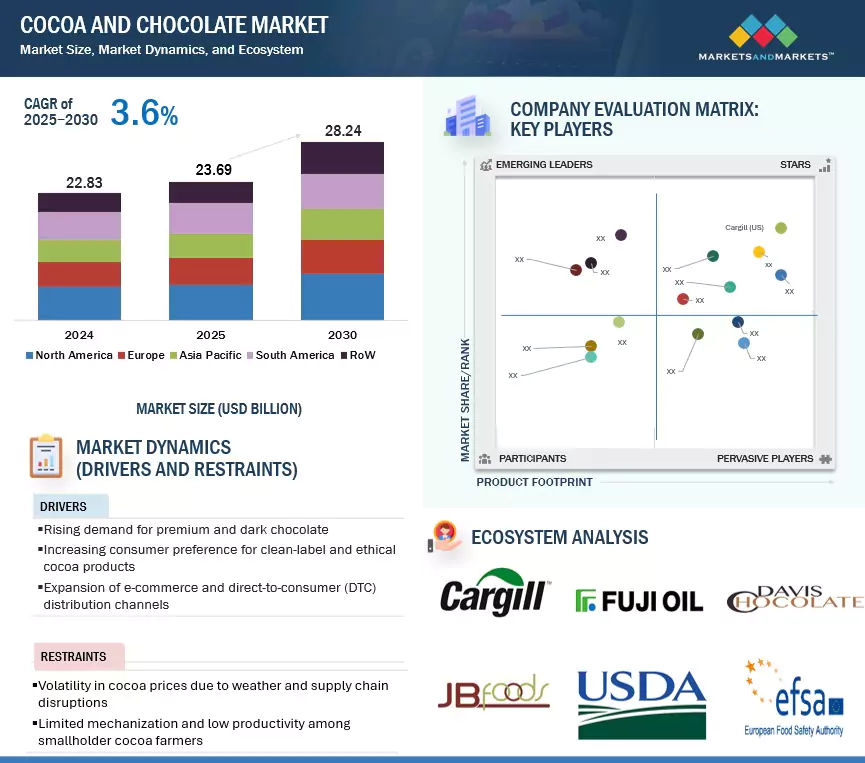

The global cocoa and chocolate market is expected to grow from USD 23.69 billion in 2025 to USD 28.24 billion by 2030, at a CAGR of 3.6%. This market includes a wide range of products such as confectionery, bakery fillings, spreads, and cocoa-based beverages. Growth is fueled by rising demand for indulgent yet functional foods, increasing disposable incomes, and the introduction of premium, sugar-free, and plant-based chocolate offerings. Greater accessibility through commercial availability and digital-first retail strategies also contributes to market expansion. Sustainability and ethical sourcing are becoming essential differentiators, as leading brands focus on traceability and certifications to meet consumer and regulatory expectations.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=226179290

By Cocoa Type: Cocoa Powder Leads Market Share

Cocoa powder holds the largest share in the market due to its cost-effectiveness, versatility, and long shelf life. Widely used in bakeries, beverages, confectionery, and nutraceuticals, its intense flavor and low-fat content align well with health-conscious trends. Its dry, stable form makes it ideal for industrial use and mass production.

Demand is rising for high-quality cocoa powder in ready-to-drink beverages and protein-rich foods. For instance, Barry Callebaut launched a line of defatted cocoa powders in 2024 under its Bensdorp brand, aimed at the health and wellness sector. Manufacturers are also integrating cocoa powder into plant-based and clean-label formulations. Emerging markets in Asia-Pacific and Latin America are key growth areas, thanks to growing middle-class populations and rising demand for chocolate-flavored products.

By Distribution Channel: Offline Sales Dominate

Offline channels—including supermarkets, hypermarkets, convenience stores, and specialty retailers—continue to dominate distribution. These outlets offer product visibility, immediate availability, and in-person engagement, which are critical for premium chocolate purchases and seasonal promotions.

Retail partnerships, in-store sampling, and festive merchandising drive impulse buying. While e-commerce has grown post-pandemic, especially in developed markets like the U.S., Germany, and Japan, traditional offline shopping remains strong due to logistical challenges and the experiential nature of buying chocolate in-store.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=226179290

By Region: Asia Pacific Set to Grow Fastest

The Asia Pacific region is projected to witness the fastest growth during the forecast period. Rising incomes, urbanization, and changing dietary preferences in countries like India, China, Indonesia, and Vietnam are driving demand for premium and innovative chocolate products. Gifting chocolate during festivals and weddings is also becoming a mainstream cultural trend.

Rapid growth in modern retail and e-commerce is improving accessibility, while global players are investing in localized strategies. For example, in June 2024, Hershey expanded its manufacturing and R&D capabilities in Malaysia to cater specifically to the regional market. The demand for clean-label, fortified, and sugar-free chocolates is also rising in response to growing health awareness.

Government support for food processing infrastructure is further enhancing supply chain efficiency, positioning the Asia Pacific as a prime region for investment and innovation in the cocoa and chocolate space.

Leading Cocoa and Chocolate Companies:

The report profiles key players such as Cargill (US), Barry Callebaut (Switzerland), Olam Group (Singapore), Mars, Incorporated (US), Ferrero Group (Italy), Mondelez International (US), Guan Chong Berhad (Malaysia), Lindt & Sprüngli (Switzerland), and Fuji Oil (Japan).

No comments:

Post a Comment