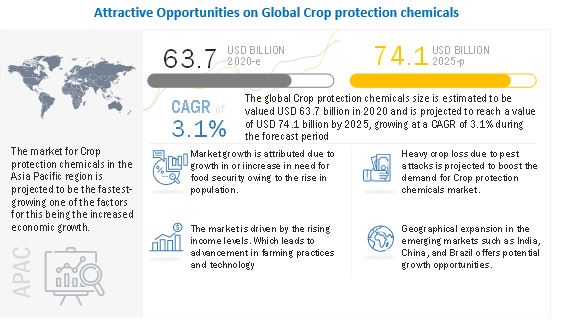

The report "Crop Protection Chemicals Market by Type (Herbicides, Insecticides, Fungicides & Bactericides), Origin (Synthetic, Biopesticides), Form (Liquid, Solid), Mode of Application (Foliar, Seed Treatment, Soil Treatment), Crop Type and Region - Global Forecast to 2025" The global Crop protection chemicals size is estimated to be valued USD 63.7 billion in 2020 and is projected to reach a value of USD 74.1 billion by 2025, growing at a CAGR of 3.1% during the forecast period. The growth of this market is attributed to an increasing need for food security of the growing population.

Opportunity: Rapid growth in the biopesticides market and organic agriculture

Biopesticides are pesticides produced naturally, with minimum usage of chemicals. Since growing environmental considerations and the pollution potential and health hazards from many conventional pesticides are on an increase, the demand for biopesticides has been rising steadily in all parts of the world. Biopesticides are growing in popularity, due to their less or non-toxic nature as compared to synthetic pesticides. Moreover, biopesticides provide more targeted activity to desired pests, unlike conventional pesticides that often affect a broad spectrum of insects, birds, and mammalian species. Further, biopesticides can be very effective in small quantities, offering lower exposure and are quickly decomposable; they leave virtually no harmful residue after application.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=380

Challenges: Environmental impact resulting in changes in regulatory policies

One of the major challenges faced by the crop protection chemicals market is development of Genetically Modified (GM) crops, with the evolution of biotechnology and microbiology. New GM seeds can be developed through gene modification to provide them with the natural ability of being pest repellent. This, development of genetically modified crops in recent years, especially for pest resistance has been observed to have resulted in relatively lesser need for traditional crop protection chemicals.

The herbicides segment of the Crop protection chemicals is projected to account for the largest share, by type

Herbicides are substances that kill or inhibit growth of unwanted plants (weeds). They are widely used in weed control, which helps in enhancing crop productivity and quality of output. Herbicides help in reducing soil erosion and increase soil fertility and crop yield. They are used to control or kill unwanted plants and are often known as weed killers. Use of herbicides in agroecosystems may change composition of weed populations. In wildlands, herbicides may increase the diversity of native species. Threats to plant biodiversity caused by habitat loss and invasive species are far greater than threats by use of herbicides. Some non-selective pesticides are used in weed waste grounds, industrial sites, railways, and railway embankments. Herbicides are heavily consumed in the agricultural sector and in landscape turf management.

The market for the liquid segment is projected to account for the largest share during the forecast period, by form

By form, liquid is the segment which accounted for the highest market share as well as the highest growth rate in the Crop protection chemicals. The growing requirement of liquid forms of crop protection chemical products, mainly in the foliar spray and seed treatment modes of application, is driving the market for liquid forms of crop protection chemicals. They are also cheaper than solid formulations and are easily mixed with any other crop enhancer or protecting product, increasing the demand for the same.

Liquid pesticides include suspensions (flowable solutions), solutions, emulsifiable concentrates, microencapsulated suspensions, and aerosols. Liquid forms of crop protection chemical products are preferred more by suppliers as well as end-users. Liquid forms offer a longer shelf-life with easy handling, transportation, and application. Also, they are cost-effective, eco-friendly, and sustainable. Companies are investing in the technological development of crop protection chemicals in liquid forms. The liquid forms of crop protection chemicals can either be water-based, oil-based, polymer-based, or their combinations.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=380

South America is estimated to hold the largest market share during the forecast period

South America is an emerging agricultural powerhouse, growing at a rapid pace above the global growth average. Growth in this region is significantly contributed by the growth in Brazil and Argentina, which are the world’s most potent agricultural producers and are expected to grow well above the regional average. The economic growth in South America has been stimulated by democratization, economic reforms, and the foundation of the two trading blocs namely, Mercosur and the Andean Pact.

Regulatory framework in South America is quite weak as compared to North America and Europe. The South American Pesticide Action Network controls the regulatory issues in the region. The international trade system from the WTO for regional and bilateral trade deals also undermines national pesticide laws and threatens the ability of South American nations to prohibit dangerous chemicals from being used. This is especially observed in the case of WTOs demand for establishing certain common minimum standards for pesticides among countries. For instance, if a country wants to implement a stricter standard on pesticides as compared to the WTO, it could be recognized as a technical barrier to trade.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the Crop protection chemicals. It consists of the profiles of leading companies such BASF SE (Germany), The Dow Chemicals Company (US), Dupont (US), Sumitomo Chemical Co., Ltd (Japan), Syngenta AG (Switzerland), Bayer Cropscience AG (Germany), FMC Coropration (US), NufarmLimited (Australia), Adama Agricultural Solutions (Israel), Verdesian LIfescineces (US), Bioworks Inc. (US), Valent US (US), Arysta Lifescince Corporation (US), American Vanguard Corporation (US), Chr. Hansen (Denmark), Corteva Agrisciences (US), UPL Limited (India), Jiangsu Yangnong Chemical Group Co Ltd (China), Agrolac (Spain), Lianyungang Liben Crop Science Co. Ltd. (HongKong), Nanjing red sun co. ltd (China), Kumiai Chemicals (Japan), Wynca Chemicals (China), Lier Chemicals (China), Simpcam Oxon (Italy).

No comments:

Post a Comment