected to grow at the highest CAGR during the forecast period.

The market for liquid fertilizers in the South America region is projected to grow at the highest CAGR from 2020 to 2025. According to FAOSTAT, Brazil is the largest producer of agricultural products due to the availability of abundant land and rural labor force, followed by Argentina. The growth in South America is majorly attributed to by the increase in the adoption of agrochemicals and advancements in farming techniques in Brazil and Argentina with distribution channels established by global agrochemical players. Due to these factors, the market in the South America region is projected to record the highest growth from 2020 to 2025.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the liquid fertilizers market. It includes the profiles of leading companies such as Nutrien, Ltd. (Canada), Yara International ASA (Norway), Israel Chemical Ltd. (Israel), K+S Aktiengesellschaft (Germany), Sociedad Química y Minera de Chile (SQM) (Chile), The Mosaic Company (US), EuroChem Group (Switzerland), CF Industries Holdings, Inc.(US), OCI Nitrogen (Netherlands), Wilbur-Ellis (US), Compass Minerals (US), Kugler (US), Haifa Group (Israel), COMPO Expert GmbH (Germany), AgroLiquid (US), Plant Food Company, Inc. (US), Foxfarm Soil and Fertilizer Company (California), Agro Bio Chemicals (India), Agzon Agro (India), BrandT (US), Nufarm (Australia), Plant Fuel Nutrients, LLC (US), Nutri-tech solutions (Australia) and Valagro SPA (Italy).