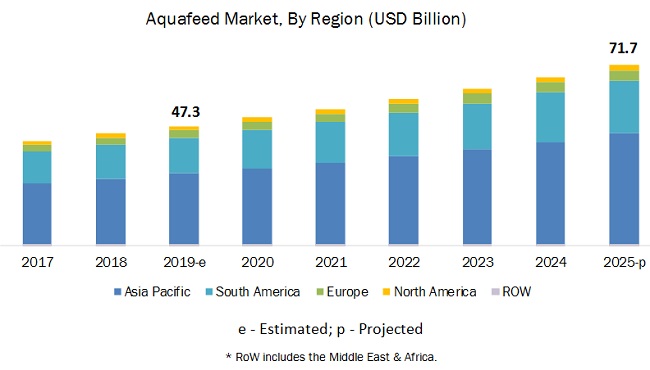

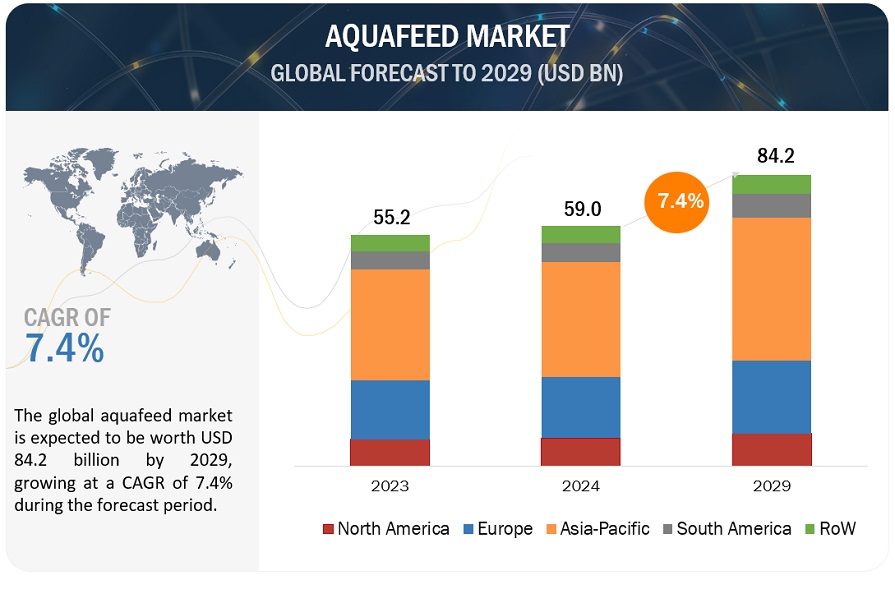

The global aquafeed market is projected to reach USD 88.0 billion by 2028, at a CAGR of 7.3% over the forecast period. It is estimated to be valued USD 61.8 billion in 2023. Several important factors are driving up demand for aquafeed products on a global scale. First, a growing worldwide population has an increased need for seafood, and aquaculture offers a sustainable way to meet this demand. Fish and prawn farming has become more popular because of the depletion of wild fish stocks. Aquafeed is crucial for the healthy growth and development of aquaculture aquatic species, increasing their output and decreasing their reliance on foraging wild fish. Aquafeed products are in high demand to support the expansion of the business since advances in aquaculture technology and practises have made it more effective and financially viable.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1151

By form, dry segment is projected to have fastest growing rate during the forecast period.

Dry form of feed is preferred due to a few factors, such as ease of transportation, storage, and convenience associated with it, as opposed to the liquid form, which requires specialized facilities for storage and transportation. It can be purchased in bulk and is available with multiple ingredient options. Cost-effectiveness is another aspect that drives the growth of this market.

By species, fish segment is projected to have fastest growing rate during the forecast period.

In the aquafeed market, the fish segment is expanding for a variety of reasons. The need for high-quality and nutritionally balanced aquafeed is being driven by the increasing demand for fish protein on a global scale, the depletion of wild fish supplies, and the growth of aquaculture. To ensure optimum development, health, and sustainability in the sector, fish farming, with its well-established practises and different species, needs specialised feeds.

By additives, the amino acids segment is projected to have the fastest growth rate during the forecast period.

Due to their vital function in fostering the growth, development, and general health of aquatic species, amino acids are witnessing expansion in the aquafeed market. As the building blocks of proteins, amino acids help to improve nutrient absorption, feed effectiveness, and disease resistance. Additionally, customised amino acid formulations suited to match the needs of particular species are now possible because to advances in research and technology, which are fuelling the segment's expansion.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=1151

Asia Pacific is expected to have the fastest growing rate during the forecast period.

The aquafeed market is expanding in the Asia Pacific region because of reasons like a growing population, rising seafood demand, favourable environmental conditions for aquaculture, technical improvements, and government backing. The expansion of the aquaculture sector is being fuelled by economic growth, shifting dietary tastes, and the need for sustainable protein sources, which is causing a commensurate rise in demand for aquafeed products.

The key players in this include ADM (US), Cargill, Incorporated (US), Ridley Corporation Limited (Australia), Nutreco (Netherlands), Alltech (US), Purina Animal Nutrition (US), Adisseo (Belgium), Aller Aqua A/S (Denmark), Biomin (Austria), Biomar (Denmark), Norel Animal Nutrition (Spain), Avanti Feeds Limited (India), De Heus Animal Nutrition B.V. (Netherlands), Novus International (US), and Biostadt India Limited (India).