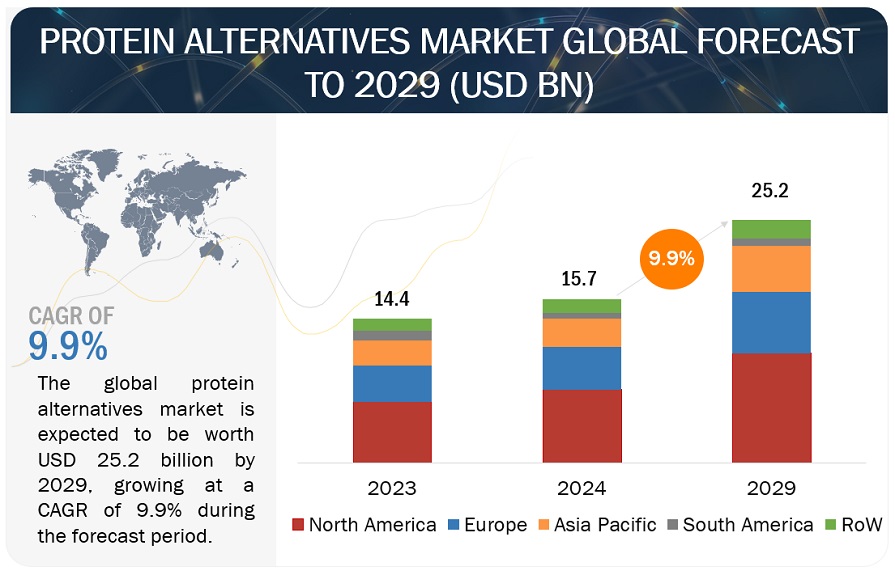

The protein alternatives market size is valued at USD 15.7 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 9.9%, reaching USD 25.2 billion by 2029. This market has seen significant expansion and diversification in recent years, fueled by a growing consumer preference for sustainable, health-conscious, and ethically produced food options. Key factors driving this growth include increasing concerns about the environmental impact of traditional animal agriculture, the health benefits of plant-based diets, and ethical considerations related to animal welfare. Major segments within the protein alternatives market encompass plant-based proteins, insect-based proteins, and microbial proteins. Brands like Beyond Meat, Impossible Foods, and Oatly have gained widespread recognition, highlighting the mainstream acceptance and growing consumer interest in these products. Additionally, technological advancements and substantial investments from both large food companies and venture capitalists have accelerated the development and availability of innovative protein alternatives.

Protein Alternatives Market Growth: Rising Demand for Alternative Protein Sources

The growing global population emphasizes the urgent need for alternative protein sources. In the last decade, substantial efforts have been directed towards developing proteins from non-traditional crops and livestock. This shift is particularly evident in Europe and North America, where consumer interest and investments in alternative proteins have significantly increased. Traditional animal protein sources like pork, beef, and chicken are anticipated to fall short of meeting future demands, opening up opportunities for the expansion of the insect protein market. Insects are not only valued for their proteins and fats but also for their rich mineral and vitamin content. Among younger consumers, especially in sports nutrition, insect proteins like cricket flour are gaining traction and are being incorporated into various nutritious food products. For example, startups like Next Step Foods in the UK produce cricket protein bars under the brand "Yuana," available in several flavors.

The transition to alternative proteins also offers environmental advantages, particularly in reducing greenhouse gas emissions compared to conventional meat production, as noted by the World Economic Forum in 2019. Additionally, the adoption of alternative proteins addresses diet-related health issues in developing nations and promotes healthier lifestyles in developed regions such as North America and Europe. These areas have already embraced alternative protein sources, including edible insects, plant-based meats, plant protein ingredients, and cultured meat. Industry experts foresee significant market growth potential for these products, with cultured and plant-based meats alone expected to grow by over 40% in the coming years.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=233726079

What factors are driving consumers to turn towards plant-based and organic protein sources?

Consumers are increasingly turning towards plant-based and organic protein sources as they become more health-conscious and environmentally aware. This shift is driven by concerns over animal welfare, sustainability, and the desire for cleaner, healthier eating options. Organic protein alternatives, such as plant-based meats, dairy substitutes, and protein-rich grains like quinoa and lentils, are gaining popularity due to their perceived health benefits and minimal environmental impact. Companies in this sector are innovating rapidly to meet rising demand, offering a diverse range of products that cater to various dietary preferences and nutritional needs. As a result, the protein alternatives market is not only expanding in size but also evolving in terms of product offerings and market reach.

Moreover, the growth in the protein alternatives market is bolstered by changing consumer behaviors and preferences towards more sustainable lifestyles. As awareness of climate change and resource depletion increases, consumers are seeking out products that align with their values of sustainability and ethical sourcing. Protein alternatives not only offer a viable substitute to traditional animal-based proteins but also often boast certifications that ensure they are produced using environmentally friendly practices. This growing market trend is attracting investment from both established food companies and startups alike, driving further innovation and market expansion. Overall, the organic nature of the protein alternatives market reflects a broader societal shift towards healthier, more sustainable food choices, shaping the future landscape of the food industry.

Asia Pacific Dominates Global Protein Alternatives Market Share

The protein alternatives market in the Asia Pacific region is experiencing rapid growth due to increasing consumer awareness of health benefits, immunity enhancement, and environmental sustainability. The shift towards alternative protein sources reflects a growing understanding of the health benefits associated with plant-based diets, such as reduced risks of chronic illnesses and strengthened immune systems. Additionally, concerns about the environmental impact of animal agriculture, including its contribution to carbon emissions and land use, are driving consumers to embrace plant-based options. This trend is further supported by advanced food technologies that provide a wide range of plant-based protein products catering to the region's diverse culinary preferences. As a result, the Asia Pacific region is becoming a key player in the global protein alternatives market, with expectations for ongoing growth and innovation in the near future.

Top Protein Alternatives Companies

Key Market Players in this include Tate & Lyle PLC (London), Kerry Group PLC (Ireland), DSM Firmenich (Switzerland), ADM (US), Cargill Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), Roquette Frères (France), Wilmar International Ltd. (Singapore), Glanbia plc (Ireland), Kerry Group PLC (Ireland), DSM-Firmenich (Switzerland), AGT Food and Ingredients (Canada), Burcon (Canada), Ynsect (France), Global bugs (Thailand), and Innovafeed (France).

Other players include BENEO GmbH (Germany), SOTEXPRO (France), Shandong Jianyuan Group (China), AMCO Proteins (US), Australian Plant Proteins Pty Ltd (Australia), NextProtein (France), Mycorena (Sweden), Burcon NutraScience Corporation (Canada), Emsland Group (Germany), COSUCRA (Belgium) and Hexafly (Ireland).