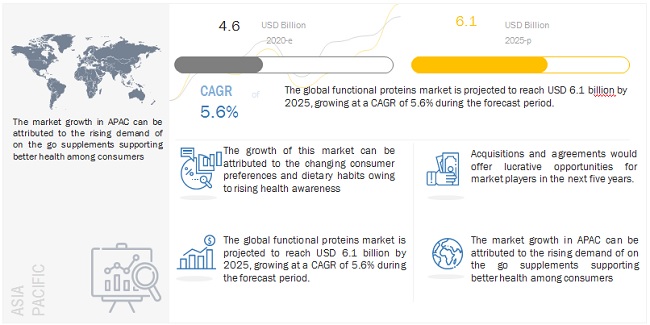

The report "Functional Proteins Market by Type (Whey Protein Concentrates, Isolates, Hydrolysates, Casein, Soy Protein), Source (Animal, Plant), Form (Dry, Liquid), Application and Region – Trends and Forecast to 2025", According to MarketsandMarkets, the global functional proteins market size is estimated to be valued at USD 4.6 billion in 2020 and projected to reach USD 6.1 billion by 2025, recording a CAGR of 5.6% during the forecast period.

The demand for functional proteins is increasing significantly owing to the shift in consumers’ food-related preferences and rising prevalence of chronic diseases. Rising health awareness and increase in disposable income across the globe are key factors that are driving the growth of the functional proteins market. The millennial population is capturing a large share of the market as the ongoing health and wellness trend ergo the surging internet penetration is altering consumer preferences and moving towards adapting protein-infused functional foods into their diets in order to maintain quality of life.

Report Objectives:

- Determining and projecting the size of the functional proteins market, with respect to type, application, form, source, and regional markets, over a five-year period, ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the region

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the functional proteins market

- Analyzing the micro-markets, with respect to individual growth trends, prospects, and their contribution to the total market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=140299581

Opportunities: Shift toward plant-based products

The market for plant proteins is growing at a high rate as consumers are drifting away from animal proteins to plant-based protein. Increasing shifts to veganism, environment sustainability and animal compassion are the key factors cumulatively leading to demand of plant-based proteins as an alternative functional ingredient. Thus, the plant-based protein market is expected to witness high demand and surging growth rate, presenting number of opportunities for expansion and investment in the functional proteins market.

Challenges: Consumer skepticism associated with off-taste of functional proteins

Although functional proteins provide multiple health benefits and streamline the diet, they have an off-putting taste which might not be preferred by some consumers. This factor poses a challenge for the functional proteins industry as aversion towards taste of products is a difficult bar to overcome. Also, the unawareness among rural and semi-urban consumers about functional proteins and the lack of education regarding the same discourages key players from investing. Due to this challenge, manufacturers are focusing on developing different formulations of proteins, with rigorous R&D to mitigate the aversion of consuming functional food and beverages.

North America is projected to account for the largest market during the forecast period

North America is projected to dominate the market during the forecast period owing to the high prevalence of chronic diseases in countries such as the US. Whey protein concentrates are gaining traction as consumers are shifting to dairy proteins to fulfil their nutritional requirements. Emerging markets in economies such as the Asia Pacific countries are going to be potential markets for the functional protein manufacturers.

Key Market Players:

Key players in this market include ADM (US), DuPont (US), Cargill (US), Ingredion (US), Arla Foods (UK), Roquette (France), BASF (Germany), Glanbia (Ireland), Fonterra (New Zealand), DSM (Netherlands), FrieslandCampina (Netherlands), Essentia Protein Solutions (UK), Amai Proteins (Israel), Mycorena (Sweden), Merit Functional Foods (Canada), Plantible Foods (US), BENEO (Germany), ProtiFarm (Gelderland), Omega Protein (US).

Recent Developments:

- December 2020, Cargill expanded its European ingredient portfolio with the addition of pea protein. This product launch enabled Cargill to get access to the pea protein market.

- November 2020, Ingredion acquired Verdient Foods (Vanscoy, SK) with 100% ownership. The acquisition enabled net sales growth and expanded the manufacturing capability of Ingredion, with the addition of two manufacturing facilities in Canada.

- September 2020, ADM expanded their protein portfolio with textured wheat and pea proteins. These high-functionality proteins improve the meat-like texture of alternative meats. This new launch ensured ADM’s leadership in the plant protein market.

No comments:

Post a Comment