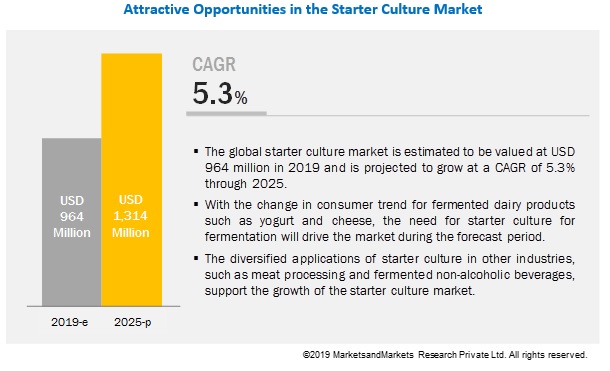

The report "Starter Culture Market by Microorganism (Bacteria, Yeasts, Molds), Application (Dairy & Dairy-based Products, Meat & Seafood), Composition (Multi-strain Mix, Single Strain, Multi-strain), Form, and Region - Global Forecast to 2025", The global starter culture market size is estimated to be at USD 964 million in 2019 and is projected to reach USD 1,314 million by 2025, at a CAGR of 5.3%. Increasing awareness among manufacturers regarding the benefits of starter culture, growing application in cheese & other dairy products, and rising demand for fermented meat & dairy products are some of the main drivers for the growth of the starter culture industry.

Based on product form, the freeze-dried segment is projected to be the more substantial contributor in the starter culture market during the forecast period

The starter culture market has been segmented based on product form into freeze-dried and frozen. The demand for freeze-dried cultures is projected to record higher CAGR between 2018 and 2023. Freeze-dried cultures are easier to maintain and transport while also maintaining the stability of the cultures. They are easier to store and are comparatively inexpensive, without the need for significant additional cold-chain support.

Download PDF Brochure:

Consumer awareness regarding the benefits of starter culture drives the market for dairy & dairy products

The starter culture market is segmented on application into dairy & dairy products, meat & poultry products, seafood, and others. The dairy & dairy products segment is dominant in the application segment due to the growth of starter cultures in the cheese industry. The demand for dairy and dairy-based products is projected to record the highest CAGR between 2019 and 2025 with the growing demand for dairy-based products across the world.

Europe is projected to account for the largest starter culture market share by 2025.

Europe is projected to account for the largest market share by 2025. The region has some of the leading manufacturers of starter cultures in this world. The combined output of the EU-28 countries in the global dairy industry contributes 44% to global dairy production. Also, the overall starter culture market in Europe is driven by the growing demand for fermented dairy-based products.

The report includes a study of the marketing and development strategies, along with the product portfolios, of the leading companies. It includes profiles of leading companies such as CHR Hansen (Denmark), DowDuPont (US), Sacco S.R.L (Italy), CSK Food Enrichment B.V. (Netherlands), THT S.A. (Belgium), Dalton Biotechnologies (Italy), Biochem S.R.L (Italy), Mediterranea Biotechnologie SRL (Italy), Royal DSM N.V (Netherlands), and LB Bulgaricum (Bulgaria).

Make an Inquiry:

Critical Questions the Report Answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for starter cultures?

- What is the impact of the dairy industry on starter cultures?

- What are the new technologies being introduced in starter cultures?

- What are the latest trends in starter cultures?