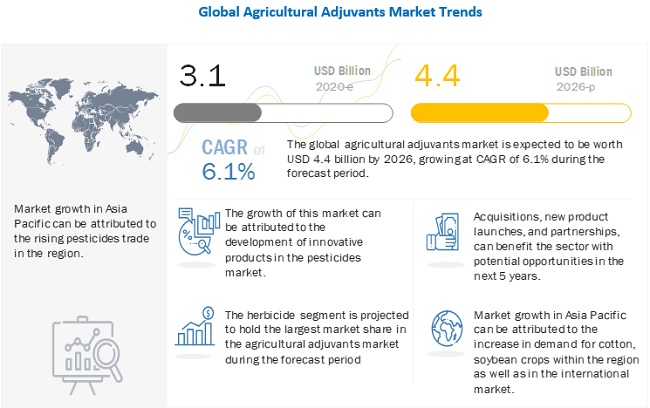

The report "Agricultural Adjuvants Market by Function (Activator and Utility), Application (Herbicides, Insecticides, and Fungicides), Formulation (Suspension Concentrates and Emulsifiable Concentrates), Adoption Stage, Crop Type, and Region - Global Forecast 2026", is estimated to be valued at USD 3.1 billion in 2020 and is projected to reach a value of USD 4.4 billion by 2026, growing at a CAGR of 6.1% during the forecast period. Factors such as the rising demand for improved crop varieties is driving the growth of the agricultural adjuvants market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

Restraint: Stringent regulations to manufacture adjuvants

Adjuvants produced from petrochemicals undergo various chemical processes that release toxic wastes and gases. Various regulations are imposed by government agencies such as the United States Environmental Protection Agency (US EPA) and the EU’s Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) to address them. These agencies map and monitor the toxicity emission levels within permissible levels. Stringent environmental regulations across all countries have increased the cost of developing new products and resulted in their delayed launch. This has been a strong barrier for new market players to utilize the opportunities to enter this market

Opportunity: Manufacturing adjuvant products for cost-effectiveness

The cost of adjuvants fluctuates and depends mainly on the prices of petroleum and vegetable oil that are used for agricultural adjuvant production. As the application costs of different single-purpose adjuvants during pesticide application prove to be expensive for growers, applicators are looking for adjuvants that are simple to use and multifunctional. The increased downstream cost, high foam formation during production, and low productivity have resulted in many R&D activities. Many new developments have been the area of focus for researchers; these include reducing the raw material costs, increasing the production yield, and developing new techniques to lower the foam formation.

By application, the herbicide segment is projected to dominate the market during the forecast period.

The herbicide segment is projected to hold the largest market share in the agricultural adjuvants market during the forecast period as according to industry experts from prominent seed manufacturers, disease resistance and herbicide tolerance are traits that have been on demand, owing to the increasing instances of early germination pest attacks and regulations against cop protection chemicals. Cereals & grains accounted for the largest consumption of herbicides in North America and Asia Pacific, owing to the high cultivation of corn and wheat in countries such as the US and China.

By the adoption stage, the tank-mix segment is projected to dominate the market during the forecast period.

Tank mix adjuvants are added to the farmer’s tank together with the pesticide for improving the performance of the active ingredients, along with mitigating the negative effects such as drift and bouncing. Tank mix adjuvants are added to the pesticides on the field by the crop growers before applying them over the crops. Tank mix adjuvants help in increasing the overall performance of the plant protection products. Adjuvants that are tank-mixed are mostly added to affect the efficacy of pesticides and are defined by the direct effect that they have on the crop-pesticide interaction.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=1240

Asia Pacific is projected to grow at the highest CAGR% during the forecast period

The market for agricultural adjuvants in the Asia Pacific region is projected to grow at the highest CAGR from 2020 to 2026, owing to the increasing investments by key players in countries such as China, India, and Thailand, and also the rising adoption of adjuvant technology by the crop growers for insecticide applications. Due to these factors, the market in the Asia Pacific region is projected to record the highest growth from 2020 to 2026.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the agricultural adjuvants market. It includes the profiles of leading companies such as this market include Miller Chemical and Fertilizer, LLC (US), Precision Laboratories (US), CHS Inc (US), WinField United (US), Kalo Inc. (US), Nouryon (Netherlands), Corteva (US), Evonik Industries (Germany), Nufarm (Australia), Croda International (UK), Solvay (Belgium), BASF (Germany), Huntsman Corporation (US), Clariant (US), Helena Agri-Enterprises (US), Stepan Company (US), Wilbur-Ellis Company (US), Brandt (US), Plant Health Technologies (US), Innvictis Crop Care (US), Interagro (UK), Lamberti S.P.A (US), Drexel Chemical Company (US), GarrCo Products Inc. (US), and Loveland Products Inc. (US).

No comments:

Post a Comment