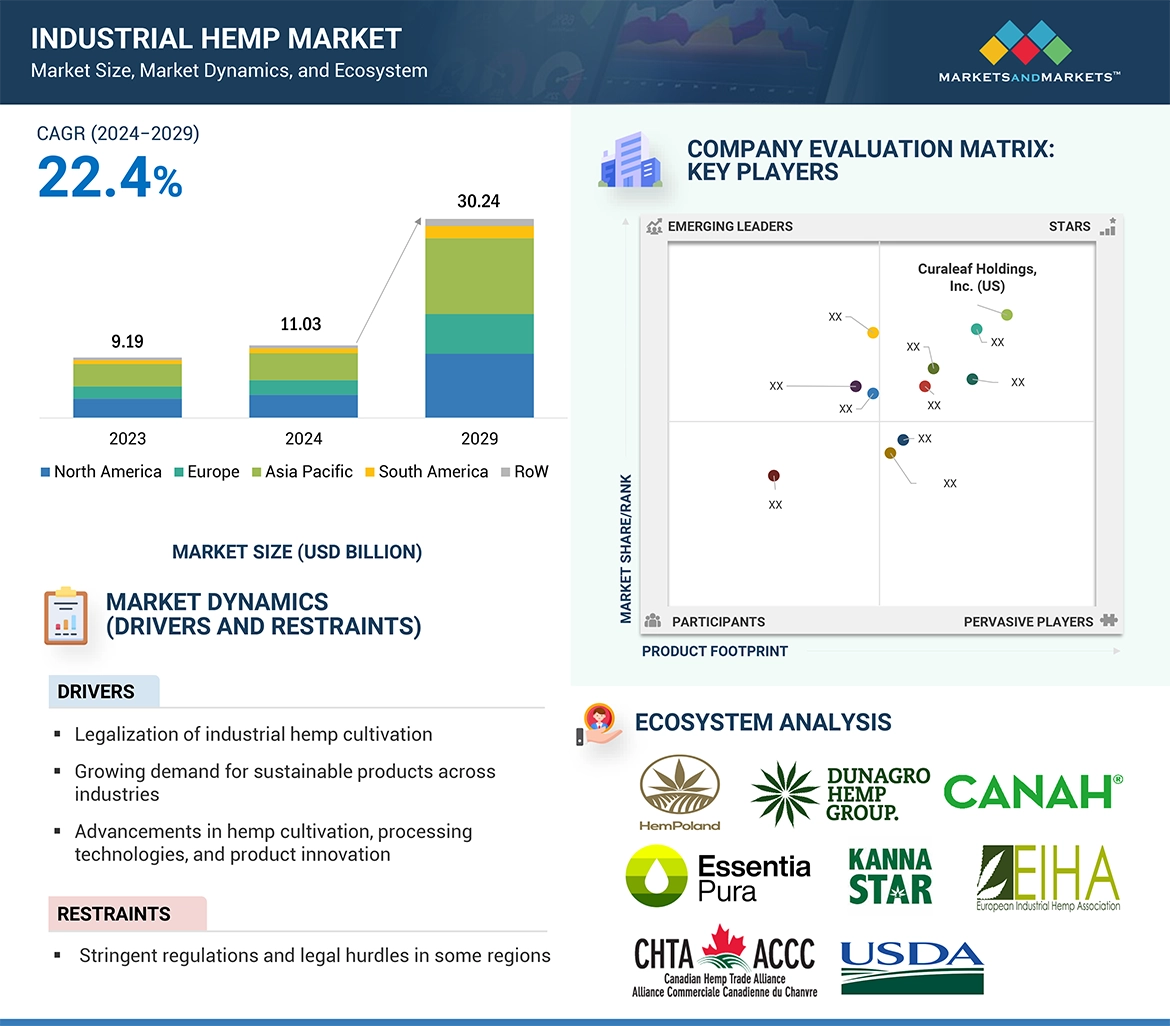

The industrial hemp market is estimated at USD 11.03 billion in 2024 and is projected to reach USD 30.24 billion by 2029, at a CAGR of 22.4% from 2024 to 2029. The demand for industrial hemp is growing globally due to increasing demands for the use of environment-friendly products in the different sectors like textiles, construction, bioplastics, personal care products, and the increased cultivation, favorable regulatory amendments, as well as widespread recognition of its environmental benefits among consumers, are driving the growing interest in the global industrial hemp market. The development of new, innovative hemp-based products is yet another opportunity to grow markets with biodegradable plastics and natural fibers. Going forward, the market will keep on growing with continuous loosening of regulations by governments to support hemp cultivation.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=84188417

The hemp seed segment holds the highest market share in the type of segment of the industrial hemp market.

Hemp seed holds the highest market share in industrial hemp because of its diverse uses, like the food sector, cosmetic areas, and even in agricultural operations. Hemp seed is high in essential fatty acids, and it does contain proteins along with vital nutrients that really make a great product for any food industry or wellness-oriented operations. Skincare products contain the oil extracted from hemp seeds. Snacks, beverages, and supplements also contain hemp seeds. As the demand for plant-based nutrition and sustainable ingredients grows, hemp seeds lead the market in industrial hemp.

The conventional source segment holds the highest share in the source segment in the industrial hemp market during the forecasted period 2024-2029.

The conventional sources of the industrial hemp market dominate because they already have established infrastructure system and are highly accepted for farming and processing. Traditional farming, along with government policies and supply chains already set up, remains the largest area of production of hemp for textiles, bioplastics, and food products. This would mean consistent yields and product quality as conventional sources assure, making it a choice source for large-scale industrial hemp production. So, with this growth of demand, conventional sources should remain the leader in this market.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=84188417

Based on region, Europe has a significant share in the industrial hemp market.

Europe accounts for significant share in industrial hemp market due to its strong agricultural sector, supportive regulatory environment, and increasing demand for sustainable products. The European Union has policies to encourage hemp farming; these policies include financial incentives to farmers and a clear framework for the processing of the crop. Hemp farming is on the rise across the European region, especially with regard to fiber production. Between 2015 and 2022, the areas planted with hemp in the EU increased by 60% from 20,540 hectares to 33,020 hectares. In the same time span, hemp production saw a growth of 84.3%, increasing from 97,130 tonnes to 179,020 tonnes. The country that leads as the biggest producer is France with more than 60%, Germany with 17% followed by the Netherlands by 5%.

In December 2021, the European Union approved its new Common Agricultural Policy (CAP) for 2023-2027, applicable from January 2023. This new policy opens the way for farmers to be paid directly for cultivating hemp varieties listed in the EU Catalogue with a THC content below 0.3%. For now, hemp varieties must contain less than 0.2% of THC. Traditionally, hemp fibres in Europe have mostly been used for specialty pulp and paper, such as cigarette paper, Bible paper, and banknotes. However, thanks to the European Commission's supports, increasing research and development lead to the expansion of this use of hemp fibers both in automotive applications and for construction materials.

Leading Industrial Hemp Manufacturers:

The report profiles key players such as Curaleaf Holdings, Inc. (US), Green Thumb Industries (US), Canopy Gowth Corporation (Canada), AURORA CANNABIS INC. (Canada), The Cronos Group (Canada), Ecofibre Ltd (Australia), HempFlax Group B.V. (Netherlands), Dun Agro Hemp Group (Netherlands), Fresh Hemp Foods Ltd. (Canada), GenCanna (US), Konoplex Group (Russia), Canah International (Netherlands), MH Medical Hemp GmbH (Germany), Liaoning Qiaopai Biotech Co., Ltd. (China), and IND HEMP (US).