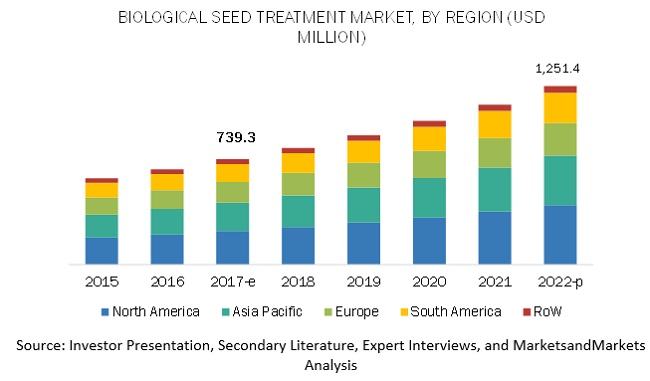

The report "Biological Seed Treatment Market by Type (Microbials and Botanicals), Crop (Corn, Wheat, Soybean, Cotton, Sunflower, and Vegetable Crops), Function (Seed Protection and Seed Enhancement), and Region - Global Forecast to 2022", The biological seed treatment market is projected to reach USD 1,251.4 Million by 2022, from USD 739.3 Million in 2017, at a CAGR of 11.10% from 2017. The market is driven by factors such as high demand for sustainable agriculture in the global market, lesser risks of exceeding pesticide MRLs, and insurance to seed investments.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=162422288

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=162422288

Microbials segment is projected to be the fastest-growing from 2017 to 2022

Microbial seed treatment includes bacterial and fungal seed treatment. Seeds treatment provides an efficient mechanism for the placement of microbial inoculum in the soil environment, where they are appropriately positioned to colonize the seedling & roots and protect them against soil-borne diseases and pests. Thus, the microbials segment is projected to grow at the highest rate during the forecast period.

Corn segment led the market with the largest share in 2016

The demand for biological seed treatment in corn has been witnessing substantial growth in the European and American regions, due to the significant requirement of corn as animal protein and ethanol in the feed and automobile industries, respectively. Thus, the corn segment accounted for the major share in the biological seed treatment market.

Opportunity: Bio encapsulation technologies for improved environmental persistence

Research and developments in the field of agricultural practices have been moving toward the production of inoculants, which could eventually lead to the advent of improved and advanced formulations to ease application processes and improve the viability of products. Conventional forms of formulations, solid or liquid, lead to several problems related to the low viability of microorganisms during the storage and application process. However, this problem can be addressed by the immobilization of microorganisms. This immobilization highly improves the shelf-life and efficacy of the formulation, keeping it viable for a longer duration. Bioencapsulation technologies could also result in a controlled microbial release, thereby improving application efficacy. Such technologies have the ability of greatly improving the persistence of biological seed treatments in the soil environment and thereby, leading to a thriving market for the product.

Speak to Analyst:

North America is projected to be the fastest-growing market

The major reason for the biological seed treatment market experiencing such a high growth rate is the highly streamlined product registration process, which makes it easier for most private companies to launch their products easily. Lower investment requirement and limited gestation period involved in the development and commercialization of biological products are key factors attracting a large number of startup companies in the industry. Additionally, growing awareness among consumers against synthetic chemicals has also led to a higher adoption of these products.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It also includes the profiles of leading companies such as BASF (Germany), Bayer (Germany), Syngenta (Switzerland), Monsanto (US), DuPont (US), Valent BioSciences (US), Verdesian Life Sciences (US), Plant Health Care (US), Precision Laboratories (US), Koppert (Netherlands), Italpollina (Italy), and Incotec (Netherlands).

Recent Developments:

- In March 2019, Corteva Agriscience (formerly known as DowDuPont) inaugurated new center of technologies applied to seed in Aussonne (France), this would help company to enhance yield of farmers in this region.

- In September 2018, Plant Health Care launched Harpin αβ product for seed treatment applications to corn, this would help the company to tap huge market for corn spread over more than 90 million acres.

- In July 2017, Syngenta and Valagro (Italy) signed an agreement under the terms of which Valagro would supply biostimulants to Syngenta for seed treatments. With the combined expertise of the two companies, Syngenta was expected to launch EPIVIO Energy by 2018.

- In July 2017, Bayer launched two inoculant technologies for seed treatment in Brazil. Bayer in partnership with Novozymes, developed the inoculant TSI, for industrial seed treatment. For the on-farm seed treatment, inoculant Biagro 10 and Biagro Líquido NG were launched by the company.