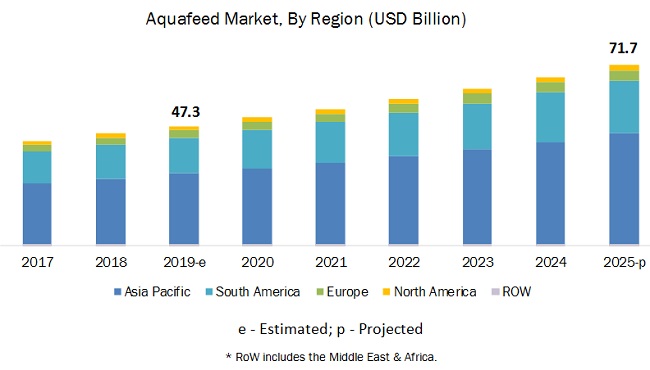

The aquafeed market is estimated to account for USD 47.3 billion in 2019 and is

projected to reach USD 71.7 billion by 2025, recording a CAGR of 7.2% during

the forecast period. The market is primarily driven by the increasing seafood

trade, growth in aquaculture production, and rising seafood consumption among

consumers due to the increasing need for protein-rich diets.

On

the basis of ingredient, the soybean segment is estimated to account for a

major share, in terms of value, in 2019.

Soybean is among the non-fish sources of

omega-3 fatty acids, proteins, and unsaturated fats. Soy protein is fed to

farm-reared fish and shellfish to enhance their overall growth and development.

Some of the commonly used soybean products in aquafeed include heat-processed

full-fat soybean, mechanically extracted soybean cake, solvent-extracted

soybean meal, and dehulled solvent-extracted soybean meal. Since soybean meal

is priced significantly lesser than fishmeal, the consumption of soybean meal

is high.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1151

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1151

The

amino acids segment, by additive, is projected to dominate the aquafeed market

during the forecast period.

Amino acids are important in animal nutrition

and are the building blocks of protein, which play an essential role in the

growth, production, and overall maintenance of aquatic animal health. Amino

acids provide the energy required for the growth of muscles and bones for

muscle movement, digestion, and blood circulation. Owing to these factors, the

amino acids segment dominates the aquafeed market, by additive.

On

the basis of species, the fish segment is projected to witness higher growth in

the aquafeed market.

The aquafeed market, by species, is segmented

into fish, crustaceans, mollusks, and others (turtles and sea urchins). Fish

farming in ponds, lakes, rivers, and coastal waters is increasing to fill the

gap between demand and supply. The increase in fish farming activities and

aquaculture has led to the increased demand for fish feed. Among fish, carp and

tilapia are high consumers of aquafeed. Also, carps are being extensively

reared, owing to their adaptability to changing climates, while Tilapia

culturing has increased in recent years due to the growing supply of

high-quality protein tilapia species at lower prices.

Asia Pacific

is projected to account for the largest share in the aquafeed market during the

forecast period.

The Asia Pacific market accounted for the

largest share in 2019; this market is majorly driven by China and Vietnam,

which are major markets for aquafeed. China is among the leading producers of

aquafeed in the Asia Pacific region. Due to the significant growth of seafood

consumption and trade in this region, the aquafeed market is projected to grow

in the region. The processed seafood market in the region is also currently

undergoing significant transformation in response to the rapid urbanization and

diet diversification. Also, consumer demand for convenience and processed

seafood offers profitable growth prospects and diversification to the region’s

food sector.

The major vendors in the global aquafeed

market are Cargill (US), Archer Daniels Midland Company (US), Alltech (US),

Purina Animal Nutrition (US), Nutreco N.V. (Netherlands), and Ridley

Corporation Ltd. (Australia).

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=1151

Key

questions addressed by the report:

- Which region will account for the highest share in the aquafeed market?

- How would the fluctuations in ingredient prices impact the growth of the aquafeed market globally?

- What is the level of support offered by governments across these countries to aquafeed manufacturers?

- Which are the key players in the market and how intense is the competition?