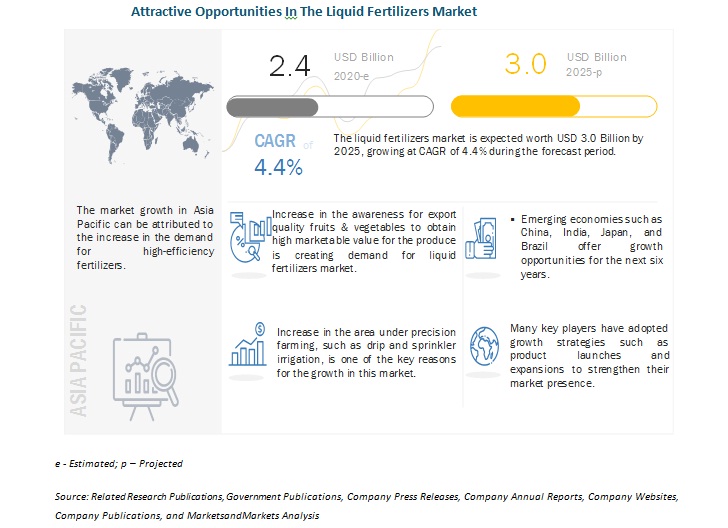

The

report " Liquid

Fertilizers Market by Type (Nitrogen, Phosphorus, Potassium, and

Micronutrients), Mode of Application (Soil, Foliar, and Fertigation), Major

Compounds (CAN, UAN, MAP, DAP, and Potassium Nitrate), Crop Type, and Region -

Global Forecast To 2025", The global liquid fertilizers market size is

estimated to be valued at USD 2.4 billion in 2020 and is projected to reach a

value of USD 3.0 billion by 2025, growing at a CAGR of 4.4% during the forecast

period. Factors such as the rise in demand for high-efficiency fertilizers and

an increase in crop varieties are projected to drive the growth of the liquid

fertilizers market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=225530281

The nitrogen segment is estimated to account for the largest market share, in terms of value, in 2020.

Nitrogen

is one of the most-widely consumed nutrients among all the macro and

microelements required for plant growth. It is used to build amino acids, which

produces proteins, takes part in almost every biochemical reaction performed in

a plant. Inadequate nitrogen (N) availability in the soil is a common problem

that farmers often witness. Therefore, additional liquid nitrogen fertilization

is used to eradicate this problem. Urea, ammonium nitrate, ammonium sulfate,

and calcium nitrate are commonly available nutrient sources of liquid nitrogen.

In addition, various combinations of nutrients are manufactured and used to

provide nutrition to plants. Urea is one of the most commonly used sources of

nitrogen.

The fertigation segment is projected to witness the fastest growth, in terms of value, in the liquid fertilizers market, on the basis of mode of application, from 2020 to 2025.

Fertigation

is an agricultural technique, which includes water and fertilizer application

through irrigation. This process provides an opportunity to maximize the yield

and minimize environmental pollution. Moreover, through fertigation, a farmer

can uniformly apply nutrients throughout the field, whenever required. This

market is projected to grow due to the adoption of efficient irrigation systems

globally. The fertigation method allows homogenous application of liquid

fertilizers in adequate amount to the wetted zone in the root development,

where most of the active roots are concentrated. This helps in enhancing the

efficiency of liquid fertilizers.

The cereals & grains segment, on the basis of crop type, is estimated to account for the largest market share, in terms of value, in 2020.

The

cereals & grains segment in the market comprises different crops, such as

rice, wheat, corn, and maze. The production of cereals and grains vary across

different regions, depending on the topography and climatic conditions. Hence,

the type of fertilizers used for crop growth also varies. Due to this, the

cereals and grains recorded the highest consumption of nitrogen-based

fertilizers in North America. This segment is projected to witness an increase

in the share of nearly 5%, which is contributed largely by the US and Canada,

according to the FAO World Fertilizer Outlook in 2019.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=225530281

South America is projected to grow at

the highest CAGR during the forecast period.

The

market for liquid fertilizers in the South America region is projected to grow

at the highest CAGR from 2020 to 2025. According to FAOSTAT, Brazil is the

largest producer of agricultural products due to the availability of abundant

land and rural labor force, followed by Argentina. The growth in South America

is majorly attributed to by the increase in the adoption of agrochemicals and

advancements in farming techniques in Brazil and Argentina with distribution

channels established by global agrochemical players. Due to these factors, the

market in the South America region is projected to record the highest growth

from 2020 to 2025.

This

report includes a study on the marketing and development strategies, along with

a study on the product portfolios of the leading companies operating in the

liquid fertilizers market. It includes the profiles of leading companies such

as Nutrien, Ltd. (Canada), Yara International ASA (Norway), Israel Chemical

Ltd. (Israel), K+S Aktiengesellschaft (Germany), Sociedad Química y Minera de

Chile (SQM) (Chile), The Mosaic Company (US), EuroChem Group (Switzerland), CF

Industries Holdings, Inc.(US), OCP Group (Morocco), OCI Nitrogen (Netherlands),

Wilbur-Ellis (US), Compass Minerals (US), Kugler (US), Haifa Group (Israel),

COMPO Expert GmbH (Germany), AgroLiquid (US), Plant Food Company, Inc. (US),

Foxfarm Soil and Fertilizer Company (California), Agro Bio Chemicals (India),

Agzon Agro (India), BrandT (US), Nufarm (Australia), Plant Fuel Nutrients, LLC

(US), Nutri-tech solutions (Australia) and Valagro SPA (Italy).