The seed treatment fungicides market is projected to grow at a CAGR of 9.24% from 2017, to reach a projected value of USD 1.88 Billion by 2022. Increasing usage of seed treatment solutions on expensive GM seeds, growth in the area under GM crops, increasing crop demand for biofuel and feed, and the use of fungicides as a low-cost crop protection solution are enhancing the market for seed treatment fungicides, globally. The growth in the fungicide seed treatment market is also driven by advanced farming technologies which ensure safe and reliable application of seed treatment formulas.

Download PDF Brochure:

The market for cereals & grains is projected to grow at the highest rate due to the rise in demand for agricultural production. Increasing demand from downstream markets in the food & beverage and feed industries has boosted the overall demand for seed treatment fungicides across the globe.

The seed dressing segment accounted for more than half of the total application technique market in 2016. Since it a low-cost technique compared to other techniques (such as coating and pelleting), it is economical to use on low-cost cereals and grains, such as wheat and corn, which are the major crop types dominating the seed treatment fungicides market.

The biological seed treatment market is expected to have a high CAGR during the forecast period, since it is an eco-friendly method for crop protection; consumers also show a preference for these fungicides as they are obtained from natural resources.

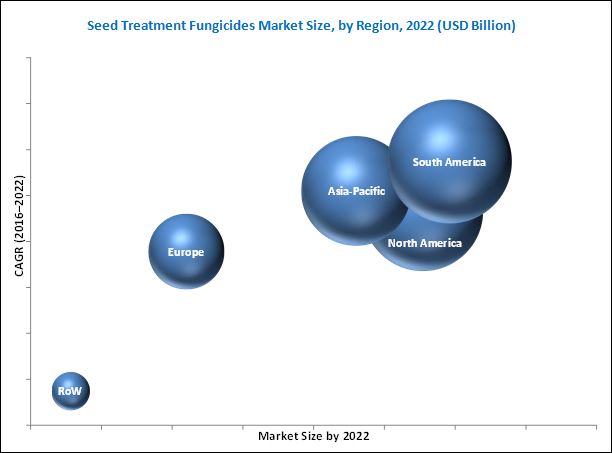

South America is one of the largest contributors to the global seed treatment fungicides due to the increase in use of seed treatment fungicides through advanced agricultural techniques and rise in need for food security in the South American countries. Brazil and Argentina constituted the largest country-level markets in the South American region in 2016. High market penetration by the leading seed treatment fungicides companies, for enhancing the agricultural growth and productivity, and the decrease in arable land are the main factors influencing the growth of the seed treatment fungicides market in South America.

Make an Inquiry:

This report includes a study of marketing and development strategies, along with the product portfolio of leading companies. These companies include BASF SE (Germany), The Dow Chemical Company (U.S.), Sumitomo Chemical Co., Ltd (Japan), and Bayer CropScience AG (Germany); these are well-established and financially stable players that have been operating in the industry for several years. Other players include Syngenta AG (Switzerland), Monsanto Company (U.S.), and Nufarm Ltd. (Australia).

Targeted Audience:

- Seed treatment fungicide manufacturers

- Seed treatment fungicide importers and exporters

- Seed treatment fungicide traders, distributors, and suppliers

- Government and research organizations

- Commercial research & development (R&D) institutions and financial institutions