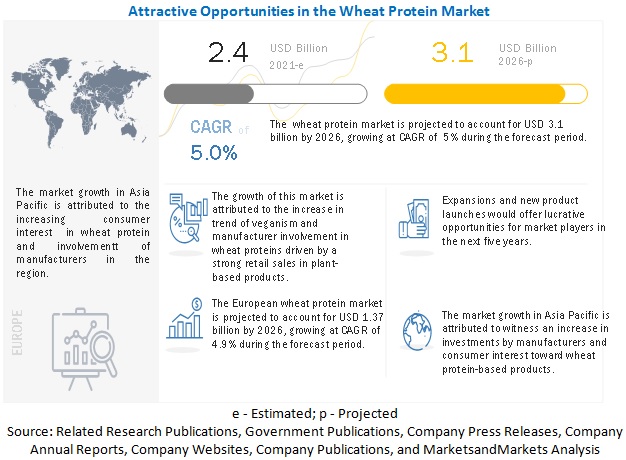

The global wheat protein market is estimated to be valued at USD 2.4 billion in 2021 and is projected to reach USD 3.1 billion by 2026, recording a CAGR of 5.0%. The market has been largely driven by the growing demand for bakery products, the increasing popularity of plant-based foods, wheat protein being a suitable alternative for non-animal protein among vegans coupled with nutritional benefits for lactose-intolerant consumers.

Market Dynamics

Driver: Nutritional benefits for lactose intolerant and health- & fitness-conscious consumers

The Lactose intolerance is defined as a condition whereby, the body cannot easily digest lactose, which is a type of natural sugar found in milk and other dairy products. Although some people having a lactose intolerance issue are able to digest whey protein isolates, without any severe repercussions, others find it easier to digest only plant-based proteins. Although whey protein isolates are further processed and filtered to help eliminate more lactose in comparison to whey protein concentrates, any individual with even a mild intolerance towards lactose should avoid the consumption of these products. In such cases, plant-based alternatives stand as the most suitable option, for those looking to increase protein intake, for health or training purposes. A number of plant-based alternatives, which could be used in place of whey proteins include pea protein isolates, brown rice protein, or wheat protein.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=67845768

Restraints: Increasing discussion on gluten intolerance and gluten-free diets

Gluten intolerance or the Celiac disease is an autoimmune disorder, which damages the small intestine lining and prevents the absorption of nutrients from consumed food items. This damage is majorly a reaction to eating foods with gluten, a type of wheat protein which is also found in barley, rye, and oats. However, some individuals may also experience discomfort in their stomach despite not having the Celiac disease. Amylase-trypsin-inhibitors or ATIs, are a group of proteins found in wheat, which could trigger an immune response, and contribute to the development of non-celiac gluten sensitivity (NCGS).

By application, pet food segment is projected to be the fastest-growing segment in the market during the forecast period.

The growing expenditure on pet food products along with pet humanization in economies such as India and the US is expected to drive the market growth in the pet food segment. Changing consumer preferences driven by awareness toward meat sourcing practices, its ecological impact, and animal-borne diseases have led to more consumers opting out of meat consumption. The resulting change has led to consumer demand shifting from conventional animal-based proteins to plant-based alternatives.

By form, dry segment is projected to dominate the market during the forecast period.

The dry form of processing of protein is used in the production of wheat protein isolates. It involves dry milling technology, which is used to reduce the particle size of raw material into fine particles. This method is used to process wheat, which is correlated to its specific tissue architecture and milling behavior. The process relies on differential particle size and density within the milled flour. Once milled, the air classification process is used to separate the smaller protein rice fragments from larger starch-rich granules or fiber-rich granules.

Europe is estimated to account for the largest share of the wheat protein market during the forecast period

In 2020, Europe is estimated to account for the largest share of the wheat protein market. Factors such as the growing investments by major players in the bakery industry, growing trend of vegan diets, and abundant availability raw materials such as wheat in this region have boosted the demand for wheat protein products in the European market. Furthermore, increased demand for bakery items such as cakes, pastries, and cookies will also drive the demand for wheat protein in the region.

This report includes a study of the marketing and development strategies, along with the product portfolios of the leading companies. It includes the profiles of leading companies such as ADM (US), Cargill (US), Agrana (Austria), MGP Ingredients (US), Manildra Group (Australia), Roquette (France), Glico Nutrition (Japan), Crespel & Deiters (Germany), Kröner-Stärke (Germany), Tereos Syrol (France), CropEnergies (Germany), and Gluten y Almidones Industriales (Mexico), Batory Foods (US), Kerry Group (Ireland), BENEO (Germany), Agridient Inc (US), AMCO Proteins (US), Tate & Lyle (UK), and PureField Ingredients (US)

No comments:

Post a Comment