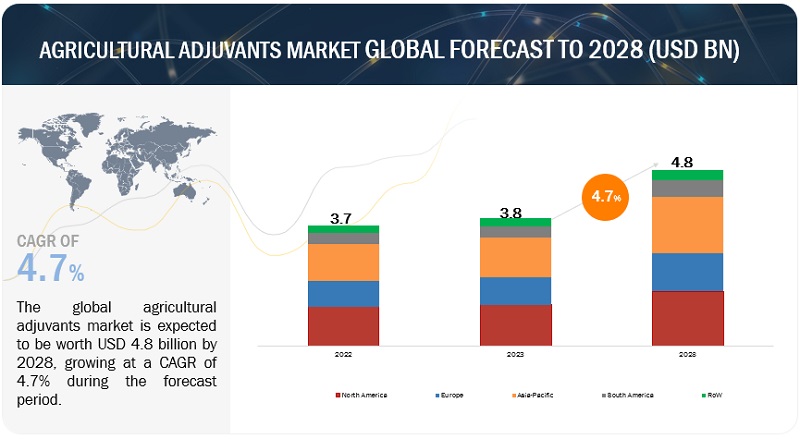

The global agriculture adjuvants market is projected to rise from USD 3.8 billion in 2023 to USD 4.8 billion by 2028, registering a CAGR of 4.7% during the forecast period. As farmers seek to enhance the efficiency of crop protection while minimizing environmental impact, the demand for adjuvants is on the rise. These substances improve the effectiveness, coverage, and retention of pesticides and fertilizers, enabling reduced chemical usage and promoting more sustainable farming practices. With the growing need for higher food production and eco-friendly crop protection methods, agricultural adjuvants are playing a vital role in advancing modern agriculture.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

The cereals & grains crop type segment held the largest market share in the agricultural adjuvants market in 2022

Agricultural adjuvants play an essential role in agriculture’s cereal and grain segment. According to FAO, in 2022/23, global cereal production stood at 2,786.6 million tons, with wheat contributing 800.9 million tons and rice 516.9 million tons of production. With the growing production and demand for cereals & grains, the utilization of agricultural adjuvants is growing. Celeral & grains are consumed as a staple food in most countries worldwide, and protecting these crops from weather, pests, and weeds requires agricultural adjuvants. This is increasing the demand for agricultural adjuvants in cereals & grains.

Tank-mix adjuvants are in the fastest-growing adoption stage in the agricultural adjuvants market.

Adjuvants are added separately into the spray tank, and pesticides or herbicides are known as tank-mix adjuvants. Tank-mix adjuvant ensures high performance, drift reduction, improved spray coverage, and increased absorption into the target crops. The farmers are increasingly using tank-mix agricultural adjuvants as they can customize and adjust on a case-to-case basis. Customization ensures desired performance characteristics while treating the targeted pest or weed; hence, the demand has been accelerating.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=1240

North America held the largest share of the agricultural adjuvants market in 2022

The demand for agriculture adjuvants in North America is witnessing significant growth due to several key factors. The cultivation of industrial crops such as corn and soybean has been gaining pace in North American countries, driving the agricultural adjuvants market growth. According to the United States Department of Agriculture (USDA) reports, in 2022, the US produced 13.7 billion bushels of corn and 4.28 billion bushels of soybean. Though the production of both these crops fell in 2021, the consumption of agricultural adjuvants is growing in the region at a significant pace.

Leading Agriculture Adjuvants Companies:

Major players operating in the agricultural adjuvants market include Corteva Agriscience (US), Evonik Industries AG (Germany), Croda International Plc (UK), Nufarm Limited (Australia), Solvay SA (Belgium), BASF SE (Germany), Huntsman International LLC. (US), Clariant AG (Switzerland), Helena Agri-Enterprises, LLC (US), WILBUR-ELLIS AGRIBUSINESS (US), Precision Laboratories, LLC (US), and CHS Inc. (US).