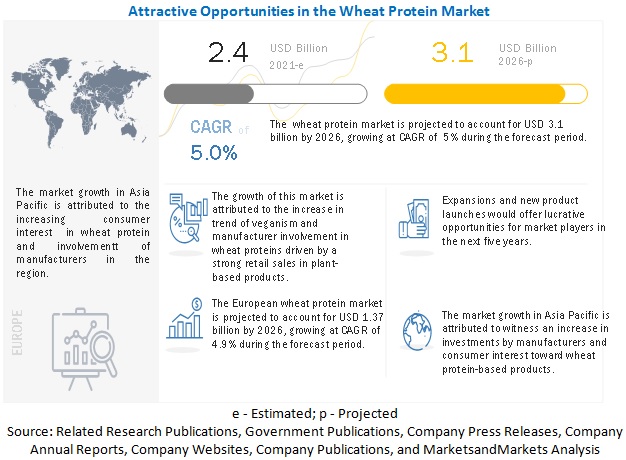

The global wheat protein market is estimated to be valued at USD 2.4 billion in 2021 and is projected to reach USD 3.1 billion by 2026, recording a CAGR of 5.0%. The market has been largely driven by the growing demand for bakery products, the increasing popularity of plant-based foods, wheat protein being a suitable alternative for non-animal protein among vegans coupled with nutritional benefits for lactose-intolerant consumers.

COVID-19 impact on Wheat Protein market

The COVID-19 pandemic has had a profound impact on the wheat protein market. Given the growing consumer awareness of the impact of the pandemic on meat production, consumers began adopting plant-based alternatives instead. This resulted in a sales surge of over 500% for meat alternative brands. The pandemic has also influenced the sales of plant-based snacks, dairy alternatives, and supplements, as consumers move towards a healthier lifestyle.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=67845768

Restraints: Increasing discussion on gluten intolerance and gluten-free diets

Gluten intolerance or the Celiac disease is an autoimmune disorder, which damages the small intestine lining and prevents the absorption of nutrients from consumed food items. This damage is majorly a reaction to eating foods with gluten, a type of wheat protein which is also found in barley, rye, and oats. However, some individuals may also experience discomfort in their stomach despite not having the Celiac disease. Amylase-trypsin-inhibitors or ATIs, are a group of proteins found in wheat, which could trigger an immune response, and contribute to the development of non-celiac gluten sensitivity (NCGS).

By product, wheat gluten segment is projected to dominate the market during the forecast period.

The wheat protein market has been segmented into wheat gluten, wheat protein isolate, textured wheat protein, and hydrolyzed wheat protein. Wheat gluten dominated the global market, in terms of both, value and volume. The wide range of functionalities of wheat gluten such as viscoelasticity, texturing, foaming, emulsification, and binding leads to its wide-scale usage in bakery products. Its role as an excellent meat alternative for consumers preferring vegetarian food products is expected to drive its demand during the forecast period.

By application, pet food segment is projected to be the fastest-growing segment in the market during the forecast period.

The growing expenditure on pet food products along with pet humanization in economies such as India and the US is expected to drive the market growth in the pet food segment. Changing consumer preferences driven by awareness toward meat sourcing practices, its ecological impact, and animal-borne diseases have led to more consumers opting out of meat consumption. The resulting change has led to consumer demand shifting from conventional animal-based proteins to plant-based alternatives.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=67845768

Europe is estimated to account for the largest share of the wheat protein market during the forecast period

In 2020, Europe is estimated to account for the largest share of the wheat protein market. Factors such as the growing investments by major players in the bakery industry, growing trend of vegan diets, and abundant availability raw materials such as wheat in this region have boosted the demand for wheat protein products in the European market. Furthermore, increased demand for bakery items such as cakes, pastries, and cookies will also drive the demand for wheat protein in the region.

This report includes a study of the marketing and development strategies, along with the product portfolios of the leading companies. It includes the profiles of leading companies such as ADM (US), Cargill (US), Agrana (Austria), MGP Ingredients (US), Manildra Group (Australia), Roquette (France), Glico Nutrition (Japan), Crespel & Deiters (Germany), Kröner-Stärke (Germany), Tereos Syrol (France), CropEnergies (Germany), and Gluten y Almidones Industriales (Mexico), Batory Foods (US), Kerry Group (Ireland), BENEO (Germany), Agridient Inc (US), AMCO Proteins (US), Tate & Lyle (UK), and PureField Ingredients (US).

No comments:

Post a Comment